In a bullish sign for the return to global travel, Webjet Limited (ASX: WEB) announced today that the company will be cash-flow positive for the first half of FY22.

The market has reacted positively to the news, sending the Webjet share price up 3.64% to $5.70.

What was announced?

Webjet released an announcement this morning providing an update on its cash flow expectations. John Guscic, Webjet’s Managing Director said:

“Our post-Covid strategy is delivering results and the Company will be operating cash flow positive for the first half of Financial Year 2022″

The company also provided an update on its business-to-business (B2B) WebBeds business, which connects hotels looking to fill vacancies and travel retailers looking for rooms.

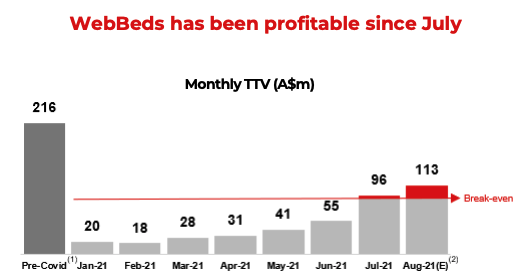

WebBeds has been profitable since July, stemming from strong demand in North America and Europe. This suggests a significant upside as more economies reopen.

Webjet’s business-to-consumer (B2C) online travel agency, which provides a search site for flights, hotels and car rentals continues to be affected by lockdowns across Sydney, Melbourne and New Zealand.

It was profitable across April to June when lockdowns abated, however, has returned to a loss as restrictions hinder travel.

“We are confident that both businesses will return to profitability as soon as the domestic Australian and New Zealand markets reopen“.

What is the outlook for the Webjet share price?

Commenting on the outlook for Webjet, Guscic was positive on the reopening of international borders and what it means for the business:

“All our businesses have significant potential to grow market share by expanding into new market segments and benefiting from consumers shifting to buy travel online… as conditions normalise, we believe our Webjet businesses will have higher market share, lower costs and greater profitability. While the exact timing is uncertain as our growth opportunities are driven by the opening of borders, we know demand for travel will return and we are absolutely ready to capture it”.

Webjet has also rebased its cost structure, removing at least 20% of expenses once the business is back to normalised operations.

My take

Travel companies are becoming increasingly bullish on borders reopening.

Just last week, Qantas Airways Limited (ASX: QAN) announced that border and quarantine restrictions should be removed by December, based on 80% of the population being vaccinated.

Businesses such as Webjet and Qantas will likely emerge stronger in a post-pandemic world as it’s given them the opportunity to slash costs. Moreover, competition has been weakened in the case of Qantas and e-commerce penetration has jumped for Webjet.

However, when choosing to invest in travel stocks, be mindful of the effect of capital raisings conducted last year, which diluted shareholder interests.

For example, Webjet’s share price is 42% below its pre-pandemic levels despite its market capitalisation up more than 12%.