The Whispir Ltd (ASX: WSP) share price has fallen 37% in 2021 despite achieving meaningful growth across customers and revenue.

Why has the Whispir share price gone quiet? Let’s have a closer look.

WSP share price

A change in direction

Since listing in 2019, Whispir had a market narrative of a home-grown technology company growing by over 20% a year.

Growth would be prioritised, but the business was tracking closer to profitability each year.

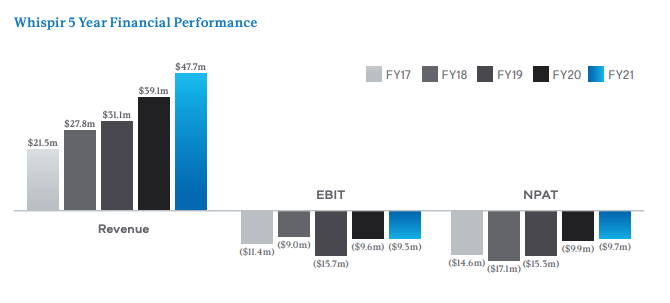

Whispir achieved an FY19 loss of $15.3 million, which fell to $9.9 million in FY20.

However, the $45.3 million capital raising in March changed this market narrative.

The business would retain its growth mandate, however, profitability would be pushed out into future years. Losses would also accelerate to over $13.0 million for FY22.

Research and development (R&D) would more than double. Meanwhile, the business would expand into the United States.

The market doesn’t like never ending loss-making companies. Moreover, it certainly doesn’t look kindly on international expansion, given the encyclopedia of Australian businesses who have tried and failed.

Overall, the market sentiment shifted.

Whispir went from a growth company approaching an inflection point to a business needing more money from shareholders.

Underwater shareholders weigh on Whispir share price

The capital raising was oversubscribed and the shares were gone in just two and a half hours.

Despite the demand back in March, the Whispir share price has not been above $3.75 since.

As the Whispir share price slid, institutions exited positions. Subsequently, any bump in share price is sold into by sellers who want to exit.

Light at the end of the tunnel?

The Whispir share price shot up 14% last week after the business released its first-quarter result.

The business recorded $16.3 million in cash receipts, added 33 new customers and churn dropped to just 2.1%.

Is it time to buy the Whispir share price dip?

Whispir is currently trading on an enterprise value to sales (EV/S) ratio of 3.86. For a growing software platform, this multiple is very low.

I think the Whispir share price offers good value at today’s prices if management can execute.

It’s a high-risk bet, given the company is still loss-making and moving into international markets.

But I’d be willing to start a small position and add to it over time.

Looking for other share ideas? Check out two ASX shares I’d buy and hold for the next decade.