The Nufarm Ltd (ASX: NUF) share price has steadily climbed up since October 2020. What do the HY21 results mean for the future of the Nufarm share price?

Nufarm manufactures and sells crop protection products and seed technology solutions. These products help farmers fight disease, weeds and pests to increase crop yields

NUF share price

Stronger revenues and earnings

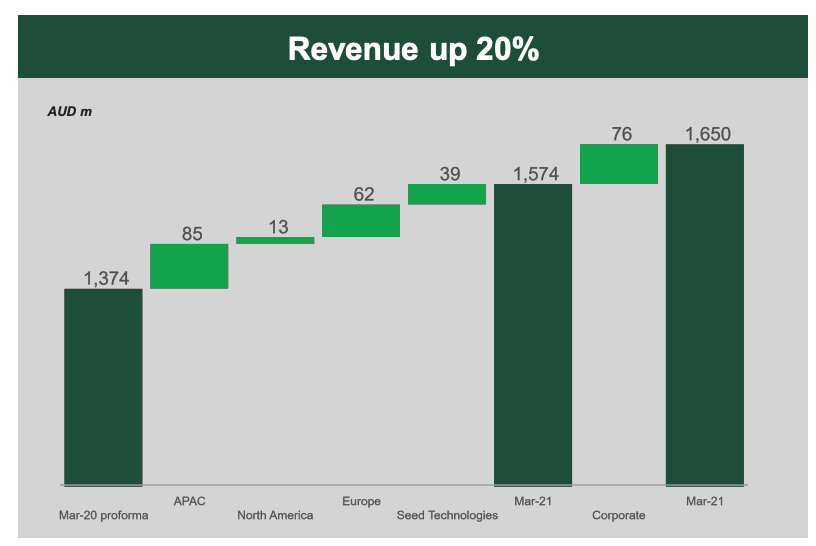

Nufarm saw an increase of 20% in revenue for the six months ending 31 March 2021 (HY21). As for earnings before interest, tax, depreciation and amortisation (EBITDA explained), this jumped by 118% compared to the prior corresponding period (pcp), being HY20.

The improved metrics were mainly due to strong growth in the Asia-Pacific and Europe markets, in particular, the seed technology segment.

If we hone in further, the growth in these markets was driven by improved seasonal conditions, especially in Australia, Indonesia and Europe.

The improvement across the top line resulted in a net profit after tax of $59 million for HY21.

Declining margins

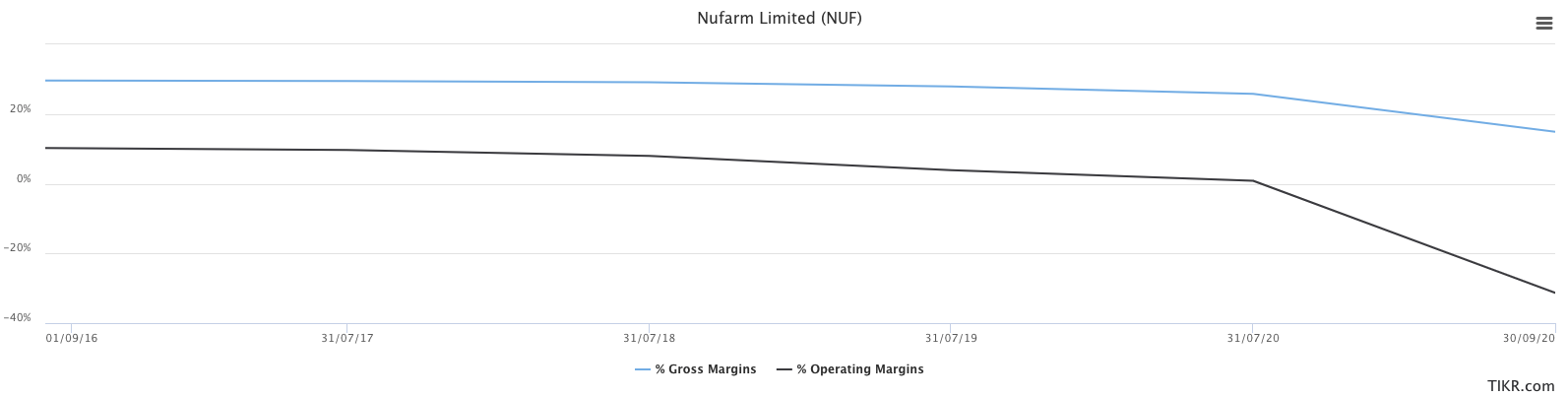

Managing Director and CEO of Nufarm, Greg Hunt said the business is very focused on growing volumes and revenue and improving margins. However, it appears management has found it difficult to improve overall margins in the past few years.

As you can see, gross margins and operating margins have steadily declined since FY16.

It appears costs of production and selling, general and administrative expenses have increased at a faster rate than revenue.

Is Nufarm approaching a new dawn?

The deceleration in revenue in recent years makes me question whether Nufarm’s clients have found better solutions to preserve their crop.

It’s quite evident that Nufarm’s business is seasonal and dependant on favourable conditions.

Such environmental factors are difficult to predict, so I tend to prefer to invest in businesses that are less reliant on such external forces.

If you are interested in other ASX growth share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.