Despite posting a record-half-year result, the ASX Ltd (ASX: ASX) share price has sunk 4.15% to $83.11.

Anchor your portfolio with these top 20 dividend growth ASX shares

ASX (Australian Stock Exchange) manages the trading of public companies, derivatives, clearing and technology underpinning Australia’s primary securities exchange.

Record-half as listings soar

Key highlights from the first-half ending December 31 2021 include:

- Revenue of $501.4 million, up 6.6% year-on-year (YoY)

- Profit after tax of $250.3 million, increasing 3.5% YoY

- Interim fully franked dividend of $1.164 per share, up 3.5% YoY

- Earnings per share of $1.293, up 3.5% YoY

It was a bumper half for the ASX spurred by 150 company listings, the highest number in 13 years.

In total, $90.3 billion was raised, a half-year record.

Revenue was also buoyed by strong trading activities, as a result of heightened mergers & acquisition activity and retail investors.

Subsequently, other divisions such as Securities and Payments and Technology and Data benefitted from the need for better market data and data centre services.

Future markets and interest income remained depressed due to record-low interest rates.

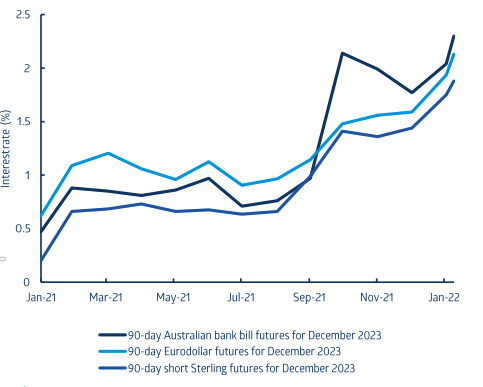

However, the 90-day bank bill across several currencies has been rising over the past year, indicating future rate rises and subsequently higher revenue for the ASX.

Source: ASX share price 2022 Half-Year Results Presentation Slides

Profit increases at a relatively lower rate than revenue, primarily from the aforementioned lower-income revenue and a marginal uptick in expenses.

Technology update

ASX’s technology revamps remain on track to go live in April 2023.

The new system utilises blockchain technology to underpin the current CHESS trading and clearing function.

“The transformation of our technology has been a multi-year, multi-project undertaking, with much achieved already. The age of some of our core equity technologies is set to drop from over 20 years to an average of less than five years“.

CEO to retire

ASX also announced today its CEO Dominic Steven intends to retire this year after six years at the helm.

He remains as CEO until the commencement of a successor. A search for a new CEO is now underway.

What’s next for the ASX share price?

It’s been a strong start to the second half for the ASX, with trading volumes up 45% and clearing volumes up 40%.

Subsequently, management upgraded its revenue estimate for growth of 7-8% in FY22.

Full-year capital expenditure of $105 million to $115 million remains unchanged.

The ASX share price will also benefit if and when rate rises occur.