Below are two ASX growth shares that I am considering buying in December.

While the overall market has been on a tear since March, I think there are still some ASX shares worth considering.

Of the two below companies, one has been a beneficiary of COVID-19 via the accelerated shift to shopping online, while the other has been severely disrupted by the global pandemic.

1. Redbubble

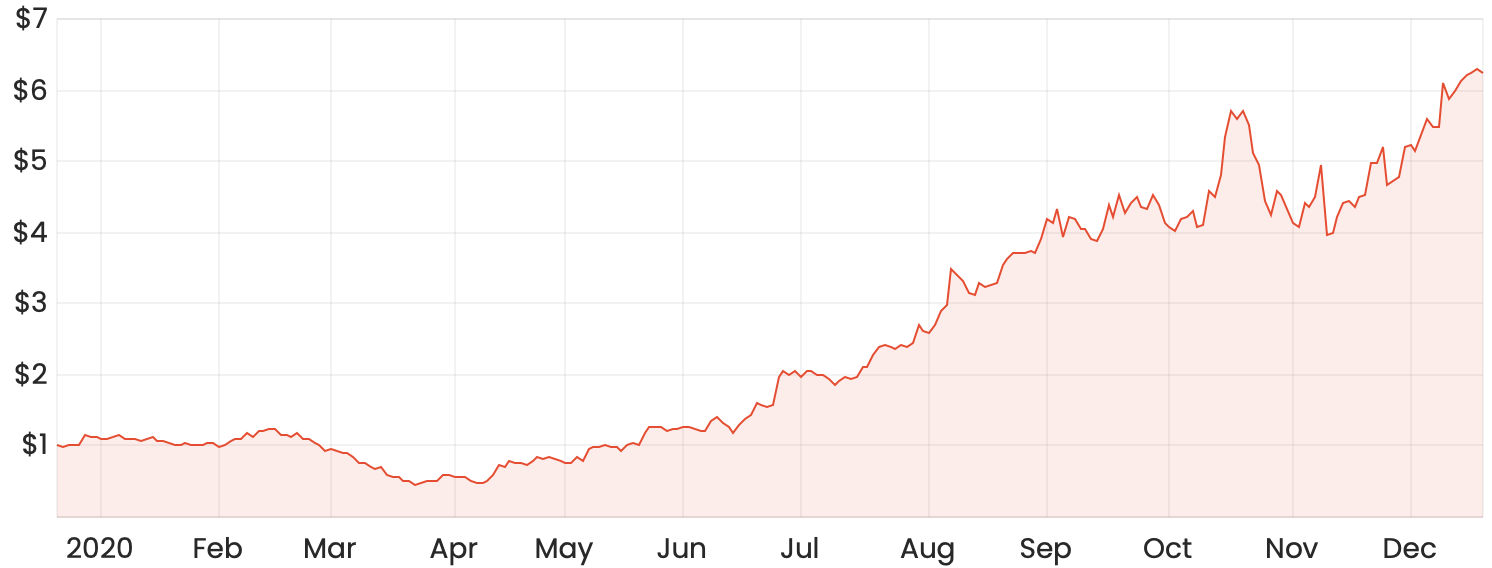

The Redbubble Ltd (ASX: RBL) share price has been sizzling this year, up about 450% in 2020. This is not surprising given that Redbubble has delivered some outstanding numbers.

RBL share price chart

Redbubble operates a global online marketplace offering print-on-demand products. Currently, over 700,000 independent artists sell their designs on the platform which can be printed on a wide range of items from clothing, bags to even masks.

Most recently in the first quarter of FY21, the company reported 116% marketplace revenue growth to $147.5 million. Gross profit lifted at a faster clip, jumping 149% to $64.5 million. Check out Jaz’s full Q1 wrap-up here.

The jump in group profitability was well summarised at Redbubble’s Q1 update by co-founder Martin Hosking:

“What we are seeing in Q1 reflects what we had foreshadowed with year-end results, namely that Redbubble is moving into a period of rapidly increasing profitability as the business scales. The scaling reflects the fundamentals of the business, our strong margins and low marginal OpEx, underlying solid growth and the acceleration brought about by the COVID crisis.”

With rapid growth in revenue and expanding margins, I think it could be a good time to consider buying Redbubble shares.

2. A2 Milk

The A2 Milk Company Ltd (ASX: A2M) share price crashed nearly 24% yesterday after shares emerged from a trading halt. The company downgraded its guidance, anticipating continued disruption in its important daigou/reseller market. The company now expects FY21 revenue in the range of NZ$1.40 million to NZ$1.55 billion and an EBITDA margin of between 26% and 29%.

A2 previously provided guidance on 28 September, explaining its daigou channel had been severely disrupted due to COVID-19. Daigou has historically been a significant component of a2’s sales in Australia and New Zealand.

Daigou is a Chinese term which roughly translates into buying on behalf of someone. In a2’s case, it represents organised groups purchasing trolley loads of a2 infant formula and reselling it into China.

A2 believes that the impact on its daigou channel is temporary, and should bounce back as COVID-19 related restrictions ease. We do not know when precisely this will occur, but recent vaccine developments are showing promise.

The a2 milk share price is down nearly 50% from its July high. I think this could represent a timely opportunity to buy a stake in a high-quality business at a heavily reduced price.