It seems the Nuix Ltd (ASX: NXL) share price has taken a back seat as people flocked to more recent IPOs like Airtasker Ltd (ASX: ART). Who’s running the show at Nuix and why is this important?

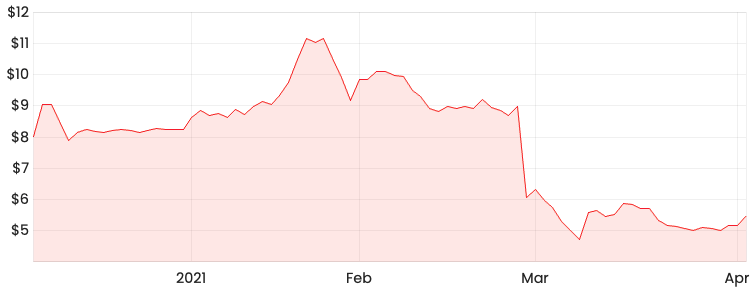

NXL share price

Does the Nuix management have skin in the game?

Nuix’s current CEO, Rodney Vawdrey holds 0.53% in shares and insider ownership including Rodney Vawdrey accounts for 3.3%. Insider ownership is essentially shares held by the board, management, and employees within the business.

The amount of ownership held by management is quite low. I consider greater than 10% insider ownership to be a minimum benchmark. The more, the better.

A higher insider ownership is a strong signal that the management team is more aligned with investors.

I prefer to invest in management teams that not only financially benefit when the business does well but also suffer when things go pear-shaped.

Incentives also matter

Nuix noted in its 2020 prospectus that both Rod Vawdrey and CFO, Stephen Doyle would be entitled to a bonus payable in cash (two thirds) and shares (one third) if performance targets are met for FY21.

I would have preferred the incentive structure to be the other way around, a third in cash and two thirds in shares. By providing executives with more shares, the more skin they have in the game.

In saying this, I am not asserting that Rod Vawdrey and Stephen Doyle are misaligned but rather pointing out indicators in line with my investing standards.

And something I do like is the discretionary long-term incentive bonus in the form of options available to both executives. This encourages long-term thinking.

The jockey or the horse?

There is a lot to like about Nuix’s business but I remain unsure about management.

As part of the Rask Investment Philosophy, I try to find management teams that are transparent and aligned.

The Nuix share price has dropped significantly mainly due to not being able to meet lofty revenue growth expectations in HY21.

In this regard, investors should keep a close eye on what management has to say if the business falls short of meeting its FY21 projections.