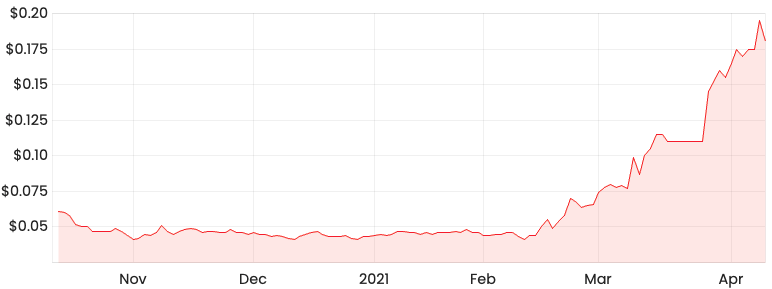

The Digital Wine Ventures Ltd (ASX: DW8) share price dropped by 7.69% yesterday despite a solid trading update. Why hasn’t growth in orders translated to growth in the Digital Wine share price?

Digital Wine share price

Digital Wine continues to grow

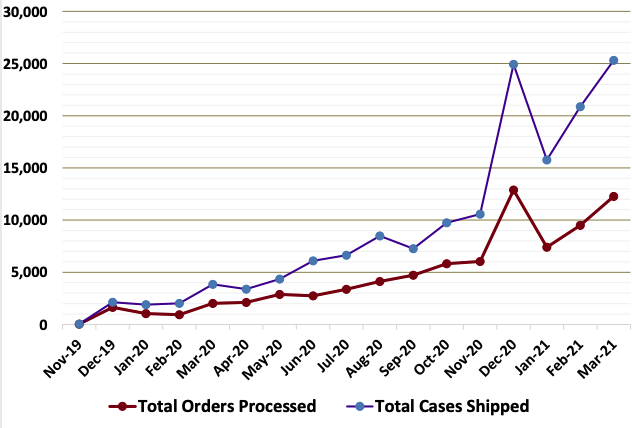

Digital Wine released a sound trading update on its WINEDEPOT business, posting strong growth in orders processed and cases shipped.

This stellar growth in volume illustrates a growing willingness of wine producers to adopt a direct to consumer model, cutting out the middle man (retailer).

Whilst the growth appears to be quite high, investors should note this is from a low base.

I would monitor the incremental revenue and costs as a key indicator of the profitability of the business.

Digital Wine appoints James Munn as COO

WINEDEPOT has appointed James Munn, previously the founder of Wine Delivery Australia, which was acquired by Digital Wine.

James Munn appears to have extensive experience in the warehousing and logistics sector given he has provided clients specialist logistics advice for five years.

This appointment aligns with Digital Wine’s strategy to become the leading direct to consumer wine business.

Is now a good time to buy Digital Wine?

There is a significant level of optimism priced into Digital Wine’s share price at the moment.

The Price-to-Sales ratio for Digital Wine is 533x based on sales revenue for FY20 of $0.56 million. Why are investors so excited about Digital Wines?

The market tends to get excited over tech shares and Digital Wines has the potential to disrupt the industry through its cloud-based platform. However, I would need to see how sticky this platform is before investing in the business.

If Digital Wine keeps attracting more suppliers and maintains high levels of retention, then this will act as a strong indicator of a high-quality solution.

The current price is too expensive for my liking but it is definitely a business worthwhile monitoring.

As part of the Rask Investment Philosophy, I try to find businesses that are operating in growing industries and I think Digital Wines is one of them.

If you are interested in other ASX growth shares, I suggest getting a free

Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.