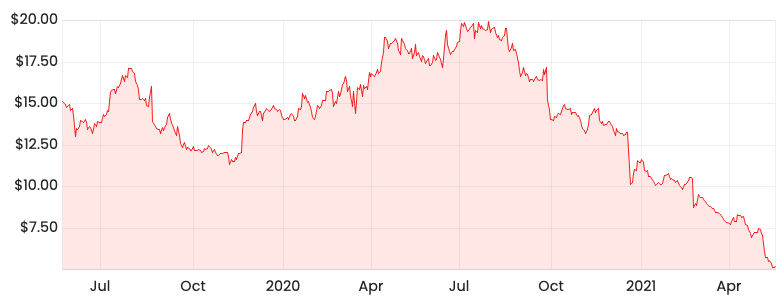

The A2 Milk Company Ltd (ASX: A2M) share price has copped a battering in the last six months, dropping by 61%. Things might get even tougher for the a2 Milk share price as the Oatly Group (NASDAQ: OTLY) floated on Wednesday.

A2M share price

The rise of Oatly

Oatly is a Swedish based oat milk maker backed by big celebrities like Oprah Winfrey, rapper Jay Z and former head of Starbucks Corporation (NASDAQ: SBUX), Howard Schultz.

It is a plant-based alternative quickly becoming so popular in some key markets that it has faced supply shortages.

A2 Milk acknowledges that new product innovation has ramped up, increasing the competitive intensity. Oatly must be one of them.

Oatly sells in more than 20 markets across Europe, the United States and China. In 2020, it hit US$7 billion in sales, a jump of 27% on a year-on-year basis.

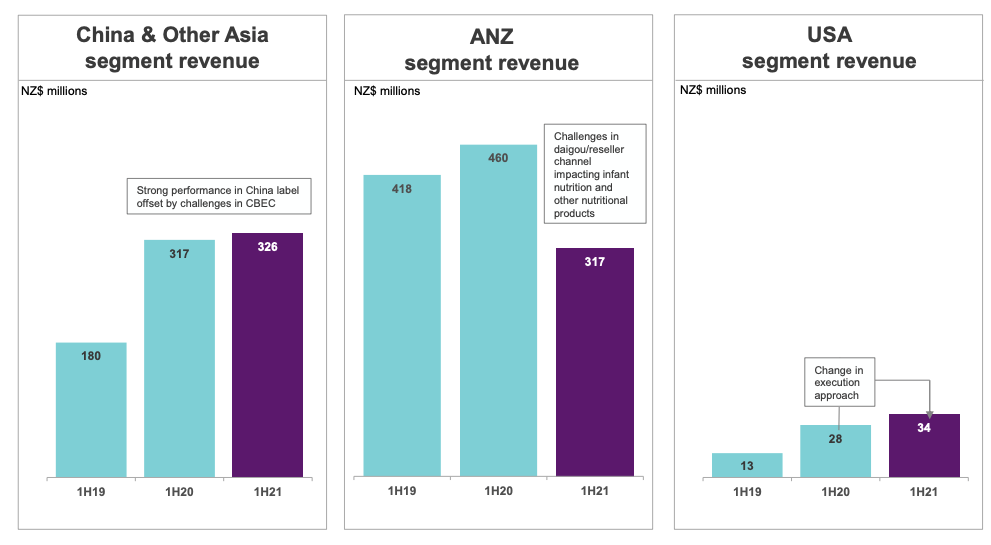

There have been a lot of concerns raised about a2 Milk’s Chinese segment but I think its US market warrants attention as well.

State of play in the US

Despite recording a severe decline in Chinese sales for the half-year of FY21, a2 milk managed to post strong growth in US sales albeit off a low base.

There are a few reasons why I have concerns regarding a2 Milk’s US segment.

A2 Milk is yet to establish its brand in the US and it will be tough with the rise in alternatives like Oatly. Also, Oatly already has relationships tied up with several US cafes, including Starbucks.

It’s also interesting to note that the per capita consumption of milk (pounds per person) in the US has constantly declined from 177 pounds to 141 pounds between 2010 and 2019. This is based on dairy data compiled by the U.S. Department of Agriculture.

Final thoughts

Even though the competition is hot in the US and there is a downtrend in the consumption of milk, people tend to like to try new things.

And on this front, a2 Milk has done extremely well in the past few years in marketing and building its brand across Australia and New Zealand and China.

A2 Milk has a sound balance sheet with a lot of capital at its disposal to continue its penetration in the US. This should not be underestimated.

I like to take a long term view and in this case, I would prefer to find businesses that operate in structurally growing industries where competition is less fierce.

If you’re interested in reading about potential catalysts and roadblocks that may lie ahead for a2 Milk, check out these articles: