Cloud network-as-a-service provider Megaport Ltd (ASX: MP1) announced a 35% sales increase and narrowing cash outflow in its FY21 result.

The market has reacted positively to the news with shares up 1.67% to $17.66.

MP1 share price

FY21 results

Revenue for the full year increased 35% to $78.3 million. Similarly, monthly recurring revenue (MRR) increased 32% to $7.5 million. Annual recurring revenue (ARR) also increased 32% to $89.8 million.

Sales growth was strongest in North America, increasing 47% for the full year. Removing the effect of currency movements, sales increased 65%.

Growth in the Asia Pacific and Europe regions was more subdued at 25% and 24% respectively.

Gross profit increased at a faster rate to sales, rising 43% to $42.1 million. This was a result of an expansion in gross margin from 51% to 54% due to a decrease in average direct network costs excluding commissions.

Operating costs for FY21 increased 10% to $55.4 million with the main contributor being an increase in employee costs.

Normalised EBITDA loss decreased from $21.1 million in FY20 to $13.3 million. This was a direct result of the lower operating costs and improved gross margins.

Positively, operating cash outflow improved from $21.7 million in FY20 to $8.6 million in FY21.

Megaport burnt through $25.8 million in cash resulting in cash on hand of $136.3 million. This was a significant improvement on FY20 when accounting for capital raising.

Operational update

The company achieved growth across all key operational metrics.

Total customers increased 24% to 2,285 and total services increased 30% to 21,712.

Moreover, total ports increased 33% to 7,689 and the number of Megaport Cloud Routers (MCR) increased 64% to 502.

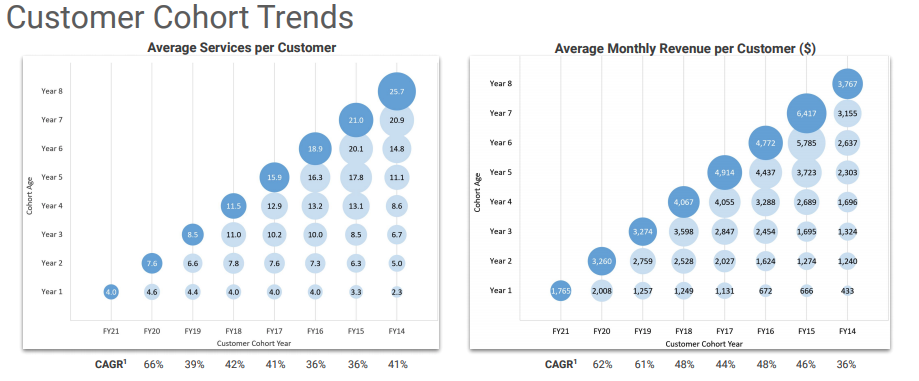

Megaport continues to experience growth in average services per customer and an increase in average revenue per customer cohort.

This means that customers take on increased services over time, therefore, Megaport’s revenue grows as its customers scale.

InnovoEdge Acquisition

Megaport announced the acquisition of InnovoEdge for US$7.5 million and up to US$7.5 million in Megaport shares.

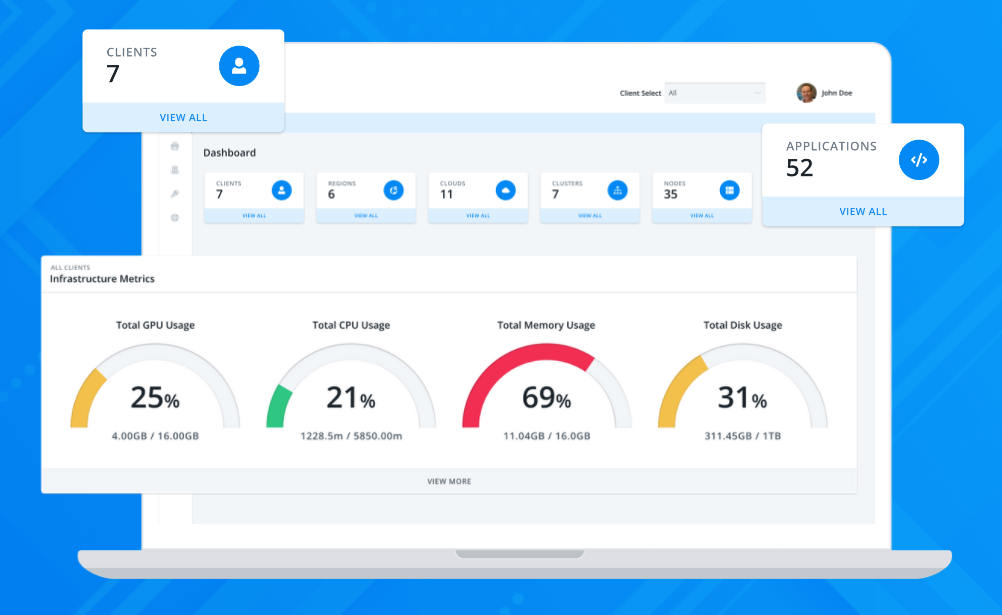

InnovoEdge provides a cloud platform for provisioning high-performance network connectivity and edge GPU resources.

The product also offers artificial intelligence-driven insights and actions.

My take

Stripping out the effect of currency movements, FY21 was a bumper year for Megaport. And so it should be given the business is trading on 30x ARR.

The business is scaling well, with operating costs growing at a lower rate than sales. Additionally, gross margin expansion supports future profitability.

On the investor call, management noted the benefits of its PartnerVantage program, which accelerated sales. This allows data centre operators, service providers and resellers to sell their product range.

The company achieved EBITDA breakeven in June 2021. This may signal Megaport is reaching an inflection point in terms of EBITDA and cash flow.

To keep up to date with the latest ASX news, make sure to bookmark the Rask news page.