Shares in Star Entertainment Group Ltd (ASX: SGR) are still over 20% down since allegations of suspected money laundering were made against the company recently.

For a detailed breakdown of what’s happened with Star over the past few weeks, check out my colleague, Lachlan Buur-Jensen’s article here.

Time to buy the dip?

In the stock market, investors and traders are often attracted to companies whose shares have fallen significantly in a short amount of time. Given that the market tends to overreact on both the upside and downside, this can often present opportunities to pick up some bargains and make some quick gains.

However, this method can be risky if you’re buying companies that aren’t growing, or worse, losing value over time. Time does not work in your favor under these conditions.

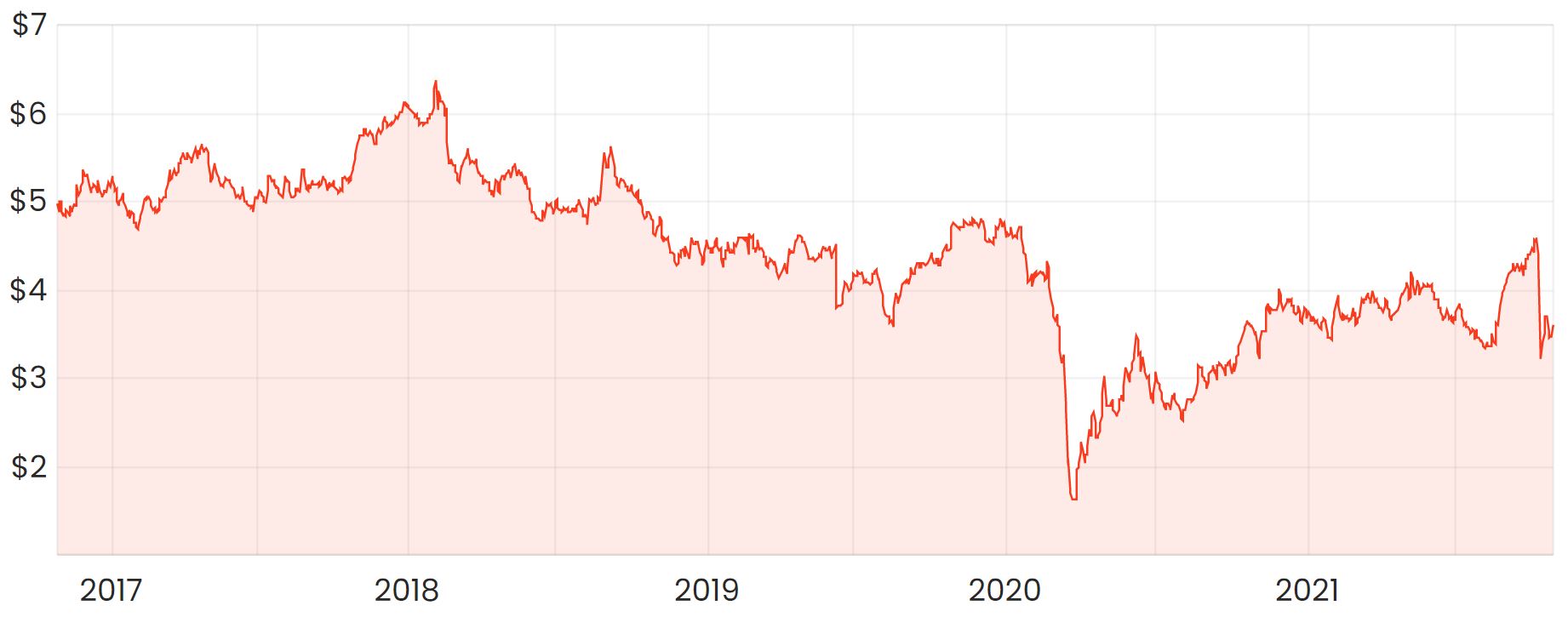

Prior to Covid, Star’s shares haven’t really lived up to the name of the company. The five-year share price chart paints a fairly accurate picture of the business’s performance.

Topline revenue has almost stalled in some years, gross margins have declined as well as return on equity – an important metric that measures profitability in relation to shareholder’s equity. The business also carries debt and its debt/equity ratios have increased over the past few years.

Star has not been a total capital destroyer however, as it’s paid a fully franked dividend of around 4% for the three years prior to Covid. Still, this is not huge growth.

What now?

My own preference would be to buy the dip for companies that are experiencing high levels of growth. In this situation, time is working with you rather than against you if you were to buy into companies that are losing value over time.

When the whole tech sector takes a hit, we often see some large losses from quality companies like Xero Limited (ASX: XRO) as an example. These are the sort of companies I’d be happy to buy as there’s often no change to the fundamentals of the business.

You can read a little bit more about Xero and Tyro Payments Ltd

(ASX: TYR) here: 2 ASX growth shares I’d buy in a tech downturn.