FY21 distributions fell for toll road developer and operator Transurban Group (ASX: TCL) as on-off COVID-19 restrictions restricted mobility.

The market reacted slightly negative to the update, with shares down 1.47% to $14.10 at the time of writing.

Transurban operates 21 assets primarily across Australia with additional roads in North America and Canada.

TCL share price

FY21 result highlights

Average daily traffic decreased 0.4% for the year resulting in toll road revenue of $2.49 billion for FY21, in line with FY20.

The revenue number is somewhat misleading, given it accounts for new assets M8/M5 East and NorthConnex. Excluding the contribution of new roads, traffic declined 7.0%.

This was primarily a result of COVID-19 induced movements restriction across cities in addition to costs related to growth projects.

Consequently, free cash flow for the year – Transurban’s measure of earnings, fell 13.5% to $1.28 billion.

Transurban did record a statutory profit of $3.27 billion. However, this was a result of proceeds from the sales of its North American operations, which resulted in a $3.6 billion inflow.

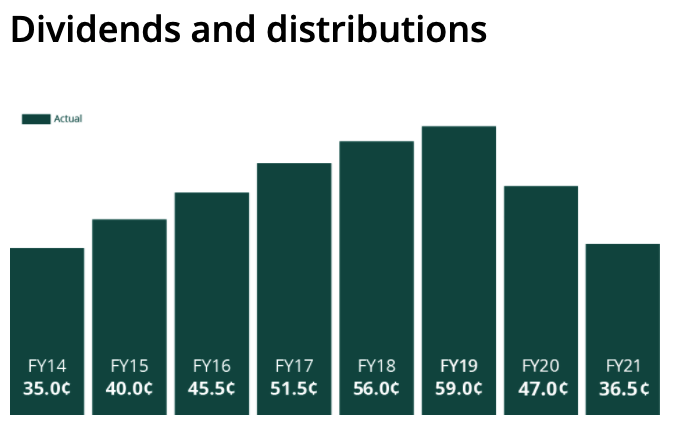

The company will pay a distribution of 36.5 cents per security implying a 2.5% distribution yield. Positively, the distribution was sufficiently covered by full-year free cash. However, this is noticeably down on past distributions.

West Gate Tunnel project update

Tunnelling has not commenced at the West Gate Tunnel project due to a dispute arising from contaminated soil found at the site.

Essentially, the soil needs to be relocated to a purpose built disposal site to avoid contaminating the community.

The Victorian

Government, builders CIMIC and John Holland, and Transurban remain at a logjam over how much each party should contribute. The estimated additional cost is $3.3 billion.

Management noted on the investor call its preference is for mediation where each party contributes to the cost blowout. However, little progress has been made.

As previously noted, completion of the project by 2023 is no longer achievable.

FY22 outlook

The company remains positive on the outlook for toll roads. A survey of 3,000 Australians showed people are 8% more likely to use private transport. Moreover, 22% of respondents said they were less likely to use public transport.

Transurban did not provide specific guidance, however, noted the effect of lockdowns across its network.

A one-week lockdown in Sydney – where the company derives more than half its revenue, results in a $10-$12 million reduction in revenue. Additionally, a one-week lockdown in Melbourne costs $7-9 million and Brisbane $5-6 million.

FY22 distributions are expected to be in line with free cash excluding capital releases.

My take

It’s tough sailing for Transurban currently, with snap lockdowns eroding any momentum in return to toll roads.

Given Transurban’s average asset concession life of 26 years and 87% of assets with CPI or greater legislated increases, I think there is potential for a takeover bid.

Taking away the effect of the pandemic, this is a high-quality infrastructure business with annuity-like earnings.

The company has an average cost of capital above 4% across its various debts. Pension of industry funds will likely have a lower cost of capital, therefore, can extract greater earnings from the business.

Keep an eye on Transurban. With mergers and acquisitions rife (just look at Sydney Airport and Afterpay Ltd), Transurban may be next in line.