Jewellery chain Michael Hill International Ltd (ASX: MHJ) has provided a trading update

for its second quarter and subsequent unaudited first-half performance.

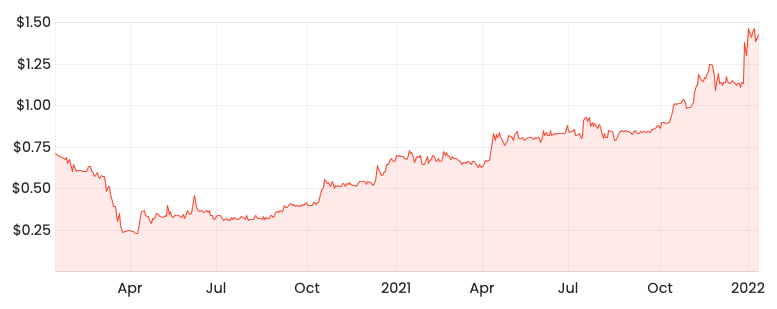

The market has largely unreacted to the update, with the Michael Hill share price down just 0.3% to $1.43.

MHJ share price

Christmas delivers record Q2

Key highlights from the trading update include:

- Earnings before interest and tax (EBIT explained) for the first half of $49 to $53 million, compared to $44.6 million in the prior corresponding period (pcp)

- Total sales up 9.8%, despite losing 2,381 trading days across its store network due to pandemic restrictions

- Same-store sales up 9.6% against the prior year

- Margin expansion of 2-3% in all markets and channels

- Digital sales growth of 28%, which now represents 8.2% of total sales compared to 6.3% in the pcp

Commenting on the result, Managing Director and CEO Daniel Bracken said:

“…I couldn’t be prouder of the entire team. From the highly engaging and emotive marketing campaign, to the deployment of new digital initiatives, excellence in supply chain and inventory management and our Christmas recruitment strategy, all came together to deliver Michael Hill’s best Q2 in the Company’s history.

First-half growth despite lockdowns

From a geographic perspective, all regions achieved same-store growth once normalising for the number of trading days.

New Zealand and Canada were the standouts, achieving 14.8% and 13.8% respectively. Meanwhile, Australia recorded 6.4% year-on-year growth.

Total sales for the half reached $306.5 million, an 11.4% improvement on last year’s $275 million.

“This strong performance now marks our tenth quarter of positive same store sales growth since FY19Q3 and further demonstrates the success of the continued transformation of the Michael Hill brand”

Sales growth was largely led by Canada, where the business had all 86 stores open.

Conversely, Australia and New Zealand weighed on the result due to the loss of trading days.

Final thoughts

How can Michael Hill have same-store growth but total sales go backwards in some regions?

Effectively, same-store sales account for days that the Michael Hill stores were open. On those days, all regions recorded growth compared to the same trading days last year.

However given some stores were forced to shut, total sales went backwards for Australia and New Zealand.

This is out of the company’s control, therefore same-store growth is a better illustration of growth.

Management noted a ‘healthy cash position’ at the end of the half and is evaluating potential capital management strategies (dividends, buybacks, new growth opportunities).

All this bodes well for shareholders. I’d expect to hear more on this in the official first-half update in February.