The Airtasker Ltd (ASX: ART) share price causing a lot of excitement. Is it an opportunity for investors, could it be the next Uber?

What does Airtasker do?

Airtasker is a platform business that connects people who need a task doing with someone who wants to do it. Tasks can be in person or online. Taskers can then offer to do the job, so the person can they decide who to go with.

What type of things can be offered? Well, almost anything you could think of. For example, after a quick look there’s a job for $150 to patch and replaster, $110 for cutting a lawn, $50 for helping with a website and $1,500 for painting and staining laminated floorboards.

There are categories like accountants, asbestos removal, balloon delivery, pest control and wedding photographers.

Is it on its way to becoming the next Uber?

Uber Technologies Inc (NYSE: UBER) has grown to become a business worth around US$100 billion. That’s just from helping people travel from A to B, as well as food delivery.

Could Airtasker eventually become as large as that? Well, it’s theoretically possible of course. But not every business that does a cool service is going to become giant.

Whilst Freelancers Ltd (ASX: FLN) is a somewhat different business to Airtasker, the share price is still a lot lower than it was several years ago.

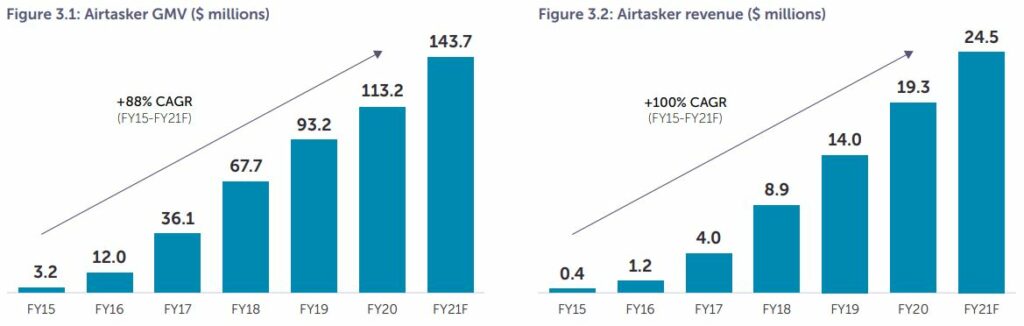

However, on the above graphs you can see that Airtasker has been consistently growing in recent years, with a strong year in FY21.

Indeed, in Airtasker’s successful IPO update it said that all metrics across the business continue to perform strongly and it’s expecting to meet or exceed its prospectus forecast. That’s promising for FY21.

A key part of future growth plans is the countries that Airtasker operates in. At the moment it serves Australia, New Zealand, the UK, Ireland, the US and Singapore. There are lots more countries that Airtasker can expand into, so I believe that investors could become even more interested in the company over time.

How much is Airtasker worth?

Well that’s the big question isn’t it? At the moment Airtasker has a market capitalisation of around $520 million, compared to the IPO prospectus FY21 estimate of $24.5 million of revenue. That’s a high revenue multiple.

If it wins a higher market share and grows into other countries then Airtasker could certainly grow a lot. For the longer term, it depends on Airtasker’s ability to show good margins and profitability.

Airtasker explains that its operating model is not reliant on direct marketing and does not require direct sales staff. As a result, individual service transactions generally require no handling resulting in a highly efficiency operating model, low incremental costs and a high operating margin.

The company said that between FY19 and FY21 its revenue is forecast to grow at a CAGR of 32.1%, with the gross profit after paid advertising (GPAPA) increasing by 67.5% over the same time period.

In FY20 its gross profit margin was 93%. It’s also expecting its operating cash flow margin to be 4% in FY21, compared to -11% in FY20 and -136% in FY19. Positive cashflow is a good step.

I think Airtasker is a very promising business and, if it can keep growing its revenue and market share, it’s on track for a good future.