The Insurance Australia Group Ltd (ASX: IAG) share price is unmoved today despite the company rising cash profit by 62% in the first half.

Keep up to date with the February 2022 reporting season calendar.

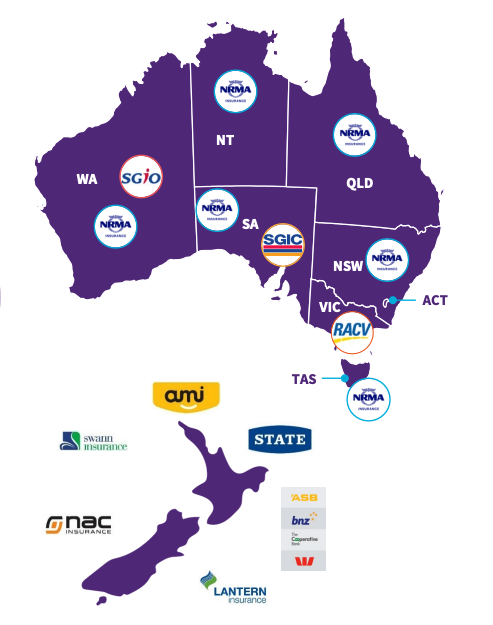

IAG is an insurance provider to households and businesses across its stable of brands including NRMA, RACV, CGU and State Insurance NZ.

Growth across all divisions

Key highlights from the first half ending 31 December 2021 include:

- Gross written premiums (GWPs) of $6.18 billion, up 6.2% year-on-year (YoY)

- Cash earnings of $176 million, down 62.1% YoY

- Net profit after tax of $173 million, a reversal of the $460 million loss in the corresponding period

- Dividend of 6 cents per share, down from 7 cents

GWP – the revenue IAG receives for its insurance policies – increased largely as a result of increased prices passed onto consumers to keep up with inflation.

Intermediated insurance – which acts as a broker between insurer and policyholder – was the strongest performer increasing revenue by 9%.

Similarly, New Zealand achieved a 5.9% increase while underlying margins improved.

The direct insurance division achieved volume growth of 3.3%. Growth in motor and home policies was offset by a reduction in third-party and commercial.

Accounting trickeries

Net profit improved but cash profit went down. How can this be?

Cash profit is a better illustration of the underlying business, whereas net profit includes non-cash items.

In the prior period, IAG had to allocate a $1.15 billion provision for potential COVID-19 claims, reducing last year’s result and flattering this year’s net profit.

Cash profit sunk due to $681 million in natural disaster costs.

October was a particularly bad month, with storms across SA, Tasmania and Victoria weighing on IAG’s insurance margin.

The higher claim costs are not exclusive to IAG, with competitor Suncorp Group Ltd (ASX: SUN) incurring lower cash earnings.

What’s next for the IAG share price?

IAG upgraded its GWP growth forecast from low single-digit to mid-single-digit growth for FY22.

Conversely, it cut reporting margin guidance from 13.5%-15.5% to 10.0%-12.0%.

The margin reduction is primarily from increased natural peril costs and to a less extent reserve strengthening and subsiding pandemic benefits.

The business also reiterated its aim to add 1 million customers and $400 million of cost reduction over the next by FY26.