When searching for ASX dividend shares there are two key characteristics I look for.

The first is defensiveness. Independent of what the economy or pandemic is doing, these businesses just keep on operating.

The second is earnings growth. Dividends are just a function of earnings. If the businesses earnings increase, typically the dividend will also follow a similar trajectory.

Here are 2 ASX dividend shares I’d add to my portfolio in 2022.

1. Endeavour Group Ltd (ASX: EDV)

Endeavour Group was spun out of Woolworths Group Ltd (ASX: WOW) housing the liquor chains (Dan Murphy’s, BWS) and hotel activities under ALH Group.

While alcohol might be discretionary in nature, it’s arguably a consumer staple. Customers are unlikely to put off consumption regardless of what the economy is doing.

Furthermore, I’d argue behind Bunnings and Officeworks, Dan Murphy’s is probably the next best category killer in the Australian market.

Dan Murphy possesses the biggest purchasing power, where it’s able to pass on scale costs through to consumers through its “Lowest Liquor Price Guarantee”.

“I beat all my competitors every month, every week, every day, every hour, on every price, on every product, on every bottle…” – Dan Murphy, October 1995

The second advantage is that its stores double up as distribution centres. Dan Murphy’s can leverage its store footprint to offer a broader delivery experience relative to the smaller competitors.

Over time, this should result in Endeavour growing its earnings and achieving higher economies of scale.

With a profit after tax of $445 million in FY21, a 75% payout ratio and a market capitalisation of $12 billion, this implies a 2.8% fully franked dividend yield.

It’s not going to shoot the lights out, but Endeavour is a defensive dividend payer I like.

2. Deterra Royalties Ltd (ASX: DRR)

Deterra Royalties is the simplest business on the ASX.

It owns six royalty streams. But the one that really matters is the royalty asset over Mining Area C (MAC) located in Pilbara and operated by BHP Group Ltd (ASX: BHP).

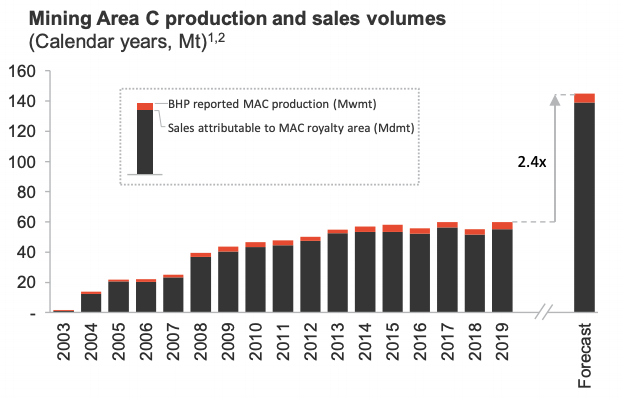

The company’s earnings (and subsequent dividends) is supported by a mine life of over 50 years and a production increase of 240% by 2023.

Any revenue derived from MAC, BHP will send a cheque in the mail to Deterra. Even if the mine is unprofitable, or the iron ore price dips, Deterra gets paid.

Then as a shareholder, Deterra pays all its profits to you.

It paid 13.97 cents per share in dividend in FY21. But this number should be much higher in FY22 as Deterra receives a full year of royalty payments.

In FY21, it only received revenue from October after it was spun out of Iluka Resources Limited (ASX: ILU).

For lower-risk mining exposure with healthy dividends, it’s difficult to go past Deterra.