The share price of Marley Spoon AG

(ASX: MMM) and Kogan.com Ltd (ASX: KGN) received a major boost today. What’s going on with the Marley Spoon and Kogan share price?

Kogan

KGN share price

The Kogan share price increased by more than 6% at one point today. So, what’s been happening with the Kogan business?

Kogan Mobile rolls out new plans

Kogan recently announced two new prepaid phone plans on a 12-month contract instead of the previous 30-day plans.

The prices of these plans have been slashed and offer more data over 12 months. The mobile plans segment generated 4.8% of Kogan’s HY21 revenue.

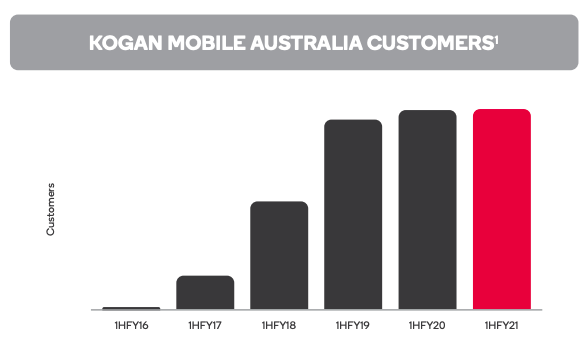

This is an interesting move as the growth in the number of Kogan Mobile customers appears to be slowing down. This is shown below.

On one side, Kogan is rewarding customers with better mobile plans but on the flip side, this may be an attempt to bolster customer growth.

My colleague, Jaz Harrison provides her bull case on Kogan here.

Marley Spoon

MMM share price

The Marley Spoon share price rocketed up as high as $2.89 per share today, equating to a jump of 7.6%. What’s happening at Marley Spoon?

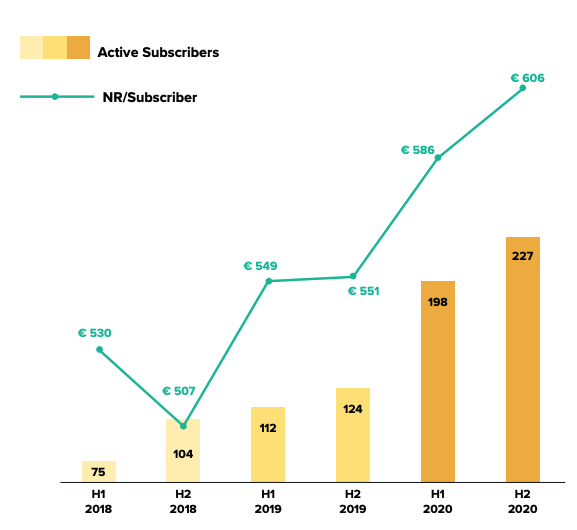

As you can see from Marley Spoons’ FY20 results below, revenue growth is outpacing subscriber growth.

Marley Spoon has been a big beneficiary of the pandemic as the lockdown encourage people to eat at home. The key question here is whether it can capitalise on this trend by trying to make ordering meal kits as a habit.

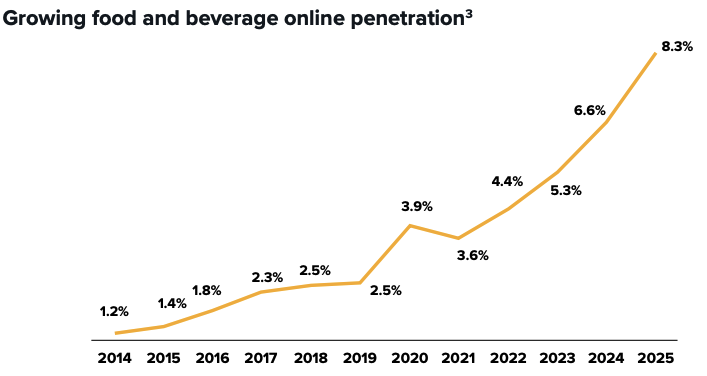

It seems like online grocery is becoming more popular as shown by the rapid rate of food and beverage online penetration below.

Given the recent share price boost, it appears the market is optimistic that Marley Spoon will continue to capture greater online grocery market share.

If you are interested in other ASX growth shares, I suggest getting a free

Rask account and accessing our full stock reports. Click the link below to join for free and access our analyst reports.