Pro Medicus Limited (ASX: PME) is the ASX share I wish I owned.

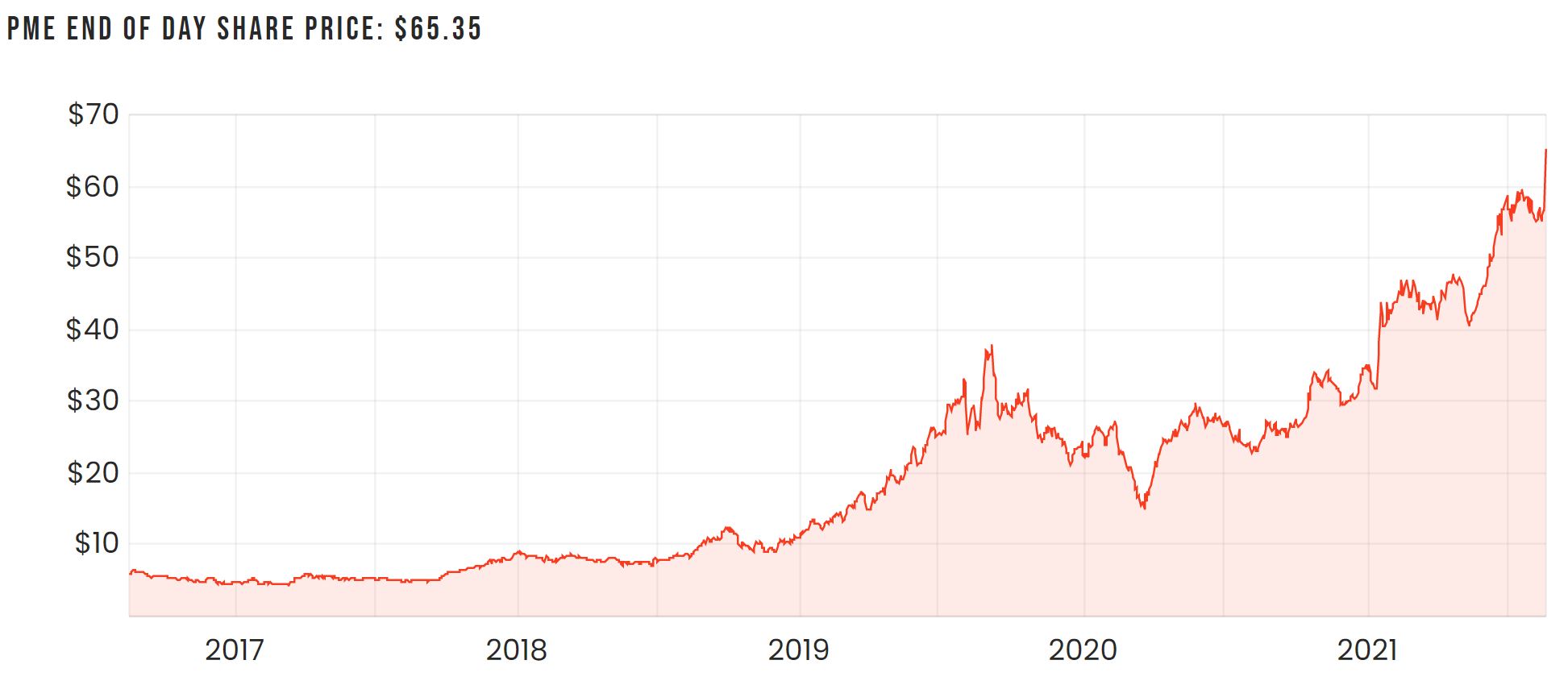

On Wednesday, the company released FY21 results which sent its shares up over 15% by the end of the day.

Taking a step further back, however, it’s easy to see why Pro Medicus has been under the spotlight recently. Long-term holders have been handsomely rewarded for their patience – earning more than a 10 bagger over the past four years.

For a detailed breakdown of its recent results, you can read my colleague, Jaz Harrison’s article here: FY21 result: Is Pro Medicus (ASX: PME) the best ASX share?

Pro Medicus results recap

Pro Medicus reported a 19.5% jump in revenue to $67.9 million. Like other software companies with high amounts of operating leverage, it was able to grow underlying net profit after tax by 41% to $42.6 million.

Excluding the effects of foreign exchange (FX) movements, this number becomes a 56.3% increase.

Pro Medicus scaled back a lot of its advertising and conferencing costs as a result of COVID-19, which partly explains why it reported an astronomical FY21 EBIT margin of more than 63% (53% in FY20).

It’s likely that this margin will compress slightly in future years as spending normalises with the recovery of the pandemic.

What to do with Pro Medicus shares?

There’s not too much disagreement about the quality of Pro Medicus as a company.

Instead, most concerns surround its current valuation. This is also a crucial factor that will impact the level of returns you, as a shareholder, can ultimately generate.

At the current share price, the market has collectively valued its shares at over 100x Pro Medicus’ latest revenue figure, or over 190x its latest underlying earnings.

I don’t doubt that the company can continue to win new contracts and move into other areas like AI and cloud competence. But, it’s worth considering how much of this growth is baked into the current share price.

Great company, not so great valuation. If the latter improves, I’d love to become a shareholder of Pro Medicus at some point. For now, they’re a hold in my book.

Did you miss out on Pro Medicus like I did? I’d highly recommend signing up for free Rask account and accessing our full stock reports. Click this link to join for free and access all of our free analyst reports.