ESG (“Environmental”, “Social” and “Governance”) investing has emerged from a fringe concept to now a key consideration for investors.

But what is it? And why should investors take note?

“There is no strict definition, but simply put ESG entails evaluating a company or industry through the lens of its impact on its people, community and planet”

The term is often used interchangeably with the likes of ethical investing, sustainable investing and impact investing.

Breaking down ESG

The three ESG components can be broken down further into specific factors and metrics.

Often, it’s difficult to measure ESG factors, since many of the metrics are qualitative rather than quantitative.

However, by looking at multiple data points such as a company’s carbon footprint, employee satisfaction and board diversity, investors can gain a clearer view of whether the business is ESG friendly or not.

Why does ESG matter?

There have been over 2,000 academic studies on the relationship between ESG and financial returns.

Over 70% of them have found there is a positive relationship.

“Companies with a high ESG rating perform on average better than low-ranking businesses”.

The other main driver towards ESG is the changing attitudes of big institutional investors.

Pension funds, endowments and sovereign funds increasingly see their role as more than simply achieving a financial return.

Deploying capital is also about the impact on people, communities and the planet

.

As a result, companies that neglect ESG factors tend to find it harder to attract funding.

“Evidence is emerging that a better ESG score translates to about a 10 percent lower cost of capital”

– McKinsey

Subsequently, money has been pouring out of poor ranking ESG industries such as fossil fuels, gambling and tobacco, towards new-world economies such as clean energy and social ventures.

From fringe to mainstream

Traditionally, firms did not bother to report on non-financial factors.

However as ESG has gained traction, new reporting standards have emerged such as the Global Reporting Initiative and the Task Force on Climate-related Financial Disclosures.

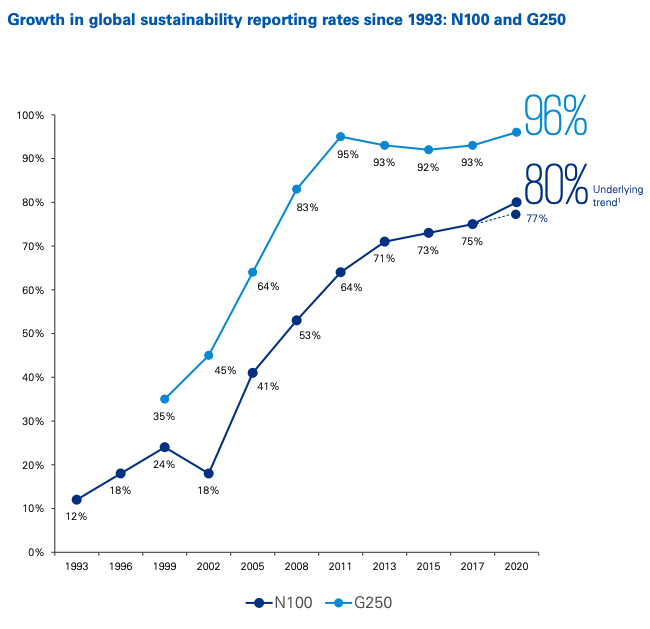

Almost 96% of the world’s largest 250 companies (G250) report on their sustainability performance.

Additionally, 80% of the top 100 largest companies (N100) from 52 nations now report on ESG.

Final thoughts

Overall, ESG is becoming increasingly prevalent in the mind of investors and is no longer pushed aside.

Companies that choose to ignore ESG will likely trade on lower multiples.

Conversely, ESG-friendly businesses on average achieve better returns and find it easier to source investors.

If you enjoyed learning about ESG investing, why not sign up for Rask’s free Ethical Investing 101 Course.

It takes an hour to complete, and by the end, you’ll be a bonafide ESG expert.