Shares in biotech company Mesoblast Limited (ASX: MSB) have taken a 21% dive this week following the release of its FY21 results.

Management flagged a widening annual loss and the US Food & Drug Administration (FDA) has more concerns over its lead product candidate, remestemcel-L.

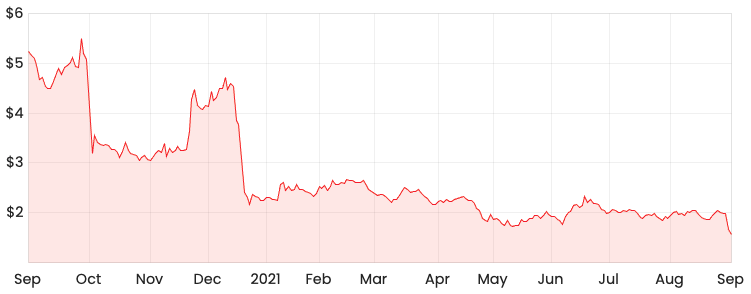

MSB share price

Outcome of FDA meeting

Mesoblast recently met with the US regulator to discuss having remestemcel-L approved for emergency use authorisation (EUA). The drug is used in the treatment of acute graft versus host disease in children, as well as respiratory distress syndrome for adults affected by COVID-19.

However, the FDA advised Mesoblast it will need to see some more proof that it can increase the potency consistency across various batches of remestemcel-L.

The FDA also told Mesoblast that potency assays must be agreed upon prior to it commencing its proposed phase 3 trials.

Mesoblast plans to meet with the FDA in the last quarter of CY21 to discuss the potency assays.

Financial results

Over FY21, Mesoblast brought in US$7.4 million in revenue, down from $32.2 in the previous year.

Research and development cost the business $53 million in FY21, with around half of this funding costs associated with remestemcel-L.

Mesoblast’s net loss widened to $99.6 million, down from a loss of $87.3 million in FY20.

Cash on hand at the end of the period was $136.9 million, but the company did flag it would require more cash in the short term in order to meet its debt obligations.

My take away

Those who have been following Mesoblast for a while now will likely remember some of the FDA outcomes last year, which saw the share price drop over 40% in a single trading day.

In August last year, the FDA’s Oncologic Drugs Advisory Committee voted 9:1 in favour of the approval of remestemcel-L, yet it still had to further prove the efficacy of the drug.

If things go well for Mesoblast, the upside could be significant. Having said that, I find it hard to assign a probability to the success of its drug candidates given the complexities involved.