Macquarie Telecom Group Ltd (ASX: MAQ) has released its FY21 results today with revenue up 7%, however, the market has reacted indifferently to the update.

Who is Macquarie Telecom?

Macquarie Telecom, not to be confused for Macquarie Group Ltd (ASX: MQG), is an Australian cloud, telecom and data centre company for business and government customers.

Similar to Aussie Broadband Ltd (ASX: ABB), the company has a distinct focus on providing excellent customer service. This is evident from its +75 net promoter score.

The business has a reputation for trust, demonstrated by Macquarie Telecom hosting 42% of Australian Government agencies as customers.

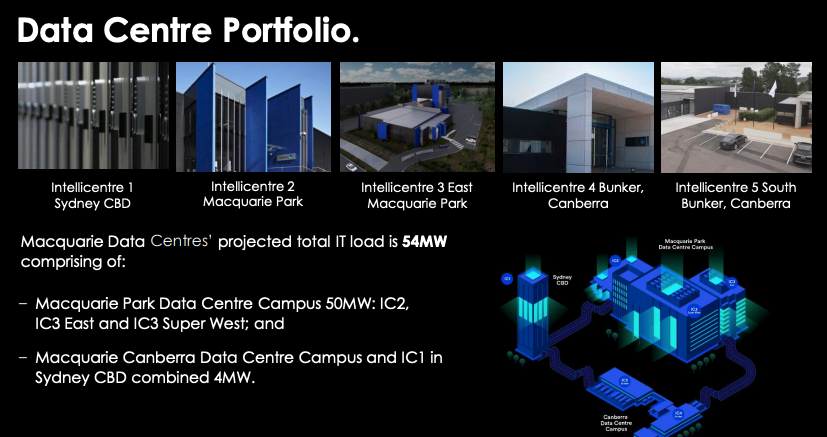

Recently, the company has accelerated its growth ambitions by building data centres in Canberra and Sydney. The total completed and planned data centre capacity is 54MW.

How did it perform in FY21?

Key financial results include for FY21 include:

- Revenue increasing 7% to $285.1 million

- Earnings before interest, tax, depreciation, and amortisation (EBITDA) rising 13% to $73.8 million

- Net profit after tax (NPAT) of $12.5 million, falling 7.4% on FY20

The cloud services & government division was the standout performer in FY21 increasing 21.3% over the year.

Data centre revenue rose by 10% however this will accelerate as more capacity comes online.

Revenue in its core Telecom activities fell 3.2% over the year, affected by reduced call volumes as employees work from home.

In the future, management expects cloud and data centre revenue growth to outpace telecom and become a bigger contributor to overall sales and subsequent profits.

The fall in net profit for the year was largely due to increased depreciation from investments over the past two years.

Data centre build update

Intellicentre (IC) 1 and 2 are up and running in Sydney CBD and Macquarie Park respectively.

The first phase (IC3 East) of IC3 was completed within budget in FY21. Plans have been announced to complete the second part (IC3 Super West).

IC4 and IC5, both located in Canberra have achieved “certified strategic” accreditation from the Australian government.

IC5 was completed in December 2020, making both sites operational.

How has the Macquarie Telecom share price reacted?

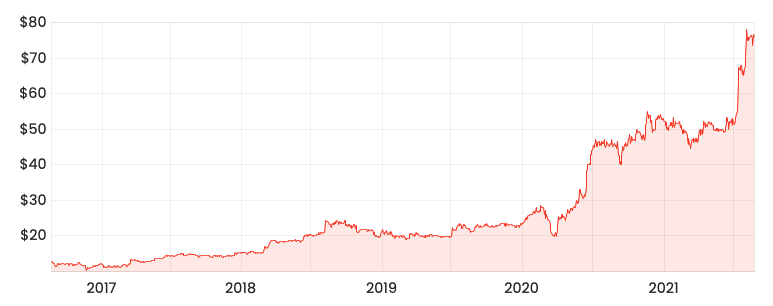

The market has reacted indifferently to the market, with shares up 0.89% to $76.69.

MAQ share price

Much of the news announced today had been flagged in past announcements. Moreover, the business’s results were on par with its previous guidance.

My take

I thought it was a solid update from Macquarie Telecom.

Management is shifting the business from competing in the low margin telco space to higher growth cloud and data centres activities.

The company is reinvesting a lot of its cash flow into building new sites, and this is subduing profitability in the short term.

Given Macquarie Telecom provides the amount of MW from its data centres, it should be relatively straightforward to conduct a valuation of the business.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.