The S&P/ASX 200 (ASX: XJO) is expected to take a slight backwards step when the market opens on Wednesday according to the latest SPI futures. Here’s what ASX investors need to know.

ASX 200 slide continues, Altium flags weakness

The ASX 200 couldn’t hold sustain early gains, falling another 0.3% on Tuesday with the financial sector the only real positive.

National Australia Bank Ltd (ASX: NAB) led the sector higher, adding 1.1% as signs of higher bond rates are likely to support higher net interest margins.

Selling pressure continued to build on the technology sector after Altium Limited (ASX: ALU) reported a 3% fall in first-half revenue as challenging conditions in the US and China put an ‘unprecedented drag’ on sales of the company’s chip design software. This came as a surprise given the huge demand for processing power and incredible shift to digital platforms throughout 2020; shares finished 2.1% lower as a result.

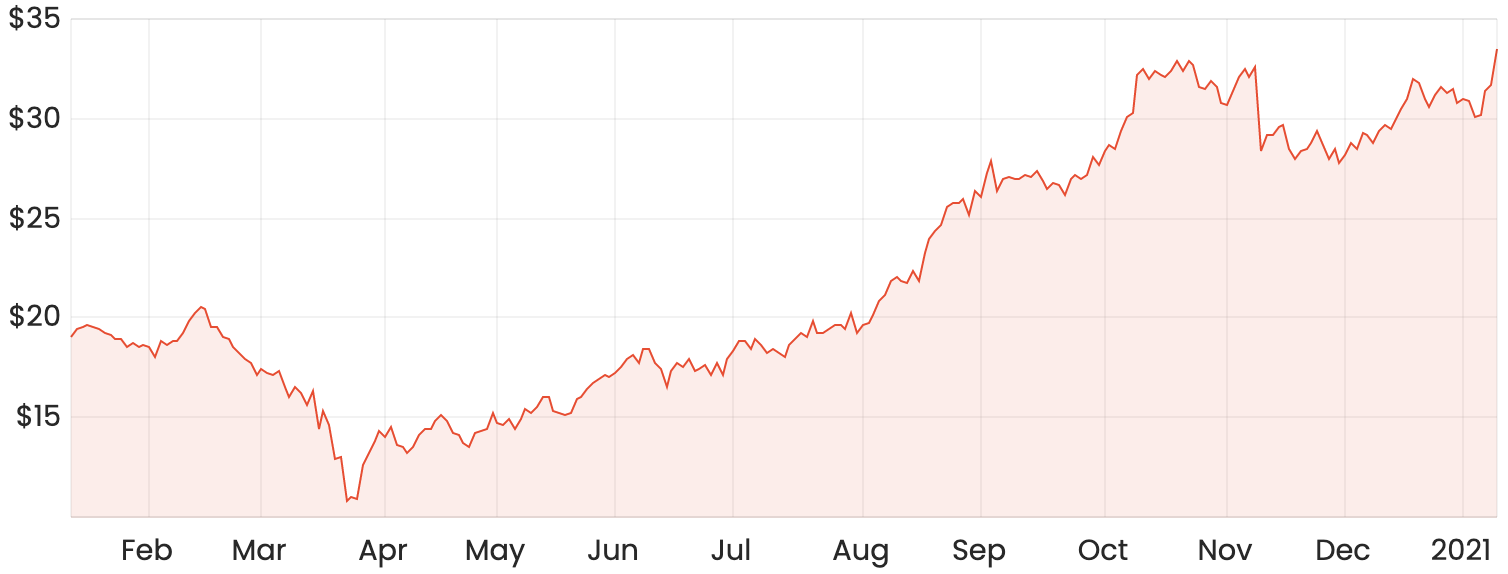

Four-wheel driver accessory distributor ARB Corporation Limited (ASX: ARB) offered a positive surprise, with the company capitalising on the ‘holiday at home’ trend reporting a 21.6% increase in sales compared to 2019 levels, sending revenue to $284 million for the first half. Management now expects profit of between $70 million and $72 million for the first half. The ARB share price finished 5.8% higher in response to the news.

Whilst a positive result, ARB has now doubled in value in less than 12 months and now trades on a valuation similar to a fast-growing tech company. In my view, this may be a stretch given the potential of a return to normal travel in 2021.

ARB share price chart

Origin turns to renewable energy, Avita share price surges

Origin Energy Ltd (ASX: ORG) announced plans to develop a 700MW battery at its Eraring coal-fired power station, Australia’s largest, in an effort to reduce pressure on the ailing electricity grid and likely cut the costs associated with their ageing asset.

Avita Medical Inc (ASX: AVH), a favourite of fund managers and brokers alike for its special burns treatments, jumped 15.3% after reporting revenue of US$5 million in the second quarter of 2021 from its primary RECELL treatment and US$5.1 million in total global revenue, an increase of 57% on 2019 levels. The company, whose shares are down over 60% over the last 12 months, reported a 9% decrease in its cash holdings as it struggles to gain traction in major hospitals.

Conversely, Polynovo Ltd (ASX: PNV) fell 13.0% despite reporting a 31% increase in sales in the first half despite slower than expected sales in October and November. The company is showing strong progress with a number of large hospitals signing purchase orders and the group reporting 89% growth in trading accounts throughout 2020. Both these results evidence the incredibly difficult task for biotech companies to bring innovative products to market on commercial terms.

US stocks pause ahead of earnings season, social sell-off continues

The value shift continued in US markets overnight, with the energy and financial sectors gaining most, sending the Dow Jones up 0.2%, with the Nasdaq also adding 0.3%.

The primary driver was more positives on the supply side of oil markets, with US shale producers confirming their intention not to increase production in an oversupplied market, sending the oil price to a 10-month high above US$50 per barrel. Major oil names benefited, including BP (NYSE: BP) and Chevron (NYSE: CVX) who added 2.6% and 1.9%, respectively.

Shares in e-commerce business Etsy (NASDAQ: ETSY) rallied another 12.1% as the reseller of vintage and handmade goods is expected to report a strong final quarter.

Meanwhile, consumers and investors seem to be responding to censorship decision made by the likes of Amazon (NASDAQ: AMZN) and Twitter (NASDAQ: TWTR), both falling another 2.0%.

The US Congress plans to vote on a second impeachment of President Trump, which is mostly symbolic given the short time before his term ends next week.