Excess returns might be hard to come by with interest rates expected to be around 0% for the foreseeable future. How about ASX dividend shares?

Here are 3 dividend-paying shares to consider adding to your portfolio in December.

Telstra

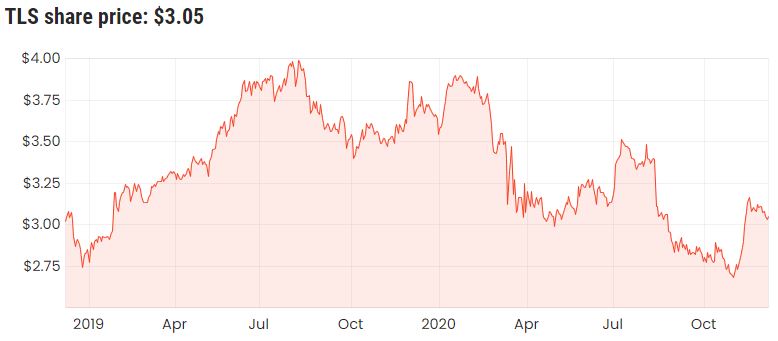

While the 10-year share price chart might not paint the nicest overall picture of the company, I think buying shares in Telstra Corporation Ltd (ASX: TLS) purely as a yield play could work out to be a wise idea. Given the stability of its dividend over time, occasionally, investors view Telstra shares as a bond proxy of some kind. Meaning, you’re not expecting significant capital appreciation, but simply to rely on dividends as the source of return.

It’s also important to remember that as the TLS share price continues to fall, this actually results in a higher dividend yield (assuming the dividend remains constant). In FY20, Telstra paid out 16 cents per share in the form of a dividend, and at this stage, management has indicated that it plans to keep this amount constant, at least for FY21. See our step-by-step explainer answering “Are dividends guaranteed?”

With a current share price of $3.05, this represents a yield of 5.2%. If you could’ve picked up shares at around the $2.70 mark not too long ago, the current dividend yield would’ve been significantly higher than this.

Accent Group

I’m really liking Accent Group Ltd (ASX: AX1) at the moment, not only as a dividend play but also as a growth stock.

Accent Group is the leader in the distribution of performance and lifestyle footwear in Australia and New Zealand. It has a well-diversified and popular range of brands including The Athletes Foot, Platypus, Vans, DrMartens, and Timberlands, amongst others.

In FY20, Accent declared a dividend of 9.25 cents per share, up 12.1% on the prior year. This represents a trailing dividend yield of around 4.74% based on current prices.

Accent Group did receive some Government wage subsidies earlier in the year, however, management indicated that these funds were not used for the final dividend. The company has a strong cash position and its stores are highly cash flow generative. For this reason, I’d say that Accent Group’s dividends might be quite consistent, and there’s also more potential upside in the share price itself.

For some further reading on Accent Group shares, check out this article: Why Accent Group is my favourite ASX retail share right now.

Magellan

Similar to Accent Group, Magellan Financial Group Ltd (ASX: MFG) is another company I see as both a dividend and a growth play. Magellan is a publicly-owned investment manager with over $102.1 billion funds under management (FUM).

Taking a look at the income statement, Magellan has had a fantastic track record of being able to grow its earnings over the several years, which has allowed the company to increase the amount of dividends it’s able to distribute to its long-term shareholders.

In FY20, Magellan was able to pay $2.14 per share (75% franked) in dividends to its shareholders. Outperforming the broader market has helped grow its funds management business grow its FUM and ensure that investors are rewarded. Given the future outlook of Magellan, I’d be a buyer at these levels.