Flight Centre Travel Group Ltd (ASX:FLT) shares were the most traded on the ASX last week according to CommSec data. Shares rallied to over $24 but have since trended downwards following the release of its AGM last week.

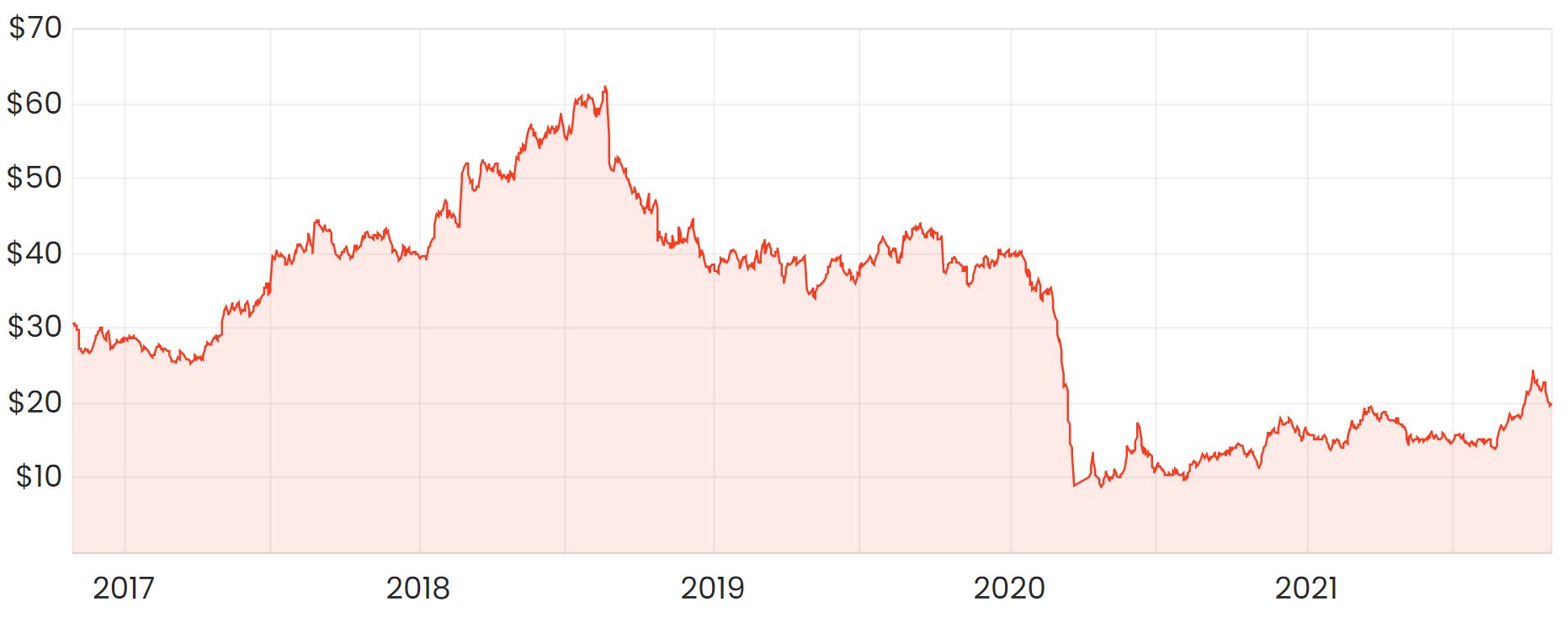

FLT share price chart

International travel to resume

For the first time in over 18 months, fully vaccinated Australians will be able to travel overseas without needing an exemption. For travellers coming into the country, skilled workers and international students are set to be allowed in by the year’s end.

Outbound travel is somewhat limited however, with only a handful of countries giving the green light for vaccinated Australians to go there without a mandatory quarantine. Getting back into Australia is a little more complicated as rules will be differ depending on which state or territory you will fly back into.

With high levels of pent up demand, Flight Centre, Webjet Limited (ASX: WEB) and Corporate Travel Management Limited (ASX: CTD) will be some of the obvious beneficiaries of the reopening.

While Flight Centre hasn’t been selling too many travel packages over the past 18 months, it has been investing in a new digital platform that could further disrupt legacy travel management companies.

I also suspect that if smaller travel companies didn’t fare so well throughout Covid, there could be some further consolidation within the industry.

Time to buy Flight Centre shares?

Things are starting to look up for many of these companies, but it still might be quite some time before they return to pre-covid levels of profitability.

https://education.rask.com.au/2020/01/06/what-is-a-capital-raising-and-entitlement-offer/

It’s also worth noting that the market has valued Flight Centre’s shares to where they were pre-Covid as you can see from the chart below. This is despite the fact that its shares are still trading significantly lower from where they were.

With the recovery looking to be priced in already, I think there could be some better ideas on the ASX at the moment.

For some more share ideas, click here to read: 2 fast-growing ASX software shares for your watchlist.