The Crown Resorts Ltd (ASX: CWN) share price popped this morning before retracing all of those gains to end the day largely unmoved as the company released its FY21 result.

How did Crown perform in FY21?

Key financial highlights for the year ending 30 June 2021 include:

- Statutory revenue of $1.536 billion, down 31.3%

- Earnings before interest, tax, depreciation and amortisation (EBITDA) of $114.1 million, falling 77.4%

- Reported net loss after tax of $261.1 million compared to a profit of $79.5 million in FY20

- Dividend cancelled

What led to the poor financial performance?

It’s been a difficult year for Crown, with pandemic related restrictions meaning all of its premises were shut for a period of time.

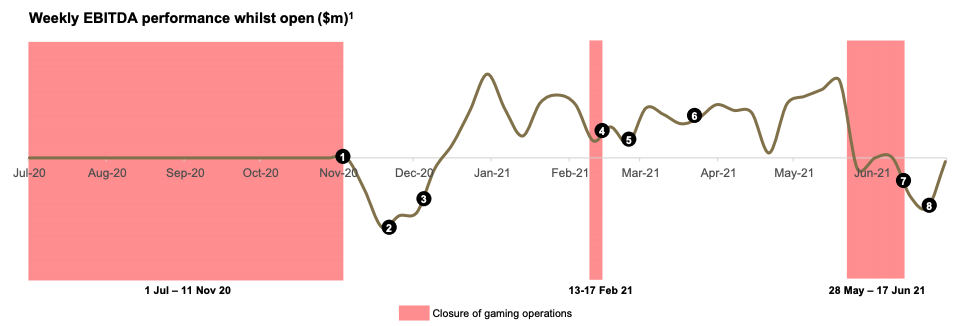

Crown Melbourne was most impacted, with activities closed for 160 days throughout the year.

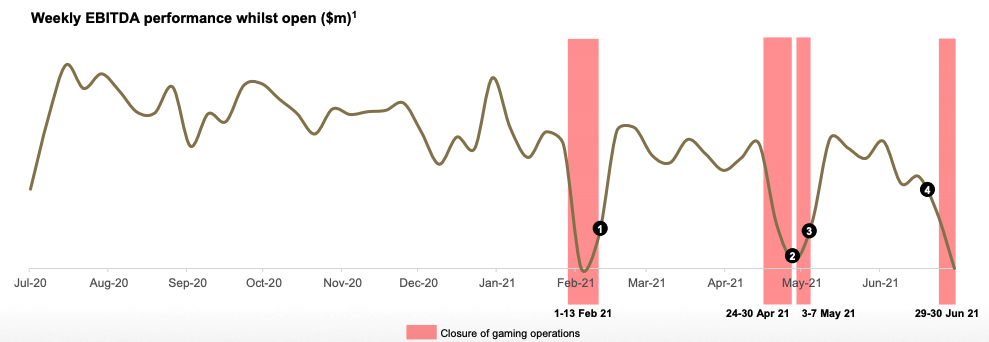

Crown Perth was the standout performer, recording $254.2 million in EBITDA as it was largely unaffected by the pandemic. Unfortunately, operations at Crown London, Crown Sydney and corporate costs reduced that number to $114.1 million.

Regarding the $261.1 million net loss, this was largely attributed to closure costs of $120.6 million while gaming activities were suspended.

Additionally, the business incurred a net $54.6 million loss relating to significant items such as credit losses, reopening costs, underpayment of tax and impairments. These costs were somewhat offset by $207.8 million in proceeds from sales of its Crown Sydney apartments.

To top it off, Crown has been plagued by regulatory scrutiny with separate investigations completed or underway in Sydney, Melbourne and Perth.

What’s next for the Crown share price?

Unfortunately for Crown, pandemic restrictions in Sydney and Melbourne have meant FY22 is off to a rocky start. These are likely to continue until either case numbers abate or vaccination rates materially increase.

Moreover, regulatory uncertainty will continue to weigh on the share price. As a result, costs will remain elevated in the short term for legal and consulting expenses.

Positively, Dr Ziggy Switkowski – ex-head of Telstra Corporation Ltd (ASX: TLS), will join the board as Chairman following receipt of all necessary approvals.

Additionally, former Lendlease Group (ASX:LLC) chief executive Steve McCann will join Crown as CEO.

My take

Crown’s interim Chairman, Jane Halton, said:

“2021 has been a challenging year for Crown, with intense regulatory scrutiny and unprecedented impacts on business operations from the COVID-19 pandemic”.

To say FY21 has been challenging I think is an understatement.

Crown couldn’t have foreseen the pandemic. Even if it could have, there was very little it could do.

However, regarding the regulatory action, it only has itself to blame.

There is a very real possibility that Crown may lose one or more of its licenses, With this kind of binary outcome hanging over the company, I think it’s prudent to watch from the sidelines for now.

Without a doubt, punters will return to the casino in a post-pandemic world.

The real question is will those casinos be run by Crown?