Non-bank lender Latitude Group Holdings Ltd (ASX: LFS) has provided its first set for half-year results to the market this morning.

Latitude specialises in consumer lending with its buy-now-pay-later offering LatitudePay, personal and automotive loans.

Since its $2.60 IPO price in April, Latitude (LFS) shares have slid 8% to $2.39.

LFS share price

Profits inflated by unwinding credit provisions

In summary, Latitude’s:

- Borrowing volumes were up 5% to $3.6 billion

- Gross receivables came in at $6.5 billion, down 6%

- Statutory net profit after tax (NPAT) was $89.5 million, up 524%

- Cash NPAT hit $121 million, up 81%, and

- An interim dividend of 7.85 cents was announced

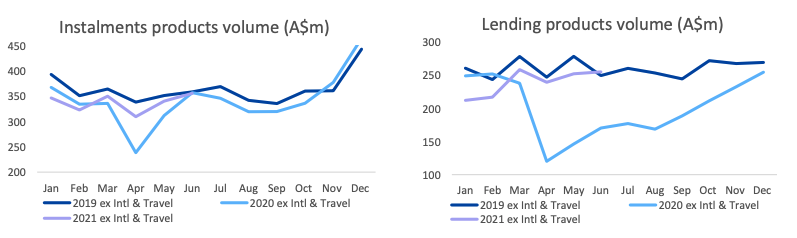

Excluding the travel and international operations, total volumes increased 11% compared to 1H20.

Despite the increase in volume, receivables fell for the first half as a result of higher than normal repayment rates. Government handouts and high households savings have meant consumers are paying off debt more quickly.

Both of Latitude’s two operating divisions experienced growth.

- Instalments, which represents the business’s BNPL offering, increased volumes by 3%

- Lending, which houses the personal and auto loans operations, experienced a 9% uptick in volumes. Both personal and auto achieved strong growth of 30% and 60%, respectively, on the prior corresponding period.

However, this should be taken with a grain of salt given the prior period was the beginning of the pandemic.

The big jump in cash NPAT was primarily the result of unwinding loan provisions. Therefore, a more accurate representation of profit would be operating profit before provisions. Using this measure, Latitude increased its cash profit by 4.9%.

From a risk perspective, Latitude receivables past 90 days due fell from 3.83% to 2.54%. This is a positive for the business, as it means customers are paying on time and less likely to default on the debt.

Outlook for the remainder of FY21

Lockdowns across Australia continue to impact the group’s revenues. However, Latitude’s management notes pent up demand picks up quickly when restrictions ease.

This was seen in November last year when Victorian lending volumes soared 43% post lockdown.

Latitude will launch its big-ticket BNPL offering, Latitude Pay+, in October after a successful pilot program. It allows customers to purchase items up to $10,000. The product will not charge interest, rather opting for a monthly fee of $10.

The company remains focused on its South East Asia expansion with a license application submitted in Singapore in addition to new product launches.

In the longer-term management will look to expand activities in B2B and B2C relationships, Canada and the New Zealand auto loans market.

Management has guided for a final dividend in line with 1H21 of 7.85 cents per share. The final dividend will be fully franked.

My take

I think this was a solid result from Latitude. The business is executing on its growth plans and the buoyant economic conditions will support consumer lending.

I’m interested to see how Latitudepay+ performs against competitors such as Afterpay Ltd (ASX: APT) and Zip Co Ltd (ASX: Z1P).

To keep up to date on all the latest news regarding Latitude and the ASX, be sure to bookmark the Rask Media home page.

And to stay up to date with the flurry of reports this month, bookmark our ASX reporting season calendar.