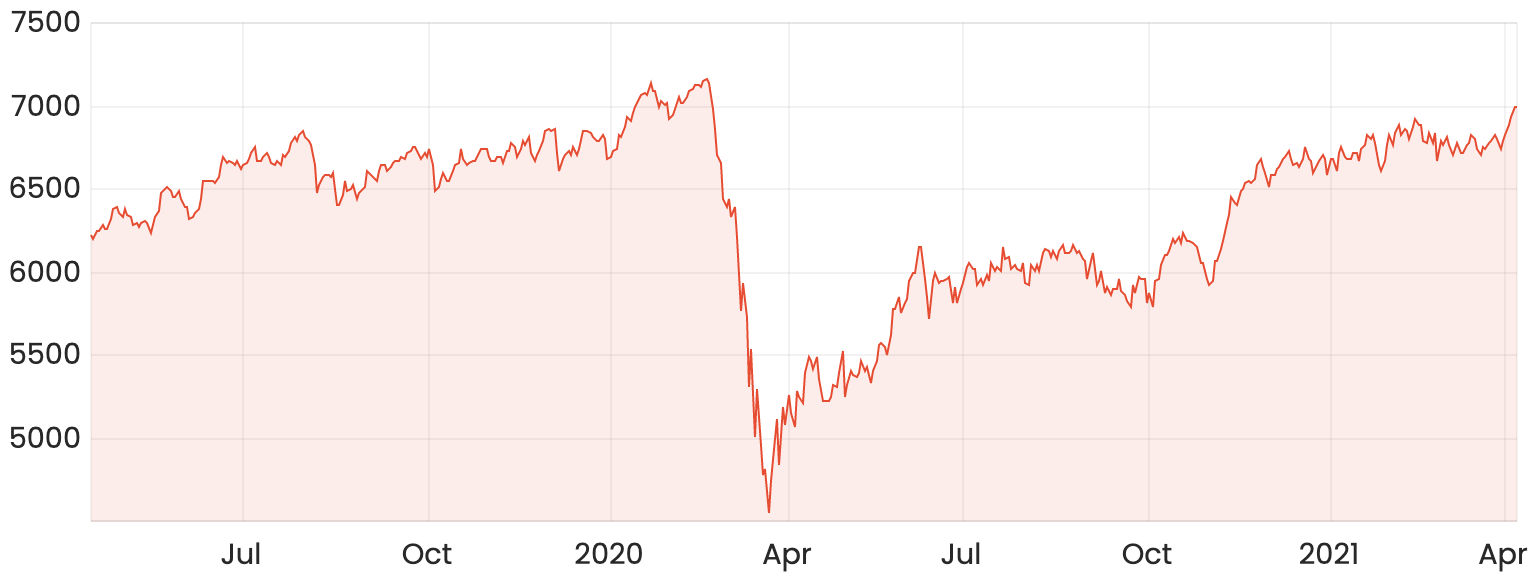

The S&P/ASX 200 (ASX: XJO) finished the week flat on Friday but managed to deliver a strong 2.4% gain despite just four days of trading.

With this, the benchmark index continues its run back towards all-time highs, finishing the week at 6,995 points.

ASX 200 chart

The initial driver was the Reserve Bank reiterating their accommodative policy settings, sending the technology sector including Afterpay Ltd (ASX: APT) up 15.1% over the week after a difficult few months.

Most sectors were higher on Friday, apart from consumer staples and healthcare, with Woolworths Group Ltd (ASX: WOW) the biggest detractor, dropping 1.3%.

The CSL Limited (ASX: CSL) also fell, more likely due to currency than its involvement in producing the AstraZeneca (LON: AZN) vaccine in Australia, which has had well-publicised issues. The biotechnology company was unlikely to gain any profit from its production.

Gold bullion is beginning to rally once again, with the likes of Greensill and Archegos bringing fear back into markets. Silver Lake Resources Limited (ASX: SLR) was the top performer on Friday, up 6.1%, as well as over the week, adding 18.6%.

Magellan Financial Group Ltd (ASX: MFG) fell 2.0% after announcing it would be shifting to quarterly flow announcements, with the latest seeing retail investors withdraw just $15 million despite sustained underperformance.

According to the latest ASX futures, the ASX 200 is expected to edge higher when the market opens on Monday.