The Vulcan Energy Resources Ltd (ASX: VUL) share price remains in a trading halt after the company became the target of a short-seller.

J Capital published a short report on Wednesday accusing the business of misleading investors over its zero-carbon lithium project in Germany.

J-Capital savages management estimates

The 24-page report described Vulcan as the “God of Empty Promises”.

J Capital accuses Vulcan of misleading investors by:

- Low-balling cost estimates

- Overstating the quality of the resource including flow rate and recovery rate

- Using low discount rates to make the project look profitable

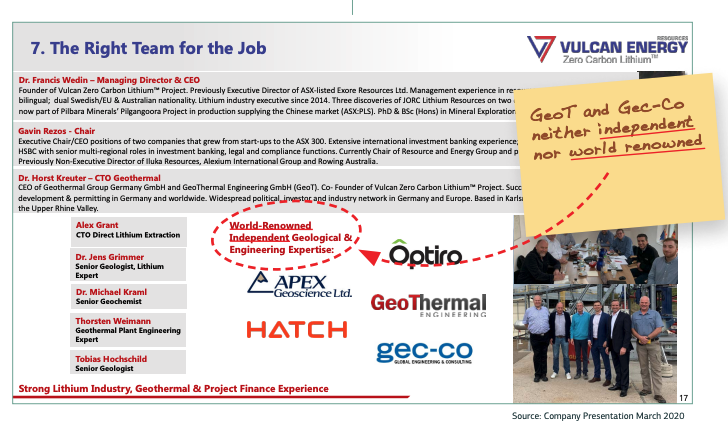

- Using small consultancies owned by management and later acquired by Vulcan

- Declining to reveal information about the direct lithium extraction (DLE) technology critical to the project

- Overstating the positive environmental impacts of the project

Notably, J Capital believes the project may actually never get off the ground due to politicians and activists opposed to geothermal power plants.

“Many experts agree with us that this project is a non-starter”.

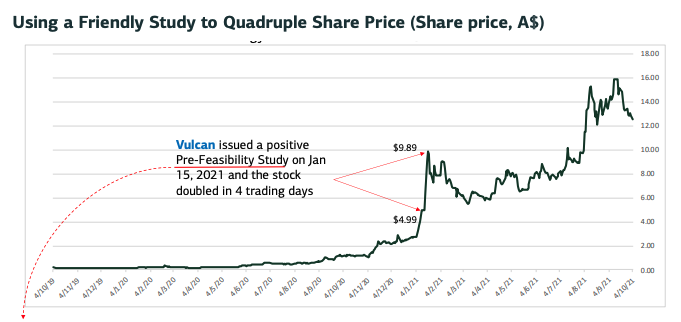

Moreover, Vulcan management is accused of using a Pre-Feasibility Study (PFS) to drive share price momentum.

Co-founder and managing director Horst Kreuter previously attempted and subsequently failed at two geothermal projects in 2003 and 2016.

Similarly, Francis

Wedin, co-founder and managing director, has never been able to develop a lithium project to production.

Finally, Thorstein Weimann, the newly appointed COO, ran a loss-making geothermal-power consulting company for the past decade.

Vulcan shareholders in Limbo

In response to the report, Vulcan issued a statement yesterday discrediting J Capital and the author of the report, Tim Murray.

“…Mr. Tim Murray, co-founder of J-Capital, who according to his own bio has lived in China for 19 years and has a degree in “Chinese Political Economy”. Based on his online profile, it is not apparent that Mr. Murray has any technical qualifications in geothermal energy or lithium extraction”.

Vulcan noted the report makes a large number of inaccurate statements or assertions. However, the company failed to address any of them directly.

Subsequently, the company was forced into a trading halt just 26 minutes later.

Shareholders now remain in limbo, as they wait for a detailed response from management.

My take

Vulcan tried to play the man rather than the ball. Unfortunately, it failed.

J Capital report is detailed and raises several concerns over Vulcan’s credibility.

As a result, management will likely have to release more detailed estimates of the feasibility study.

With a $1.86 billion market capitalisation and effectively no revenue, it could get ugly for the Vulcan Energy share price.