The SEEK Limited (ASX: SEK) share price is on watch this morning after the leading online job advertisement company released its FY21 results.

In late morning trade, the SEEK share price is up more than 1% to $32. This means SEEK shares have gained around 9% year-to-date and more than 50% over the last 12 months.

SEEK share price chart

Source: Rask Media 2-year SEK share price chart

Underlying business performance resilient

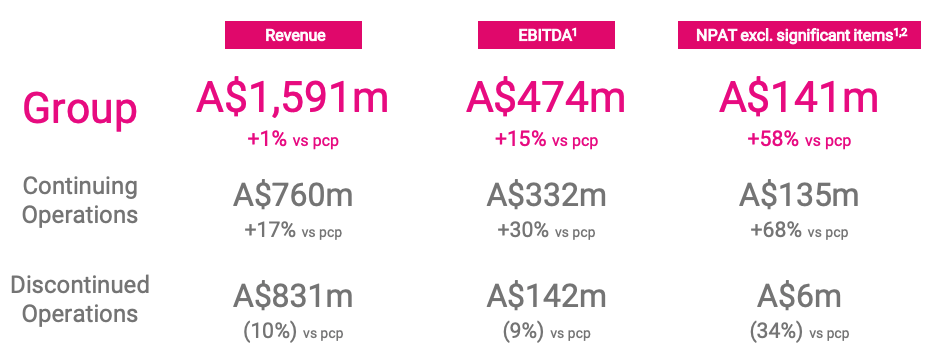

SEEK’s financial highlights for the year ending 30 June 2021 include:

- Revenue of $1.59 billion, up 1% on FY20

- Earnings before interest, tax, depreciation and amortisation (EBITDA) $473.6 million, up 15% on FY20

- Reported net profit after tax (NPAT) excluding significant items of $140.8 million, jumping 58% on FY20

- Final dividend of 20 cents per share, total FY21 dividends of 40 cents per share fully franked

Seek’s financial results for FY21 are somewhat skewed by its reduction in ownership of Chinese online recruitment site Zhaopin from 61.1% to 23.5%.

The company also decided to restructure its strategic investments into a separate entity (more on this later).

Looking at performance on a continuing operations basis, which excludes the impact of Zhaopin and strategic investments, the company performed strongly.

Revenue increased 17%, EBITDA spiked 30% and NPAT excluding significant items grew 58%.

Growth in continuing operations was largely a result of increased job ad volumes in Australia and New Zealand (ANZ). This was somewhat offset by activities in Asia and Latin America, which both recorded negative growth.

The poor performance in discontinued operations was led primarily by the reduced contribution from Zhaopin since the company was deconsolidated from Seek’s financial accounts.

Restructure to better align two divisions

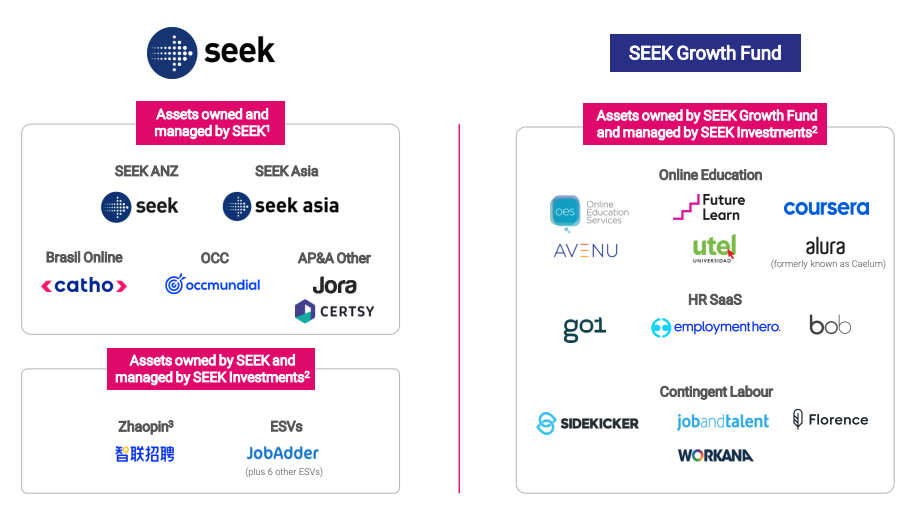

Seek will split off its investments division into a separate unit structure named the Seek Growth Fund.

Seek will own 84.5% of the entity with the remainder held by co-founder and ex-CEO Andrew Bassat and external investors.

Bassat will head up the new entity while stepping away from his previous role of CEO of Seek.

This will allow each entity to focus on its core activities.

Seek will manage the more mature online classifieds business. Meanwhile, Seek Growth Fund will invest in new ventures in online education, human resources and contingent labour.

Strategy and guidance update

The company is aiming to double revenue over the next five years. The biggest opportunities lie in ANZ and Asia in addition to potential acquisitions.

Seek’s aim is to create a central marketplace for jobs over the next three years, with Asia to be integrated onto the ANZ website.

Consequently, earnings per share growth will be subdued in the short-term. However, this should lead to better margins and a more resilient product in future years.

Management also provided the following guidance for FY22:

- Revenue between $950 million to $1 billion

- EBITDA will be in the range of $425 million to $450 million

- NPAT to be in the range of $190 million to $200 million

Should revenue be weaker than expected, the company will potentially “reduce discretionary [costs] but will proceed with strategic investment” to maintain earnings guidance.

The Seek Growth Fund expects to make a loss of between $20 million to $25 million for the first half of FY22.

My take on SEEK’s FY21 result

Similar to other online classified sites such as REA Group Limited (ASX: REA) and Carsales.com Ltd (ASX: CAR), Seek has done a sound job delivering underlying growth.

Now that the accounts are easier to read through since Zhaopin and investment have been removed, I’ll be undertaking a new valuation for Seek.

If you’re looking to learn how to do your own ASX company valuations, take our free share valuation course, which takes you through 6 common share valuation techniques, step by step.

Or try our Beginner Shares Course if you’re just starting out. Both are free.