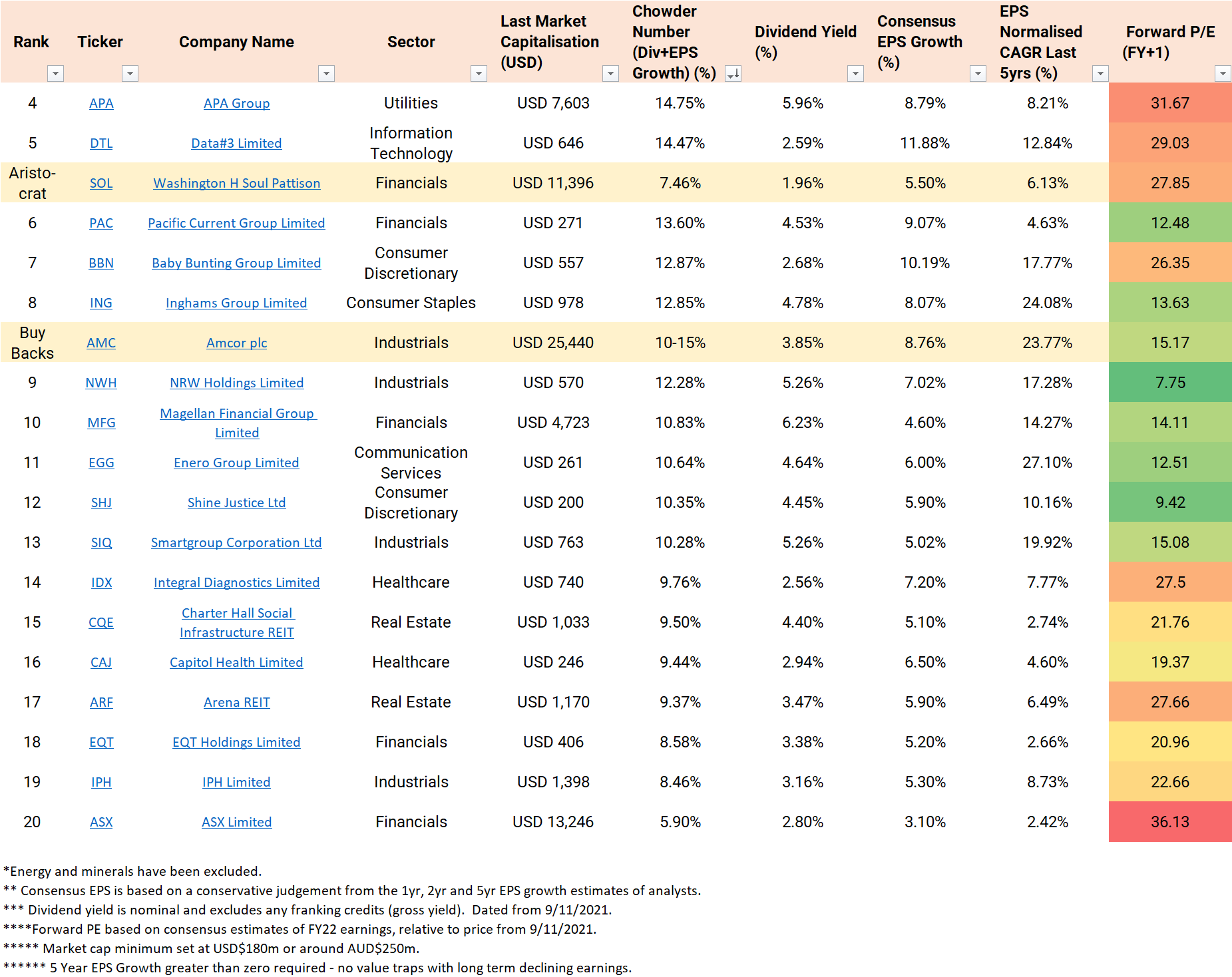

APA Group (ASX: APA) is a $33 billion midstream gas company that comes in at number four on the Dividend Growth Investing list. APA pays a 5.95% gross dividend yield, and analysts believe they will grow earnings at an optimistic 8.79%. This provides an exciting 14.75% Chowder Number.

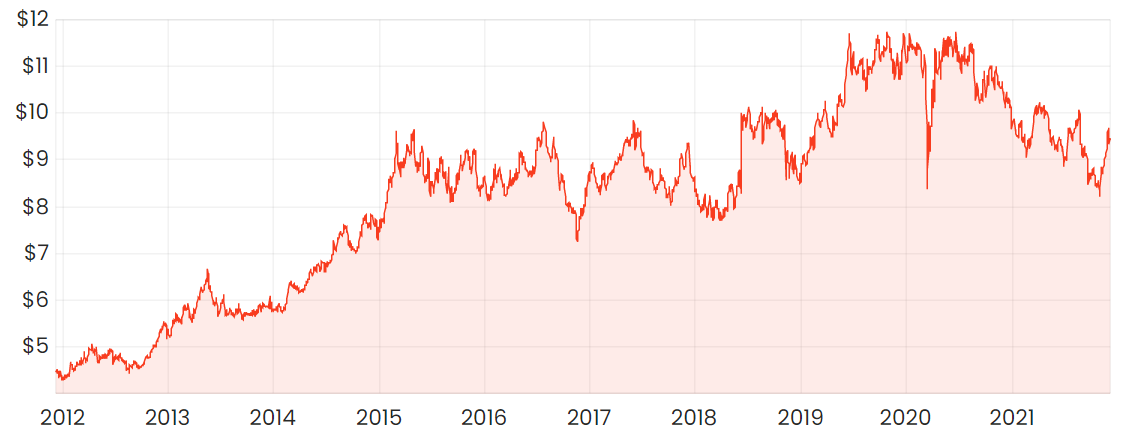

APA share price

What does APA do?

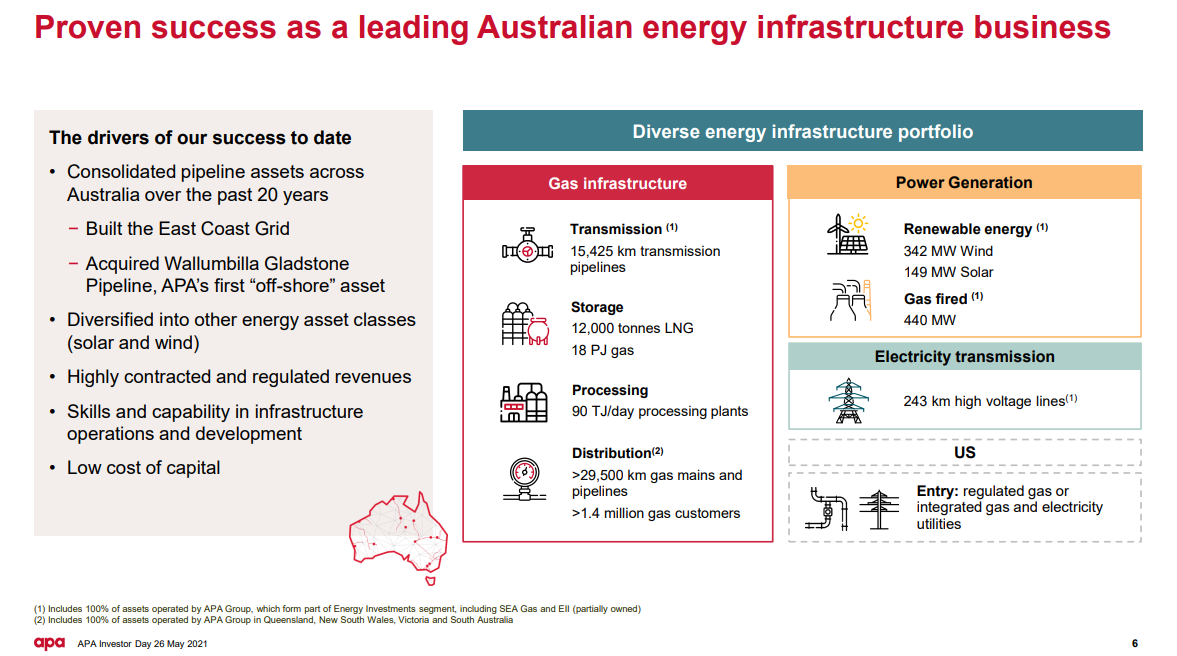

APA mostly focuses on Australian gas networks. They develop, own, and operate over 14,000km of gas transmission pipelines, almost 30,000km of gas distribution lines services 1.4 million customers, gas storage facilities, and gas processing plants.

APA was born out of the east coast gas network – connecting and distributing gas from Mt Isa in Queensland to Port Campbell in Victoria. More recently they expanded into Western Australia, where they continue to invest heavily in their network that connects the Northern Goldfields, Kalgoorlie, and Perth.

Outside of gas, APA is a newcomer to renewable and storage assets. It owns three wind farms and three solar farms mostly in Western Australia. While this represents only ~1.5% of revenue and ~1.8% of EBITDA, APA is the 8th largest owner of Australian renewable energy projects.

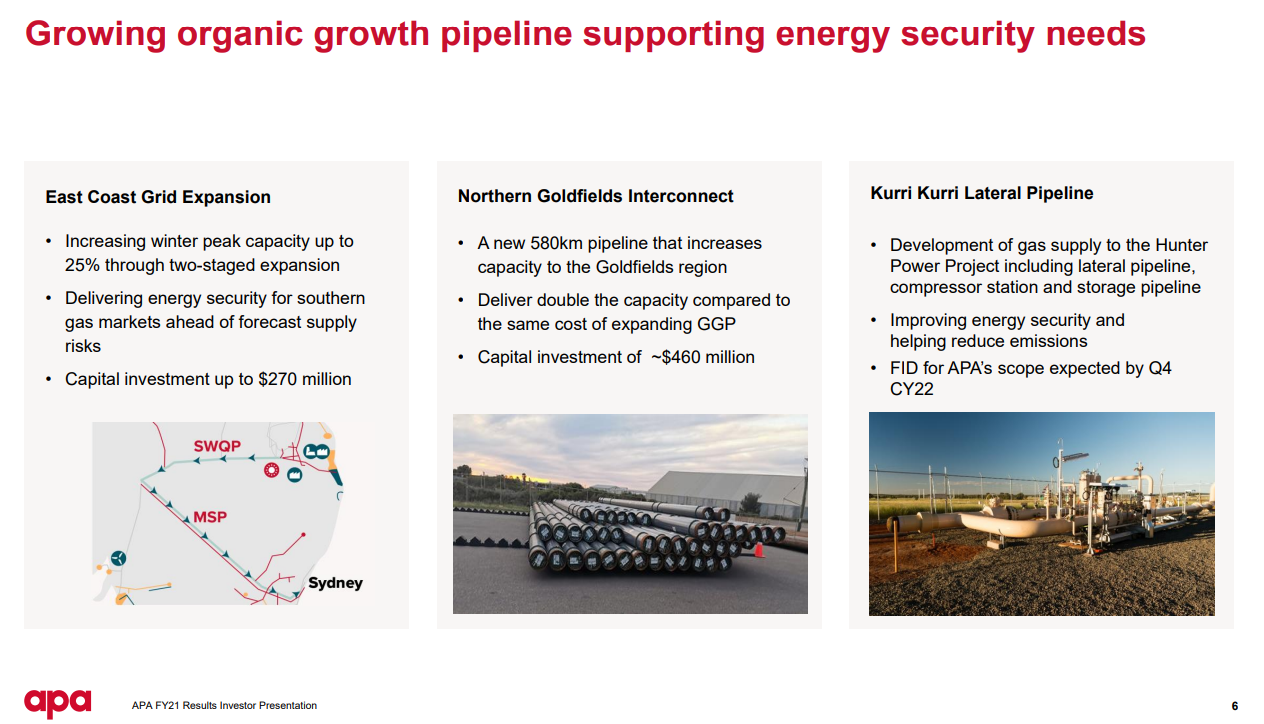

Capital intensive growth strategy

APA has a $1.3 billion growth capital expenditure pipeline and is expecting to deploy over $600m in FY22. Most of this is on the Western Australian gas network and the East Coast grid expansion. Gruyere Hybrid Energy Microgrid is being developed for $38 million, though large renewable investments in hydrogen or the like are still far away.

APA’s dividends

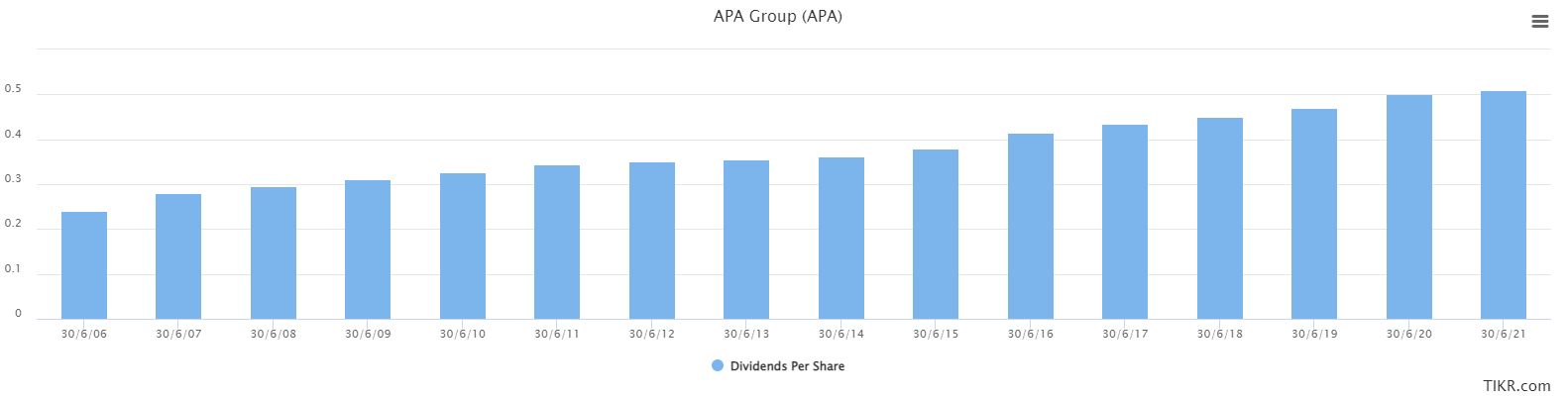

APA has managed to grow its revenue by 16.46% CAGR since 2005. However, shares on issue have increased by almost five-fold. So, the returns to the individual shareholder have been significantly lower. I have previously mentioned the benefits of buybacks and the costs of dilution.

APA has grown its dividend for 15 years at 5.5% CAGR. Today’s yield is 6.24%, and the company expects to continue to grow this. The outlook for FY22 is a 3.9% increase to 53c per share.

Looking to forward returns

Nine analysts following this stock have an average 5-year EPS growth expectation of 9.7% CAGR. Normalising for one-off items (e.g. $249m impairment on Orbost Processing Plant), I have used 8.79% in the Chowder Number.

This perhaps still feels high. The historical return on capital has declined from around ~8% to ~6.5%. Expecting growth to outstrip this may seem optimistic.

Valuation

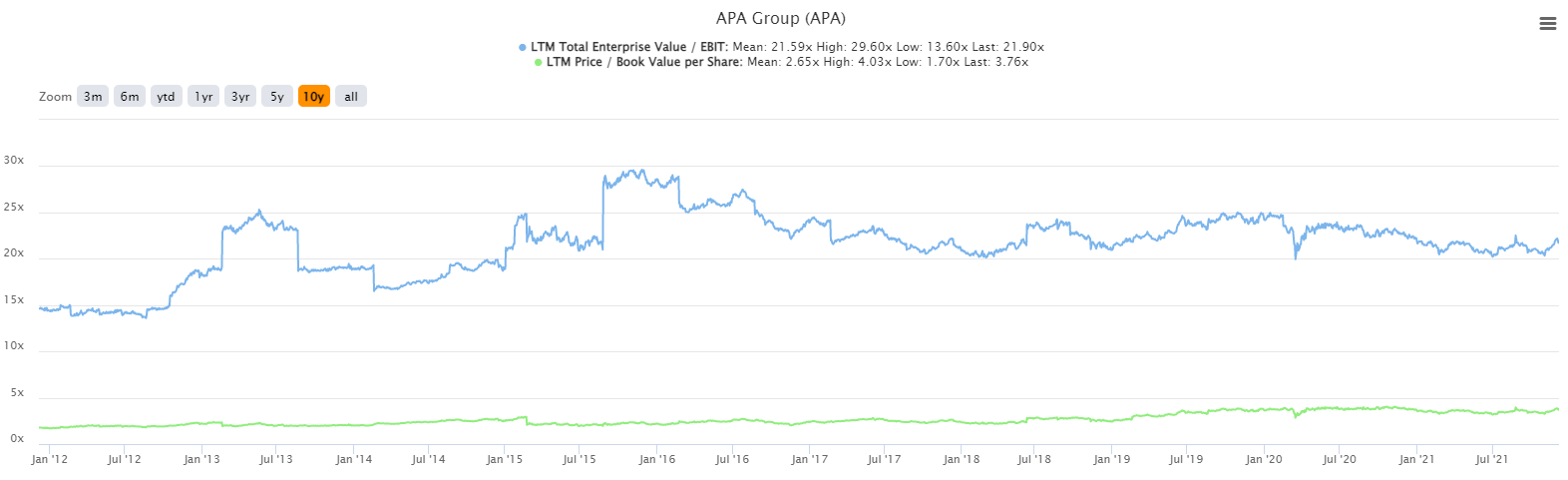

The enterprise value to earnings before interest and tax is currently ~22x, or a ~4.5% yield. This is below the dividend payout ratio and is historically average. The price to book value is 3.76x, significantly higher than the historical average of 2.65x. While it’s trading at 2015 prices, it’s likely to be slightly above fair value.

Risks

ESG is a major risk. Gas is expected to continue to be a key part of the energy sector well into 2050 despite climate change considerations. While it is unlikely APA will have any stranded gas assets, investors may simply pay lower multiples for gas assets.

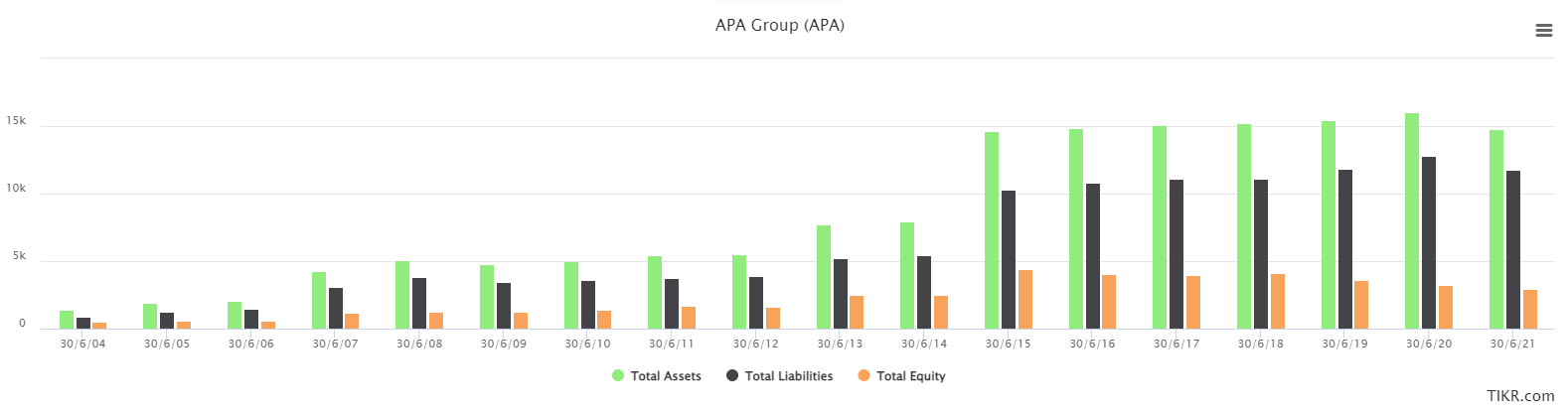

The balance sheet is another risk. While assets have been increasing, liabilities have been increasing at a quicker rate. In fact, shareholder equity has been declining since 2015. Relatedly, since 2016 the dividend payout ratio has been above 100%. This makes future increases in dividends unsustainable.

Final thoughts

Analysts may see value in APA’s high dividend yield, though there is a chance it investors may find it a value trap. With ESG and dividend sustainability risks, I’m happy to fish elsewhere.

For more on Dividend Growth Investing, see my recent article that outlines the screener approach being used here.