The Globe International Limited (ASX: GLB) share price finished the day flat despite releasing impressive revenue and profit growth for the half-year ended 31 December 2020.

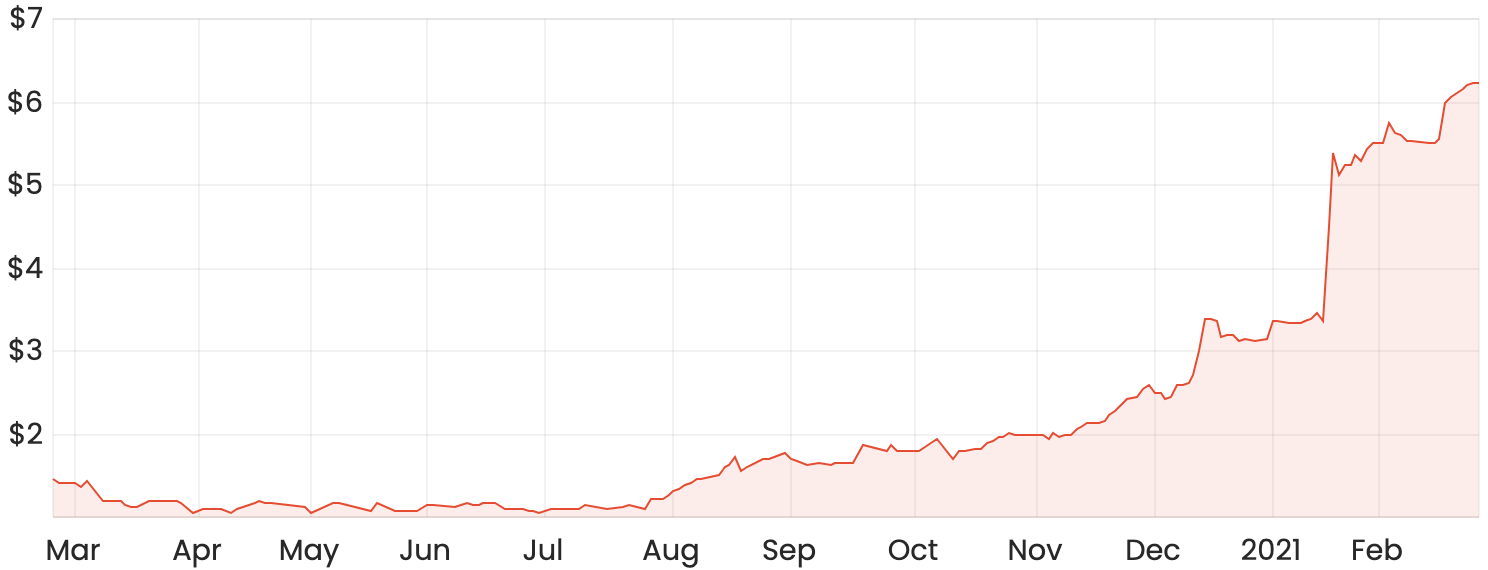

I was slightly surprised by the lack of share price movement, but it’s important to note that the stock has rallied quite hard recently and is up over 85% since the start of the year.

Additionally, today’s earnings results were pretty much in line with the company’s previous trading update which was released in January.

GLB share price chart

Globe’s key highlights

Across the board, Globe reported sales of $124.8 million, up 60% on the prior corresponding period (pcp).

Its key brands of Impala, Globe, FXD

and Salty Crew were said to be performing strongly even before the onset of COVID-19. Nonetheless, these results confirm the upwards trajectory of the retailer’s core brands, with its standout geographic region being North America, experiencing almost double the number of sales on the prior period.

EBIT came in at $21 million, up from $4.2 million in the pcp, and net profit after tax (NPAT) jumped to $15.3 million, an increase of 300% on the prior period.

Globe declared a fully franked interim dividend of 12 cents per share, an increase of 140% compared to the 2020 interim dividend, which was 5 cents and unfranked.

Profit drivers

Globe management indicated that its increase in EBIT was the result of a combined impact of a spike in sales volume, as well as increased gross profit margins, which came in at 43.2%, up 5.6 points over the pcp.

A significant boost in online sales also helped Globe’s bottom line, which was further strengthened by a weaker USD along with a shift towards higher-margin hardgoods products.

Cash flow from operations was reported to be $17.8 million for the period, with only a $3.8 million increase in working capital despite the much larger jump in sales. Management has said that its low inventory and receivables balance is a strong indication of the underlying demand for its products.

My take

I think this was a pleasing result, and I’d happily be a buyer of Globe’s shares today, as I think it’s a well-run company with some evidence that its recent performance hasn’t been a one-off result.

For some more reading on Globe’s shares, click here to read: Is Globe International (ASX: GLB) the best ASX retailer right now?.