Best known for its gambling and lottery operations, Tabcorp Holdings Limited (ASX: TAH) increased profit by 47% in FY21.

Shareholders of the company have seen the share price go nowhere in five years. Is Tabcorp starting to turn a corner?

How did Tabcorp perform in FY21?

Key financial highlights for the FY21 include:

- Group revenue up 8.8% to $5.6 billion

- Earnings before interest and tax (EBIT) up 21.5% to $724 million

- Net profit after tax (NPAT) before significant items of $399 million, increasing 47.2%

- Normalised earnings per share of 18.3 cents, rising 36.6%

- Final dividend of 7 cents per share fully franked, total dividends of 14.5 cents per share, up 31.8%

Tabcorp reduced $30 million of costs from the EBIT line through its 3S initiative. Additionally, it incurred a reduction in costs due to pandemic induced lockdowns.

This contributed to higher profits despite modest revenue growth.

Divisional performance

The Lotteries & Keno division achieved a record profit despite below-average jackpots. EBIT increased 16.7% to $516 million.

Typically, big jackpots bring in relatively more customers and therefore are a decent bellwether for lottery performance.

However, improvements to games and digital experience offset the low total jackpot, leading to increased sales.

Overall, Lotteries & Keno contributed 71% of the group’s total EBIT.

Wagering & Media also performed strongly with EBIT up 23.4% to $216 million representing 29% of group EBIT.

Customer and marketing initiatives increased engagement in addition to technology platform improvements.

The smallest division, Gaming Services was heavily impacted by lockdowns especially in Victoria, which has the most gaming machine contracts.

Outlook for FY22

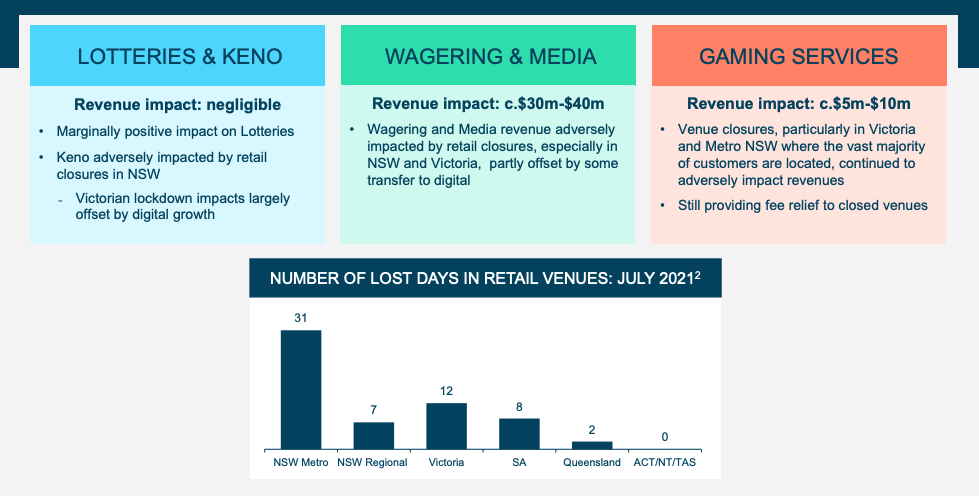

Lockdowns in Sydney and Melbourne has led to a $35-$50 million decrease in revenue to start FY22.

Other than the above, management did not provide any firm guidance numbers.

Tabcorp did however provide an update on the planned demerger of the lottery business. The expected completion date is June 2022.

Is Tabcorp starting to turn a corner?

The short answer is I don’t believe so.

The lottery business remains the jewel in Tabcorp’s crown, while the wagering and gaming services segments face stiff competition.

It’s positive to hear the demerger remains on track, as it will realise value for all of Tabcorp’s shareholders.

I believe the lottery business on its own could trade on a similar market cap to the current Tabcorp entity right now.

In other words, you get the wagering and gaming divisions for free.

To keep up to date on all the latest news regarding Tabcorp and the ASX, be sure to bookmark

the Rask Media home page.