Online luxury retailer Cettire Ltd (ASX: CTT) share price is up 4.08% to $3.57 despite one of its directors selling over $500,000 in shares.

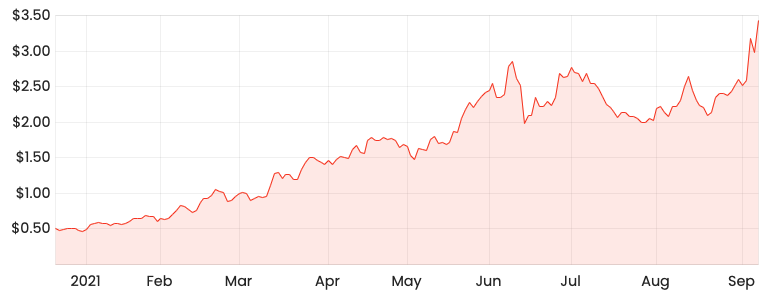

CTT share price

Who sold shares today?

Non-Executive director Bruce Rathie has sold 200,000 shares on market for $2.55 per share. This has netted him $510,000.

He still owns 810,000 shares across three entities and its his first sell down since the company began public trading in December 2020.

Why did he sell shares?

No specific reason was given for the sell-down in the notice submitted to the ASX.

However, given the IPO priced shares at $0.50, this would mean shares today are a 7-bagger in under a year.

The sell-down only represents about 20% of Rathie’s shareholding. It seems reasonable to take some chips off the table given the impressive share price run.

Additionally, it’s not uncommon for directors to sell down shares after reporting season with four CEOs also selling shares last week.

How has the Cettire share price been performing recently?

Since its $0.50 IPO, the Cettire share price has been on an absolute tear.

In its most recent company update, the business recorded a whopping 304% jump in revenue to $92.4 million. This was well above its prospectus forecast of $70 million.

Furthermore, all key metrics are tracking well, with active customers, product margin and repeat customers all meaningfully increasing.

The market is divided on this business, given its opaque wholesale agreements with luxury brands.

However, it seems to be gaining solid traction and is looking to work directly with brand owners to complement its existing supply chain.

Should I buy Cettire shares today?

If you’re interested in the company, I wouldn’t let today’s director selling influence your decision.

Directors sell for a range of reasons, which may or may not be linked to the company.

If company founder and CEO Dean Mintz sold shares I would be a little more concerned. However, his 65.9% shareholding is escrowed until at least February 2022.

I would need to do a valuation of Cettire before deciding to buy shares or not.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.