The Marley Spoon AG (ASX: MMM) share price is up 4.51% to $2.66 in late afternoon trade after releasing its Q4 results to the market.

The company’s share price has been a true rocket in the past year, rising from a low of $0.25 to record a one-year return of 968%.

MMM share price chart

Marley Spoon’s Q4 results

Marley Spoon reported Q4 2020 revenue of €68.6 million, an increase of 103% (on a constant currency basis) compared to the previous corresponding year.

With the conclusion of the Q4 results, the company also announced full-year revenue of €254 million, a 101% increase in constant currency.

The company achieved its third consecutive quarter of profitability, delivering operating EBITDA of €1.2 million, compared to a loss of €2.4 million in the prior corresponding period.

The primary driver of growth was the United States, which recorded 146% revenue growth, operating EBITDA just short of €2 million, and a contribution margin of 26%.

The Australian operations began to mature, recording a 59% increase in revenue and operating EBITDA of nearly €3 million, and the region’s contribution margin reached 36%.

European revenues increased 95%, with a contribution margin of 25% and breakeven EBITDA excluding global headquarter costs.

Marley Spoon generated negative cash flow from operating activities of €3.6 million in Q4 2020, resulting largely from seasonal working capital effects.

The company continued the global roll-out of its new enterprise resource planning system and finalised its in-production machine learning infrastructure, which assists in identifying customers’ taste profiles, therefore increasing the reliability of demand forecasting models.

Introduction of key metric

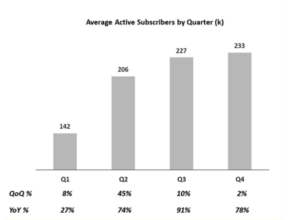

Management introduced a new metric called Active Subscribers, to better illustrate the underlying growth of the business. The metric measures customers who have an active subscription on an average weekly basis during the quarter. This minimises the effect of one-off customers who are on a trial basis.

Marley Spoon enjoyed a full-year of consecutive active subscriber growth, with Q4 resulting in 233,000 active subscribers. This rapid growth correlates primarily with the global lockdowns during the second quarter, which brought forward future demand as more customers opted for meal delivery. However, since Q2, the growth rate has fallen significantly, resulting in an immaterial growth rate from Q3 to Q4.

Now what?

The pandemic created a seismic demand-pull for Marley Spoon, resulting in rapid revenue growth and providing the catalyst for the share price soaring in 2020.

However, in my eyes, the slowing growth rate is concerning. Next quarter’s results will be telling if the meal-kit provider is here to stay or a temporary pandemic benefactor.

Instead of Marley Spoon, I suggest getting a free Rask account and accessing our full stock reports. Click this link to join for free and access our analyst reports.