The Flight Centre Travel Group Ltd (ASX: FLT) share price landed on the green tarmac, up 4% today. Can the Flight Centre share price finally take off?

FLT share price

FY21 results

In a challenging environment, Flight Centre reported total revenue of $395.9 million, a far cry from the $1.89 billion it earned in FY20. It’s completely understandable given COVID.

The leisure segment contributed around 40% of revenue and corporate chipped in with 55%, the remaining balance relates to other revenue.

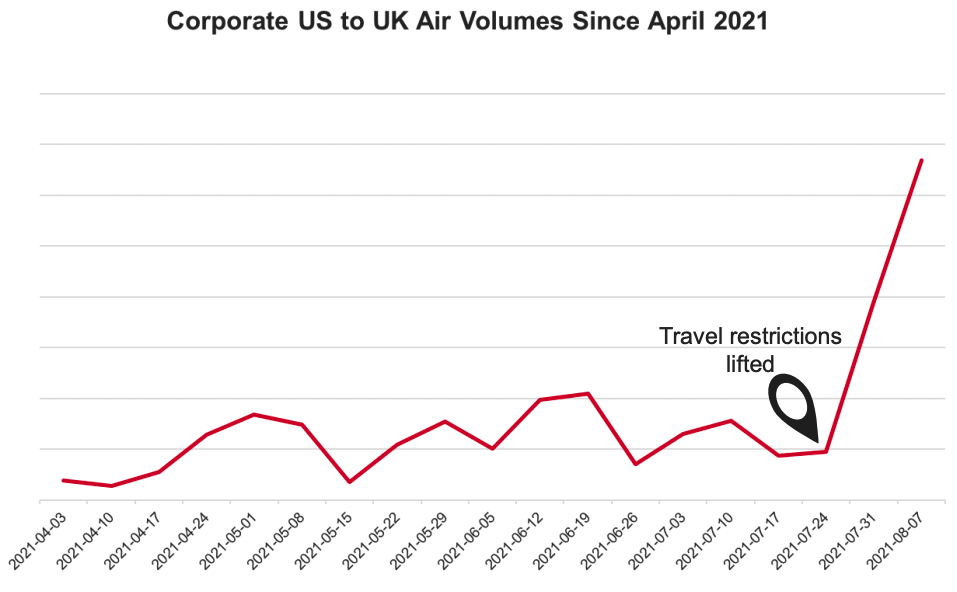

Whilst the current situation in Australia paints a bleak outlook ahead, the rest of the world have been flying around.

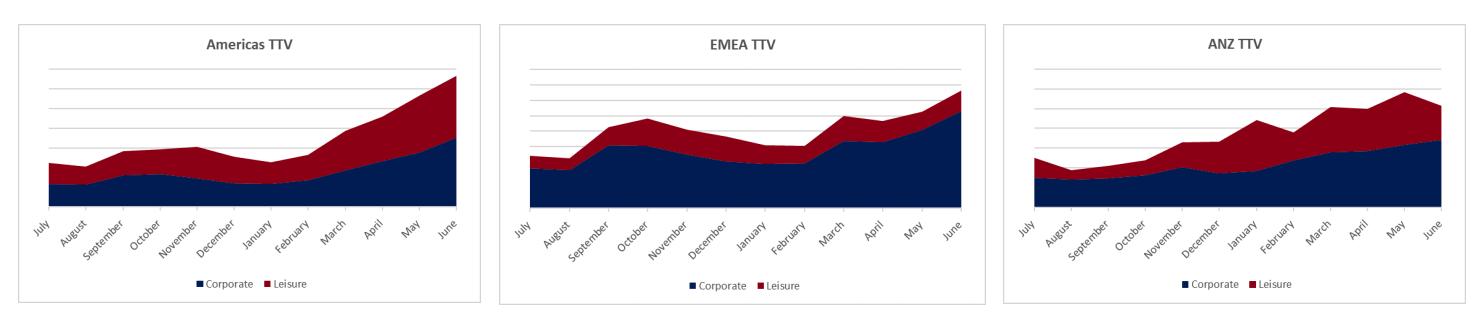

Source: FLT FY21 Investor Presentation

As you can in the above graphs, the total transaction volume across Americas and Europe, Middle East and Africa (EMEA) continue to climb.

The cut in expenses, mainly employee costs, sales and marketing and other expenses helped improve net profit after tax from -$662 million to -$433 million.

Management is targeting monthly profitability in both corporate and leisure during FY22, which is reliant on the efficacy of the vaccination.

My thoughts

The travel industry is hurting a lot at the moment but there is light at the end of the tunnel.

The trends illustrated above paint a positive outlook.

Flight Centre may seem to be cheap relative to previous prices but on an enterprise to revenue multiple, it’s actually trading near record highs.

In any event, Flight Centre’s future is dependent on so many external factors outside of its control. As a result, it’s not something I fancy.

If travel stocks interest you, check out Lachlan Buur-Jensen’s article on Qantas Airways Limited (AS: QAN).

Otherwise, if you want to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.