AGL Energy Limited (ASX: AGL) confirmed it will contribute $341 million to fund its portion of Powering Australian Renewables‘ (PowAR) acquisition of Tilt Renewables Ltd (ASX: TLT).

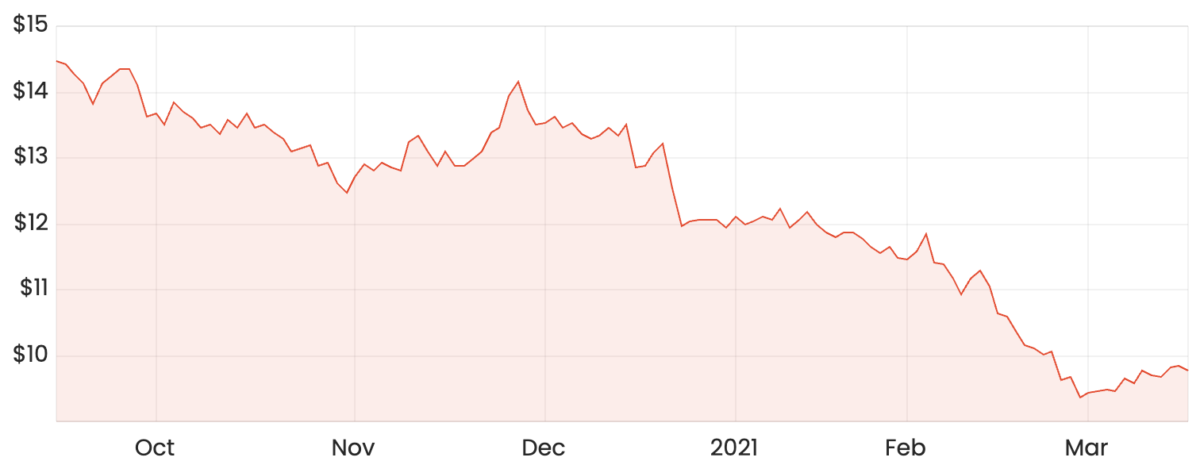

AGL’s share price fell a bit upon this announcement but it’s still on an upward trend. Will the PowAR acquisition help maintain this momentum?

AGL share price

AGL’s main business involves electricity generation, gas storage and the sale of electricity and gas to residential, business and wholesale customers.

What does this mean for PowAR and AGL?

AGL owns a 20% stake in PowAR with the remaining ownership held by the Queensland government’s QIC fund and the Commonwealth Government’s Future fund.

AGL created PowAR in 2016 in partnership with QIC and the Future Fund to drive investment in large-scale renewable energy generation in Australia. This acquisition will further strengthen PowAR’s leadership in renewable energy generation.

The acquisition will also widen AGL’s renewable energy generation portfolio, facilitating its transition away from coal-fired power.

My thoughts

Customer demand for cleaner energy is growing at a rapid pace, so this deal is a step in the right direction.

The move away from coal-fired power will inevitably mean that some of AGL’s sources of revenue will need to shut down. This will cause short-term pain but hopefully long-term gain.

AGL already has a strong foothold on the Australian energy market, so it’s a matter of being able to provide scalable renewable energy options.

It appears AGL is on track to provide Australians clean, reliable and affordable power, which is encouraging.