Fractures are starting to emerge over the Sydney Airport Pty Ltd (ASX: SYD) takeover offer.

The Australian Financial Review today reported on a disgruntled shareholder, who believes the airport is worth $12 per share and has called for a board spill.

Sydney Airport’s board has already endorsed the $8.75 per share takeover offer by the infrastructure consortium dubbed Sydney Aviation Alliance (SAA).

Shareholders will have the chance to vote on the proposal early next year.

SAA includes IFM Investors, QSuper and Global Infrastructure Management.

The illusion of price charts

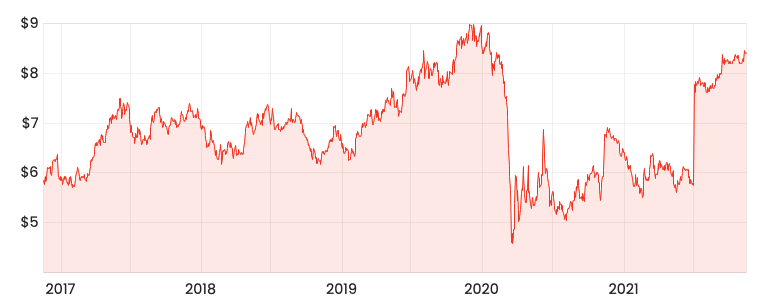

Sydney Airport traded just below $9.00 pre-pandemic.

If you assume that price was indicative of its true market value, the $8.75 per share offer by SAA doesn’t look that compelling.

However, it’s worth noting Sydney Airport had to increase its share count by 20% to get through the pandemic.

Subsequently, that $9.00 share price is now equivalent to about $7.50.

When you look at it this way, the $8.75 per share offer looks like a decent premium.

Who’s on the other side of the trade?

When buying, or selling any asset, it’s worth thinking about who is on the other side of the trade.

Why would SAA want to buy Sydney Airport?

Infrastructure investors typically want three features in an asset:

- Monopoly or difficult to replicate

- Long lease or complete ownership

- Reliable cash flows

Sydney Airport can’t be replicated, mainly because there’s no land within 10km of Sydney that could support an airport. Even if there was, the enormous cash and regulatory burden would price out any new entrant.

The airport’s lease concession expires in 2097. Infrastructure investors take a generational outlook. SAA wants to own Sydney Airport for decades, not years.

The first two ultimately lead to the third feature, reliable cash flows.

Planes fly in and out, Sydney Airport clips the ticket. Sure, the past 18 months has thrown a spanner in the works, but when considered over 76 years, it’s less than 2% of its cash flows.

It’s also worth noting infrastructure investors such as SAA will require a lower rate of return compared to equity investors.

Hence, SAA can afford to pay more for the asset as it doesn’t need to generate equity-like returns.

That’s likely why UniSuper is retaining its 15.01% shareholding.

If the offer was so good, it would sell out and redeploy the capital elsewhere. If the offer was poor, then it wouldn’t agree to the terms.

My take

Overall, I think the $8.75 per share offer is a decent outcome for all parties.

The proposed $12 per share valuation is clearly a stretch and suggests Sydney Airport was worth over $14 before the pandemic hit.

I doubt the public markets had mispriced the asset by 50%. Therefore, I think the Sydney Airport takeover criticism is overdone.