The Altium Limited (ASX: ALU) share price has risen by as much as 5% today. What do I monitor when the Altium share price jumps?

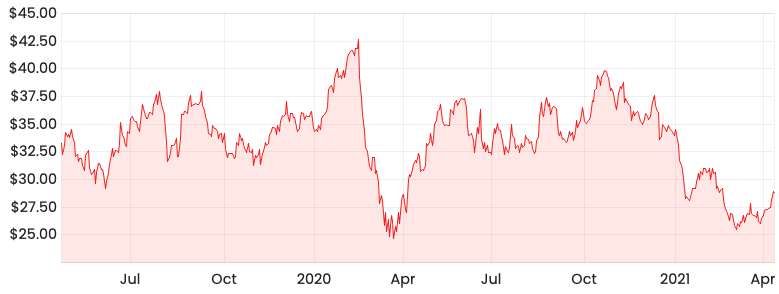

Altium share price

Altium’s recent performance

The Altium share price is starting to recover from its results for the half-year (HY21).

The business recorded higher expenses due to COVID-19, resulting in a 15% decline in earnings before interest, tax, depreciation and amortisation (EBITDA) for HY21.

Altium has experienced really high revenue growth but this slowed down in the last year.

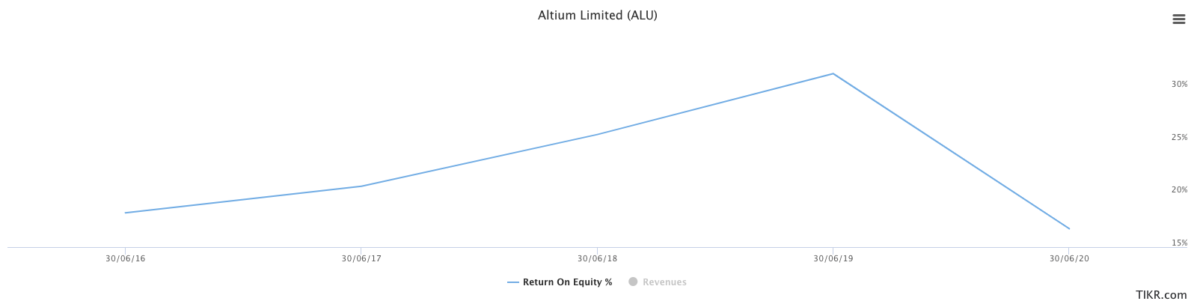

Altium’s return on equity (ROE)

Another possible key reason for Mr Market’s negative reaction is the fall in return on equity (ROE).

The ROE measures the amount of net profit a business is able to earn using its equity. In the case of Altium, this has dropped by almost half.

It seems investors have founds businesses with higher ROEs to be more attractive like CSL Limited (ASX: CSL) and Pushpay Holdings Ltd (ASX: PPH).

Altium’s future

As my colleague, Patrick Melville notes in his article, Altium 365 remains the key source of future growth.

It is a cloud-based platform enabling multiple users to collaboratively work on a single project in real-time. I would monitor the return on investment on this product.

In situations where a business has experienced significant growth, I try to use the ROE of other businesses to determine where my capital is best invested.

If you are interested in other ASX growth shares, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.