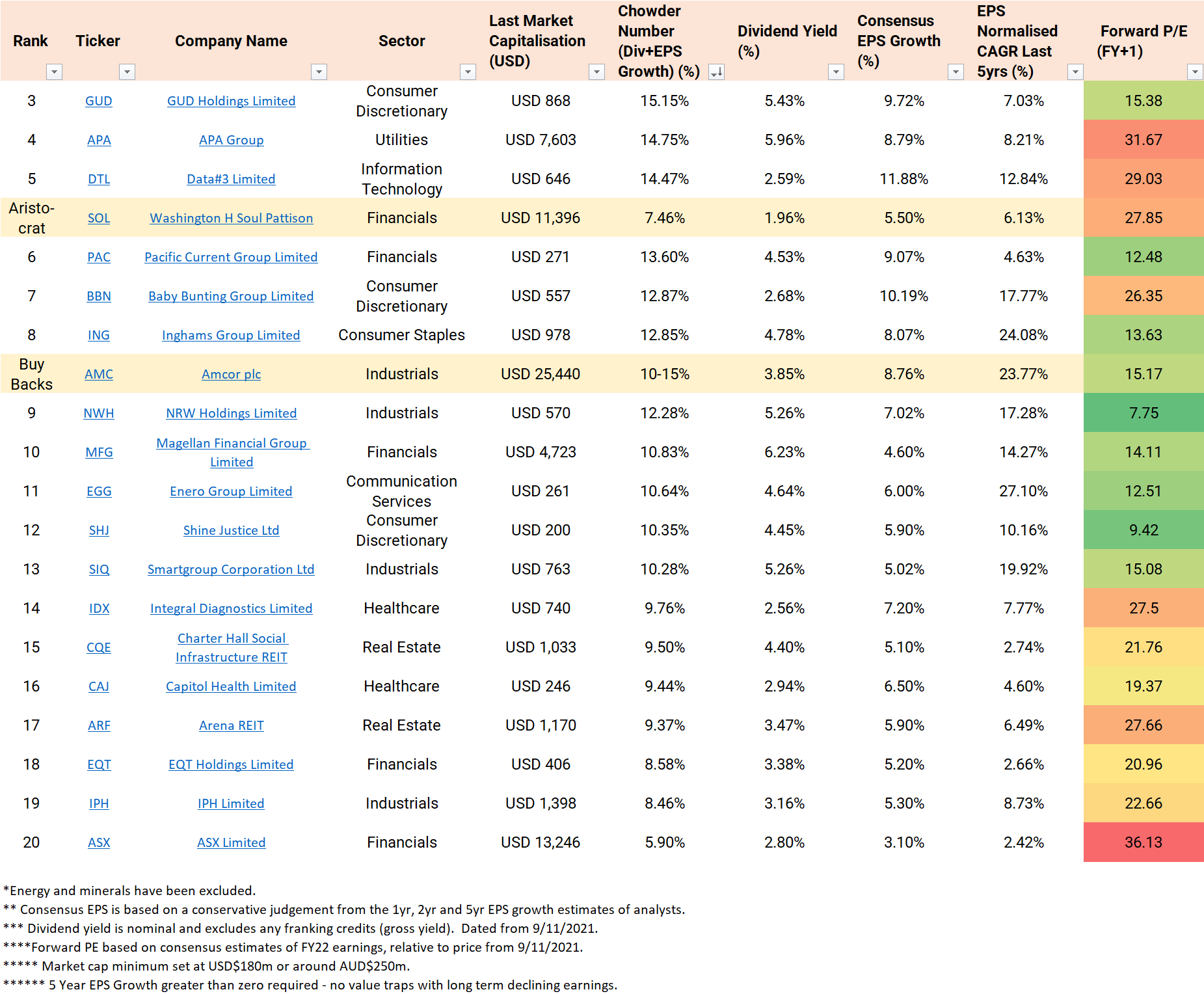

GUD Holdings Limited (ASX: GUD) is an aftermarket auto parts company that comes in at number three after benefiting from the Covid trend in outdoors activities. GUD is paying 5.43% fully franked or 7.75% gross dividends. Analysts are predicting 9.72% EPS growth, giving GUD a super-impressive 15.15% Chowder Number at a reasonable valuation.

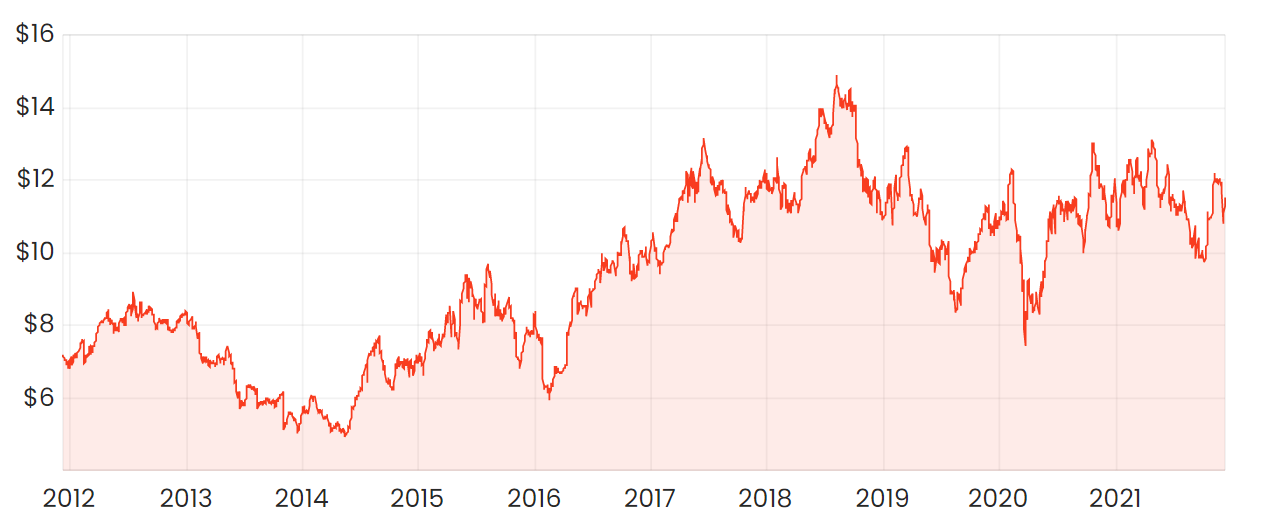

GUD share price

What does GUD do?

GUD is a holding company that has acquired and divested a range of businesses since listing in 1999. Looking back a decade, the largest segment accounting for over 50% of revenue was consumer products that included Sunbeam Appliances and Oates. However, GUD completely divested consumer products due to poor margins.

The second largest segment was water products accounting for 25% of revenue. Now, water products account for 10% of revenue. This segment includes Davey Water Products, a global exporter of domestic, farm and community-based water products.

The automotive segment a decade ago was 15% of revenue, though generated around 30% of earnings. GUD has continued to invest in the automotive segment, and it now accounts for 90% of its revenue.

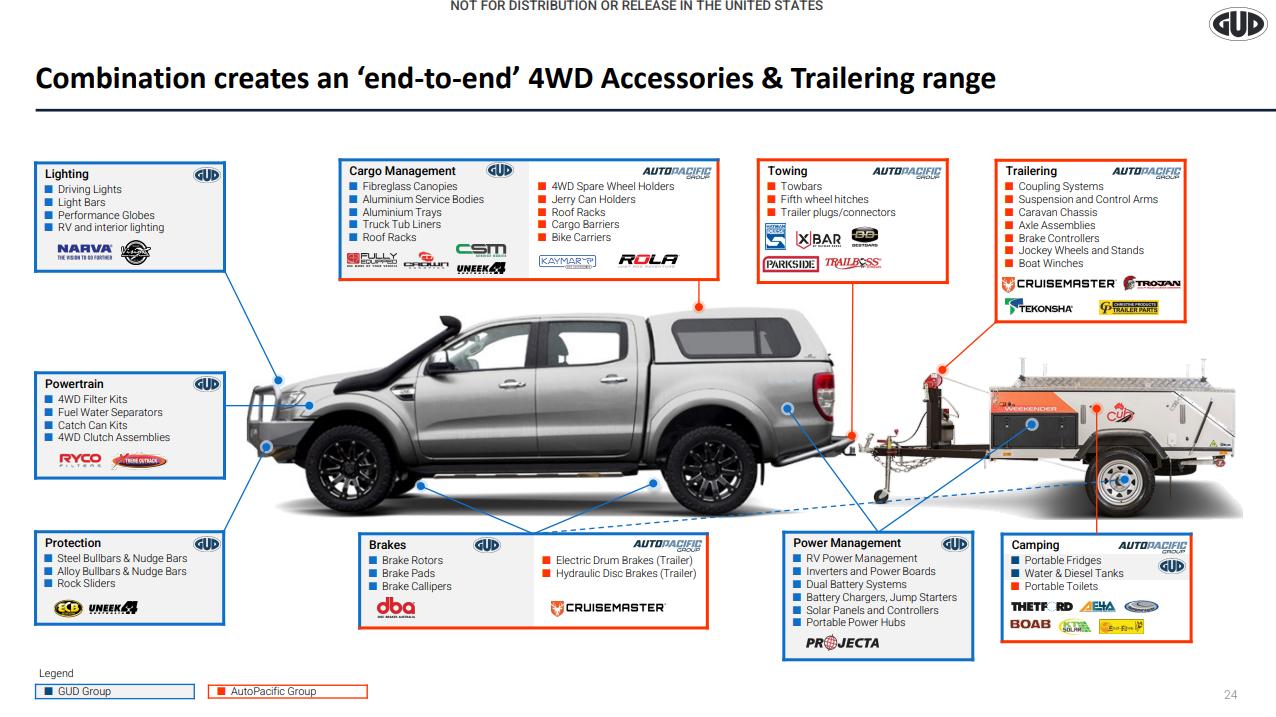

GUD automotive companies have a range of aftermarket accessories. The main emphasis is on 4WDs, though some of the brands include products for cars, trucks, agricultural and mining equipment.

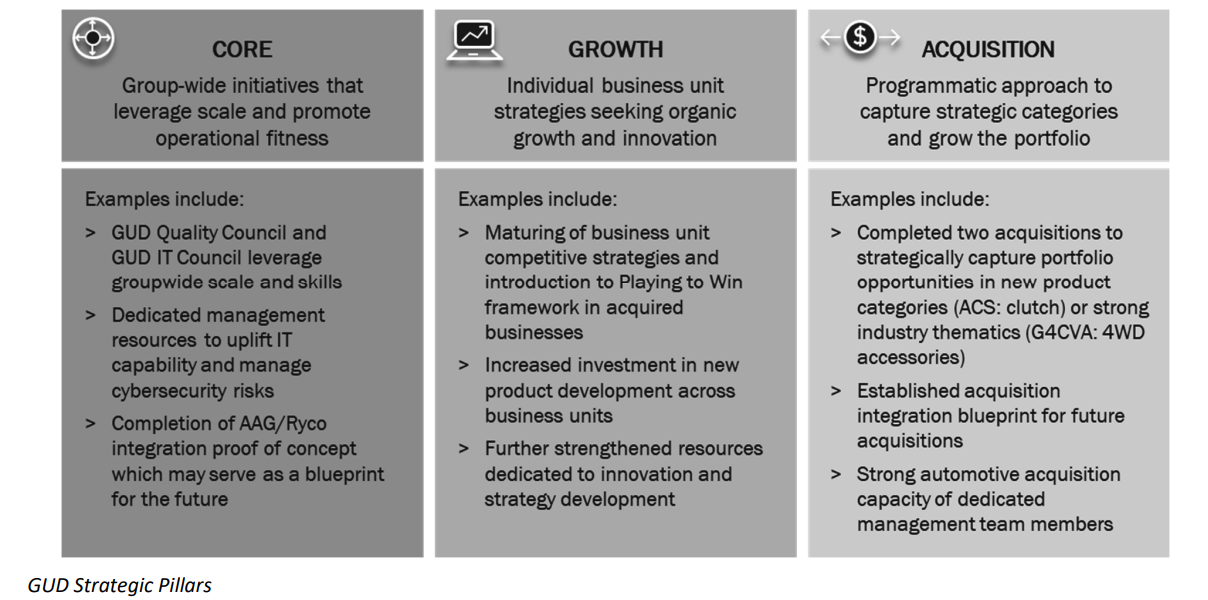

Acquisitive strategy

GUD invests heavily in growth, with particular emphasis on acquisitions. In FY21, they made two major automotive acquisitions (G4CVA and Australian Clutch Services), increasing revenue by +25%.

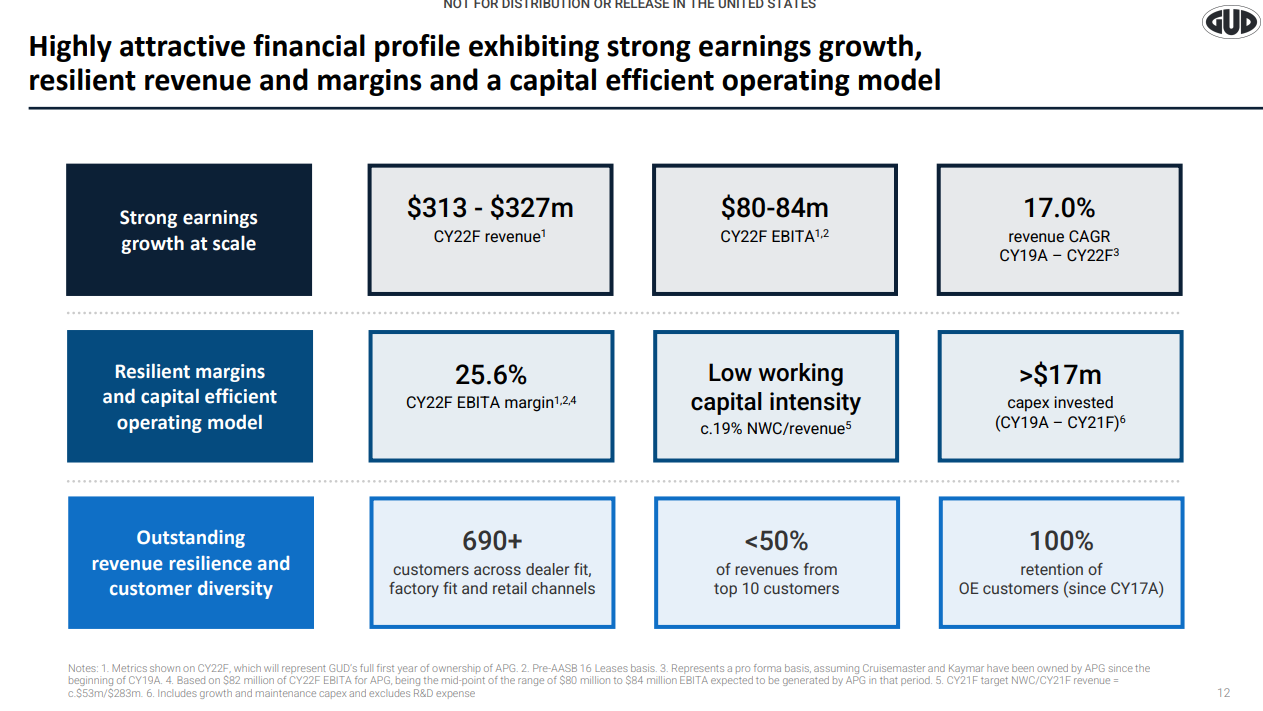

On 30 November 2021, GHD made a seminal announcement to acquire AutoPacific Group (APG) from private equity for $774 million. To put this in perspective, it will add around 75% to EBITDA.

To fund the acquisition, GHD will raise $405 million of equity, issue a further $75 million of shares to the vendors, and borrow $282 million in debt. Diluting shareholders to fund acquisitions has been its strategy – increasing shares outstanding from ~60 million in 2010 to ~137 million today.

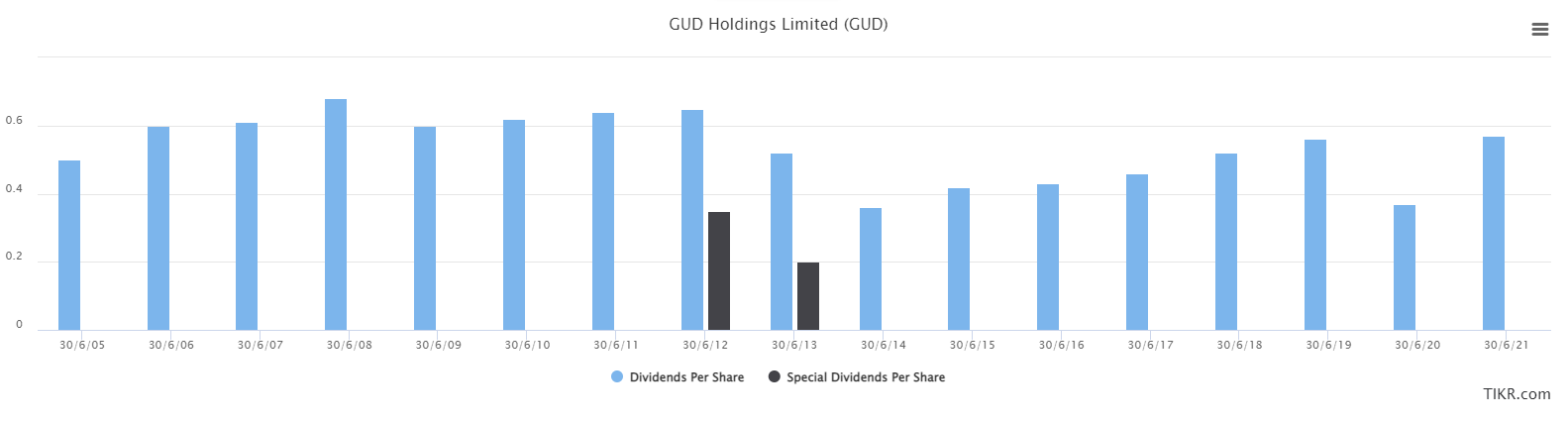

GUD’s dividends

GUD has not meaningfully increased its dividend over the past 15 years. FY21 increased 81% on FY20, though this was due to GUD being a cyclical Covid-beneficiary. Over time, shareholder dilution has meant dividends have not kept up pace with revenue or EBITDA growth.

Currently, the yield is an impressive 5.59% gross, though five of the past 10 years have had a +100% dividend payout ratio meaning it may not be sustainable.

Looking to forward returns

Eight analysts follow GUD, of which one has a buy, six hold, and one underperform. Despite this, analysts expect Covid tailwinds to boost EPS growth by 9.72-14.24% prior to the APG acquisition.

Valuation

The valuation is not a stretch with a price to earnings ratio of 15.38. This may seem artificially lower due to the cyclical high earnings in FY21. However, using FY19 earnings as a base would provide a similar figure.

Risks

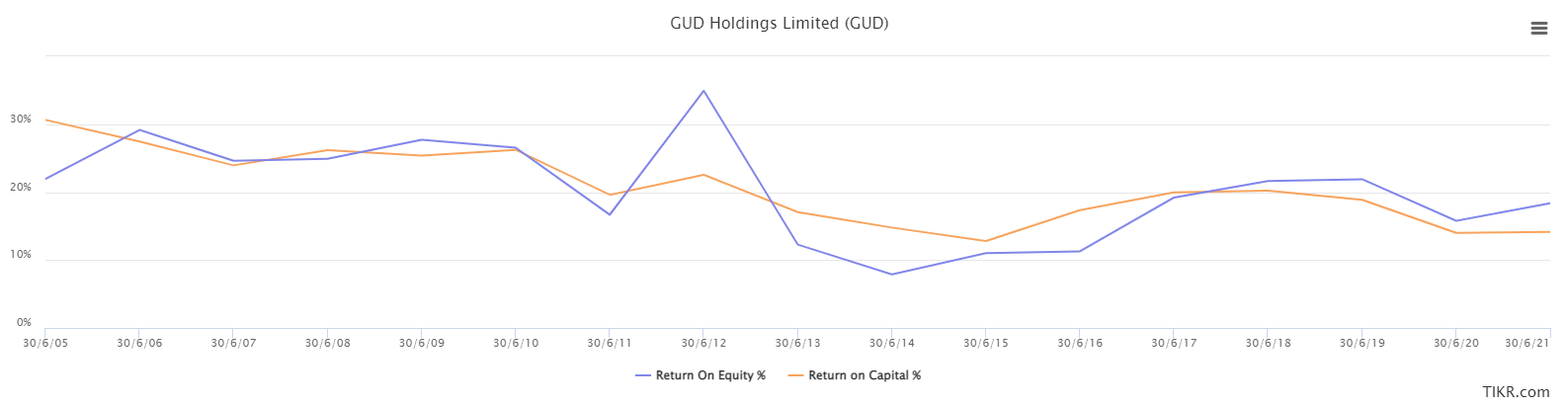

The main risk for GUD is capital allocation and shareholder dilution. Return on capital has been trending down over 15 years, though arguably this may be increasing over the past five. One should have strong confidence in GUD’s ability to grow, and for the APG acquisition to not be at cyclically high prices.

Final thoughts

GUD has a penchant for growth. With a decent dividend yield and improving returns on capital, this could be interesting for investors. However, the risk to the automotive aftermarket sector post-Covid seems real.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.