The Breville Group Ltd (ASX: BRG) share price has increased by 4.3% to $31.82 in midday trade after announcing a strong first-half result.

Work from home spurs spending on premium appliances

The home appliance seller reported a 28.8% growth in revenue, from $552.0 million to $711.0 million, supported by work-from-home and premiumisation trends.

This translated into a net profit after tax (NPAT) increase of 29.2%, from $49.7 million to $64.2 million.

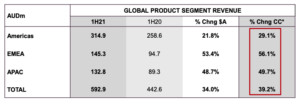

Each of Breville’s global product geographies recorded impressive growth amidst varying COVID-19 outbreaks and lockdowns, outlined in the table below.

Management noted, revenue and NPAT would have been higher if it wasn’t for inventory shortages and currency headwinds.

Gross margins improved 1.1%, driven by lower advertising spend and customers opting for premium products, which more than offset increased freight costs.

The company continued to invest in research & development, approaching its strategic goal of investing 12% of net sales. This investment will drive margin improvement, as well as differentiating its products from competitors.

Dividend reduced to fund future growth

Management revised down its targeted dividend payout ratio from 70% of earnings per share (EPS) to 40%, in order to fund company growth through expanding working capital, capital expenditure, and future acquisitions.

As a result, the interim dividend fell to $0.13 per share, down from $0.205 a year earlier.

Full-year guidance increased

On the back of a strong strong first-half result, management upgraded full-year EBIT

guidance to be approximately $136 million, an increase from the guidance provided at the AGM of between $128 million and $132 million.

Summary thoughts

Despite income investors’ disappointment with the dividend reduction, the decision to increase funding for numerous growth opportunities is a positive sign the business believes it can earn a better return on capital than simply paying profits out to shareholders.

Given that Breville recorded a return on equity of 19.6%, I remain optimistic about management’s ability to deliver on those investments.

With many companies citing the impact of COVID-19 and ongoing lockdowns as a reason for underperformance, it’s refreshing to see a business excelling despite difficult circumstances.

I’m willing to back strong management who can deliver high returns on investment, therefore I’d be happy to take a small position now and add more funds as the business executes on its strategy.

To access more quality share research, I suggest getting a free Rask account and reading our full stock reports.