The Zip Co Limited (ASX: Z1P) share price and other buy-now-pay-later (BNPL) companies continue their downwards trend as investors shift away from high-growth tech names.

Zip shares are currently changing hands for $2.6 each, down a huge 81% from their all-time highs reached at the start of last year. Is the worst finally priced in for Zip?

Tide brings down all boats

Negative sentiment has spread across the broader tech and BNPL sector. Last week, US-based BNPL competitor Affirm Holdings Inc (NASDAQ: AFRM) reported its latest quarterly results, which caused shares to finish 21% lower by the end of the day.

While Affirm is still growing its top line roughly in line with expectations, this has come at the cost of short-term profitability. Affirm’s net loss for the quarter was $157.9 million, compared to $26.6 million from a year ago.

In a rising interest rate environment, unprofitable businesses with cash flows far into the future will have more discounting involved in valuation models, resulting in a lower estimate of its intrinsic value.

Business still growing

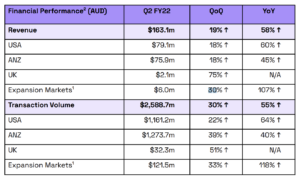

Zip last updated the market for the three months ending 31 December 2021. Similar to Affirm, Zip is still showing strong signs of momentum. The business has continued to sign up merchants and make complementary acquisitions, allowing quarterly revenue and transaction volumes to grow at 58% and 53%, respectively year on year.

This update didn’t delve into any profitability metrics, however. Looking back to the FY21 investor presentation, Zip recorded a loss before tax of $359.6 million after adjusting for the QuadPay acquisition.

Zip is unprofitable at the moment as it continues to embark on a land and expand strategy to bring new customers to its platform. With its customer base of over 9.9 million and growing, these could prove to be valuable customers if they remain loyal to the Zip brand over their customer lifetime.

Summary

Zip operates in a high-growth industry that will likely ride the wave of continued adoption of e-commerce and digital payments. The addressable market is large and growing, a quality we look for as part of the Rask investment philosophy.

This blue sky scenario should be considered alongside potential risks, however. With various BNPL players offering a similar service, Zip will likely need to continue to innovate and differentiate itself to retain its growing customer base.

If you’re looking for some ASX share ideas, check out this article: 3 ASX shares I’m looking to buy this month.