Despite the tough economic backdrop from COVID-19 which threatened to bring sports and racing to a standstill, Betmakers Technology Group Ltd (ASX: BET) proved to be a surprising beneficiary of the situation.

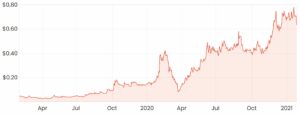

Since March last year, the BetMakers share price has returned more than 500%.

BET share price chart

BetMakers hasn’t been covered on Rask Media before, so here’s a brief rundown on the company and some of my thoughts.

What does BetMakers do?

BetMakers is not a bookmaker. In other words, it doesn’t accept and place bets like companies such as PointsBet Holdings Ltd (ASX: PBH) or Sportsbet.

Rather, part of what BetMakers does is provide all of the back-end data and analytics to bookmakers and racing authorities that it’s partnered with. The company primarily deals with horse racing, so it provides things like comparison odds, racing overviews and other information that its customers need to enhance their own platform.

BetMakers’ white-label solution for bookmakers is essentially a complete software platform that provides the functionality to manage things like user accounts, promotional content and available markets.

As an example, a new bookmaker entering the market could partner with BetMakers and use its pre-built model rather than building one from scratch.

If you’re familiar with Jumbo Interactive Ltd (ASX: JIN), Betmaker’s platform seems fairly similar to Jumbo’s Powered by Jumbo platform – which allows its customers to instantly access a model with a proven track record.

BetMakers’ revenue model

BetMakers is currently in the process of transitioning from a fixed fee revenue model to a variable revenue model.

Under the variable model, its revenue is more aligned with the underlying performance of the bookmaker or racing authority as it charges a percentage of turnover or a percentage of the revenue deal, respectively.

Variable revenue accounted for 26% of total annualised revenue in 2019, however, this number has since grown to roughly 57% as of July last year.

One thing to consider is that this variable model can be a double-edged sword. If the racing industry is experiencing growth which it has been recently, potentially boosted by COVID-19 and an increased amount of gambling, the business is likely to do well as more bets are placed.

But if the opposite happens in regards to gambling activity, it’s fairly easy to guess what will happen to the underlying revenues.

Further growth opportunities

The US is one of the company’s biggest growth opportunities, with an estimated total addressable market of roughly A$3 billion per year in annualised revenues in the racing industry.

As it currently stands, fixed odds racing isn’t legal in every US state, so the company sees this as an opportunity as horsemen groups and regulatory bodies push towards the implementation of fixed-odds betting.

BetMakers is hopeful that legislation will be soon changed in the US state of New Jersey, but has said a bill still needs to be approved by a majority of both the Senate and the General Assembly before it can progress further.

The company completed a $50 million capital raising last year to fund its acquisition of the racing and digital assets of a UK-based sports betting company called Sportech PLC. Sportech provides betting software, hardware and other solutions to more than 150 clients in over 30 countries.

According to BetMakers CEO Todd Buckingham, the acquisition represents an opportunity for the company to further its product suite by offering a full spectrum of digital and retail betting solutions across multiple licenced jurisdictions.

Time to buy?

There are a lot of moving parts to a business such as this that would play into my investment decision here.

Firstly, the underlying thematic of sports betting and gambling, in general, has been on a rampage since the onset of COVID-19. Will it continue in a post-COVID world at this same level of growth, or will it revert back to some mean level?

Furthermore, I don’t have any knowledge on US state regulations concerning fixed-rate betting and as such, I’m unsure how to quantify the risk that the company may face concerning the regulatory environment.

I think it might also be worth investigating the strength of the company’s software platform through client reviews and to try to get an idea of the competitive landscape.

None of this is to say the company’s shares aren’t worth buying, I would just need to perform more research, or simply invest in different industries that I think are less complicated.

A good example of that would be Globe International Limited (ASX: GLB), which I recently wrote about in this article: Is Globe International the best ASX retailer right now?. Retail is a competitive industry as well but for me, Globe’s product offering (apparel and footwear) is relatively simple to get an understanding of compared to betting software.

If you’re on the hunt for more share ideas, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our in-depth analyst reports.