Congratulations Melbourne. You did it!

The world’s most locked-down city is celebrating its freedom today as pandemic-induced restrictions are eased.

No more 15km rule. Gathering limits loosened. Staying out past 9pm. Restaurants and bars back in business.

With Melbournians out and about, I expect the following 3 ASX shares to directly benefit from the city’s reopening.

1. Endeavour Group Ltd (ASX: EDV)

Demerged from former majority owner Woolworths Group Ltd (ASX: WOW), Endeavour houses liquor, gambling and hotel operations.

Notable brands under the Endeavour umbrella include Dan Murphy’s, BWS and Jimmy Brings. The business also operates 330 pub and club venues.

With restrictions easing today on dining and gatherings, expect the city of Melbourne to celebrate big time.

For Endeavour, it will benefit from both at-home and on-premise consumption. It very well might be the business’ biggest trading weekend on record.

Leading up to Christmas is also a bumper time for liquor retailers as customers splash out for Christmas and New Year’s Eve.

It’s perfect operating conditions for Endeavour, therefore I’m expecting a big maiden half-year result in February.

2. Tyro Payments Ltd (ASX: TYR)

You may not have heard of ASX growth share Tyro Payments, but you’ve likely used its service.

Tyro terminals. Source: Tyro website

The business provides merchants in the retail, hospitality and health space with terminals and related software to process payments.

All three of Tyro’s verticals have been impacted by restrictions, particularly hospitality and retail. Furthermore, Tyro’s two biggest markets by terminal numbers are New South Wales and Victoria.

I’m not in Melbourne, but I can imagine this weekend is going to be big business for cafes, restaurants and bars.

Tyro will directly benefit from this as the company clips the ticket on each transaction processed.

Expect to see Tyro’s weekly transaction numbers released each Monday to increase rapidly over the next month.

3. Transurban Group (ASX: TCL)

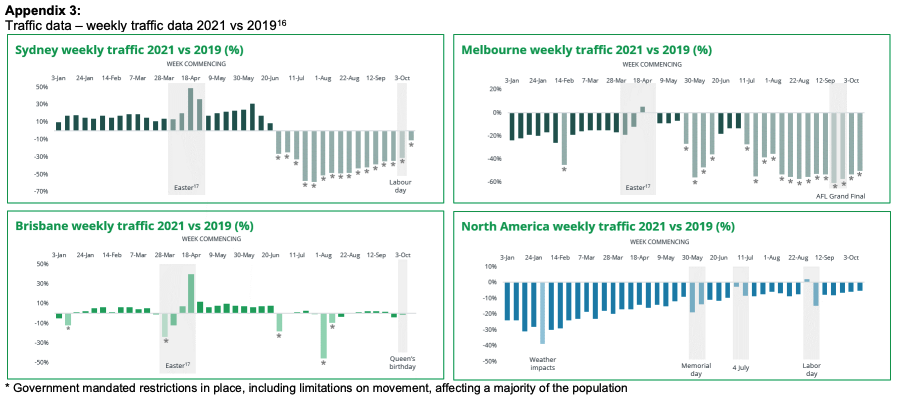

Yesterday, toll-road operator Transurban provided a trading update for the first three months of FY22.

Notably, traffic across Sydney was down 43.7% compared to pre-pandemic numbers. It was a similar story for Melbourne, down 30.7%.

The company cited lockdowns as the biggest contributor to low traffic numbers.

With the 15km travel limit out the window, expect to see toll traffic pick up as Melbournians visit family and friends.

Transurban will be a direct beneficiary, as it charges fees to vehicles when using its toll road network. Subsequently, I expect the second quarter to be much better than the first.