The Fortescue Metals Group Limited (ASX: FMG) share price will be on watch today after the company announced its Chief Executive Elizabeth Gaines will step down

.

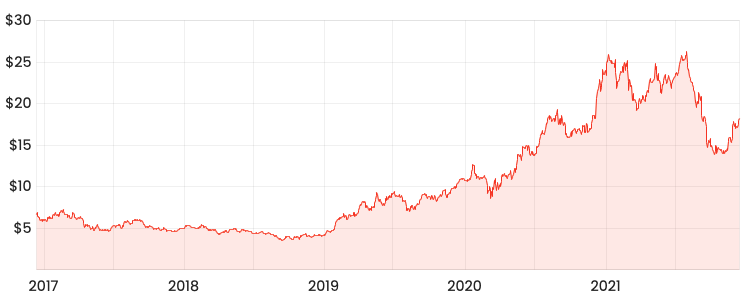

Currently, the Fortescue share price is down just 0.66% to $18.13.

FMG share price

CEO moves to global ambassador

Ms Gaines will remain a part of Fortescue, becoming the miner’s global green hydrogen brand ambassador.

She will also join the board, this time as a non-executive director after previously serving in an executive capacity for eight years.

Ms Gaines prior positions with Fortescue include non-executive director, CFO and CEO.

Since her appointment as CEO in 2018, the Fortescue share price has risen by over 260%.

The company will begin searching for a new CEO with a focus on appointing someone with global experience in heavy industry, manufacturing and renewable energy.

In the meantime, she will remain as CEO of Fortescue.

“At the heart of Fortescue is its people and our unique culture and values. Our commitment to operational excellence and our leading ESG credentials is second to none. I look forward to continuing to work with the talented team across the business as we grow and diversify. My heartfelt thanks to everyone at Fortescue for their support of me during my time as CEO and I look forward to ensuring a successful handover to the Board’s appointed successor and continuing as CEO until I subsequently transition to the Non-Executive Director role.”

A new chapter

In addition to announcing the leadership changes, Fortescue detailed its transition from an iron ore producer to an integrated green energy and resources group.

The company now has the largest portfolio of renewable hydrogen, green ammonia and green iron ore development in the world under the wholly-owned Fortescue Future Industries (FFI) entity.

“…green hydrogen, green ammonia, green energy and all its products, are combined, the only practical implementable solution to global warming that can be delivered on a commercial, highly sustainable basis”

My take

Often when CEOs resign, the share price of the respective company falls.

For example, the Bapcor Ltd (ASX: BAP) share price is down 20% since its CEO resigned last month despite the underlying business being unchanged.

Fortunately, Fortescue has built a strong leadership team, led by Ms Gaines, which means the transition to her successor should be relatively seamless.

To keep up to date on all the latest news regarding Fortescue and the ASX, be sure to bookmark the Rask Media home page.