Outdoor retail conglomerate Super Retail Group Ltd (ASX: SUL) has doubled profits off a 22% sales jump in FY21.

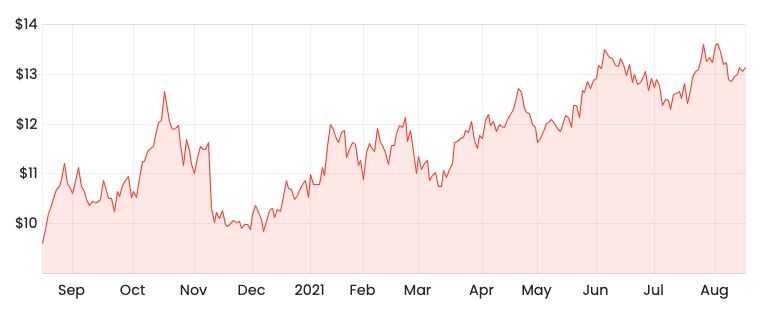

The share price has been on a tear recently, gaining 33% over the past year to $13.16.

SUL share price

Super Retail operates four key brands: Supercheap Auto, Rebel Sport, Macpac and Boating, Camping and Fishing (BCF).

Super Retail key brands Source: SUL FY21 presentation

Record FY21

Super Retail benefitted from closed international borders, with households reallocating budgets towards discretionary items such as sporting and outdoor purchases.

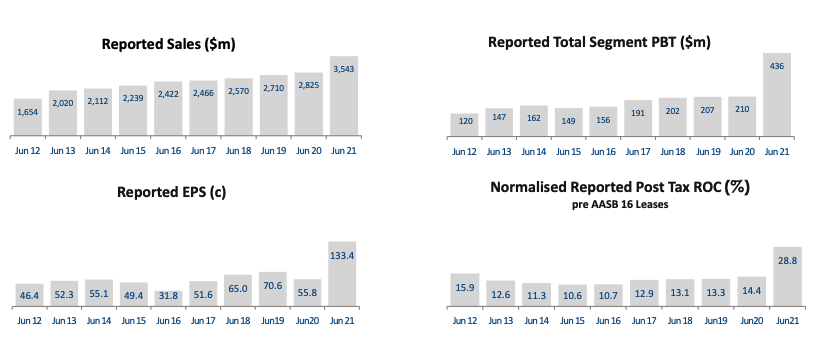

Key metrics from FY21 include:

- Total group sales up 22% to $3.45 billion

- Online sales increase 43% $415.6 million

- Earnings before interest and tax (EBIT) up 80% to $476.8 million

- Normalised net profit after tax (NPAT) up 107 % $306.8 million

- Earnings per share of $1.334

- Final dividend of 55 cents per share (fully franked), FY21 total dividend of 88 cents per share

- 22% increase in active club members to 8 million

BCF was the standout performer among the four brands, reporting a 49.1% increase in sales. Supercheap Auto, Rebel and Macpac each recorded mid-teens sales growth.

Similarly, BCF led the growth in online sales up 90% compared to FY20.

As a result of the unprecedented customer demand and strong cost discipline, the company achieved significant operating leverage leading to a doubling of profits.

In addition to the record dividend, Super Retail paid down $247 million in debt and now has no external bank borrowings.

The company has $242 million of cash on hand on June 30.

Growth trajectory

Super Retail is looking to capitalise on a strong FY21 by expanding its store footprint and experience.

50 new BCF and Macpac stores will open over the next five years while existing Supercheap Auto and Rebel stores will be converted to new store formats.

The company is planning to spend $125 million towards these growth ambitions in FY22.

FY22 Outlook

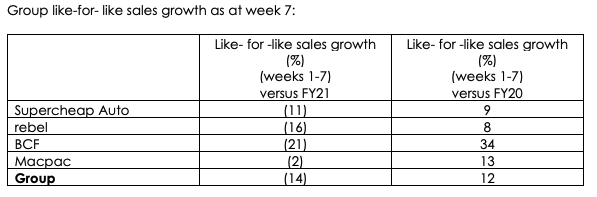

Trading in the first seven weeks of FY22 remains 12% above FY20 levels (pre-pandemic) however 14% below FY21 levels.

My take

Not to take away from the record result, but the level of demand Super Retail experienced in FY20 is well above historical levels.

Even CEO Anthony Heraghty noted the demand as “unprecedented”.

I’d be wary of buying a company at share price highs while also cycling abnormal demand.

For now, Super Retail remains a hold until demand moderates. Then it should be easier to forecast an accurate valuation for the business.

To keep up to date on all the latest news regarding Super Retail and the ASX, be sure to bookmark the Rask Media home page.