With many ASX travel and leisure shares still trading at significant discounts to their pre-COVID levels, there remains to be quite a lot of potential upside as our economy reopens and gradually recovers.

This isn’t to say this will happen any time soon though, so you’d probably have to take a long-term outlook for these types of companies.

Why I’m holding on Treasury Wine shares at the moment

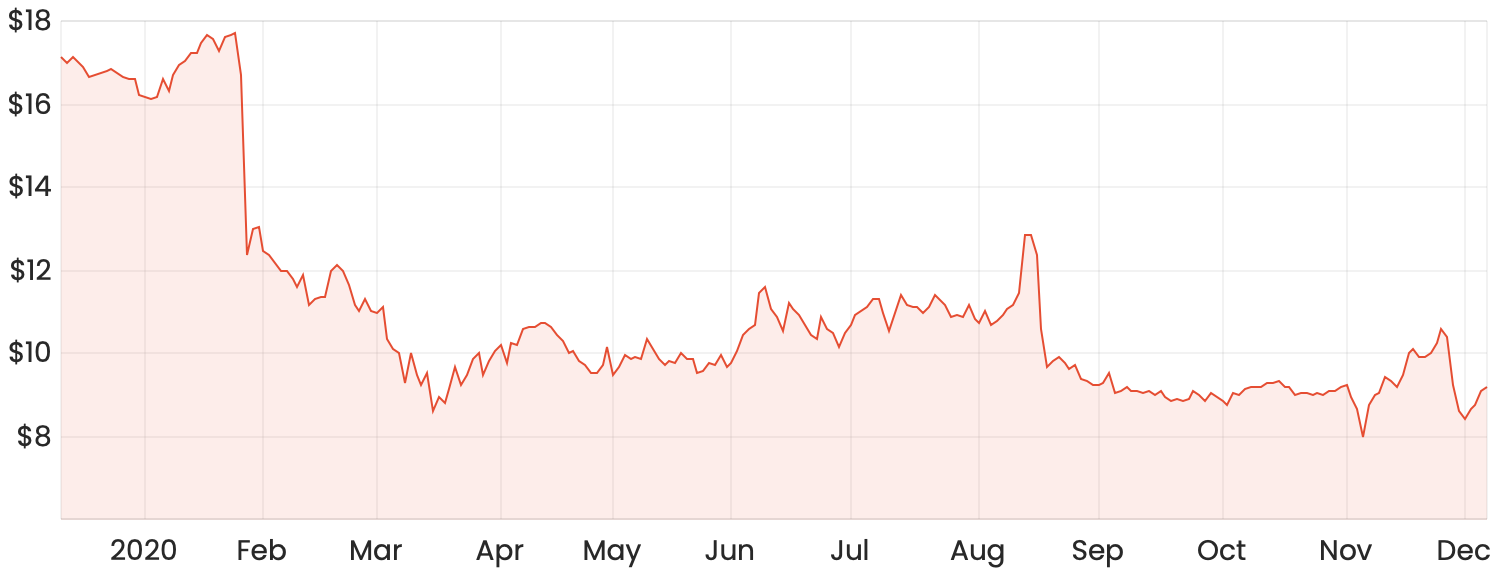

I recently wrote an article that outlines the catalysts this company needs to get back on its feet. TWE shares are still down nearly 50% compared to where they were pre-COVID.

TWE share price chart

Right now, Treasury Wine’s exports to China have been hit with a 169.3% tariff for smaller containers, which could potentially be in effect until August 2021. Given that Chinese exports account for roughly 30% of TWE’s total earnings, it could take a substantial amount of time for sales to recover even if the overall COVID-19 recovery is much quicker.

For this reason, I think there are some other ASX shares that are better leveraged to the overall reopening of the economy and aren’t subjected to trade barriers like TWE is facing.

Aristocrat Leisure

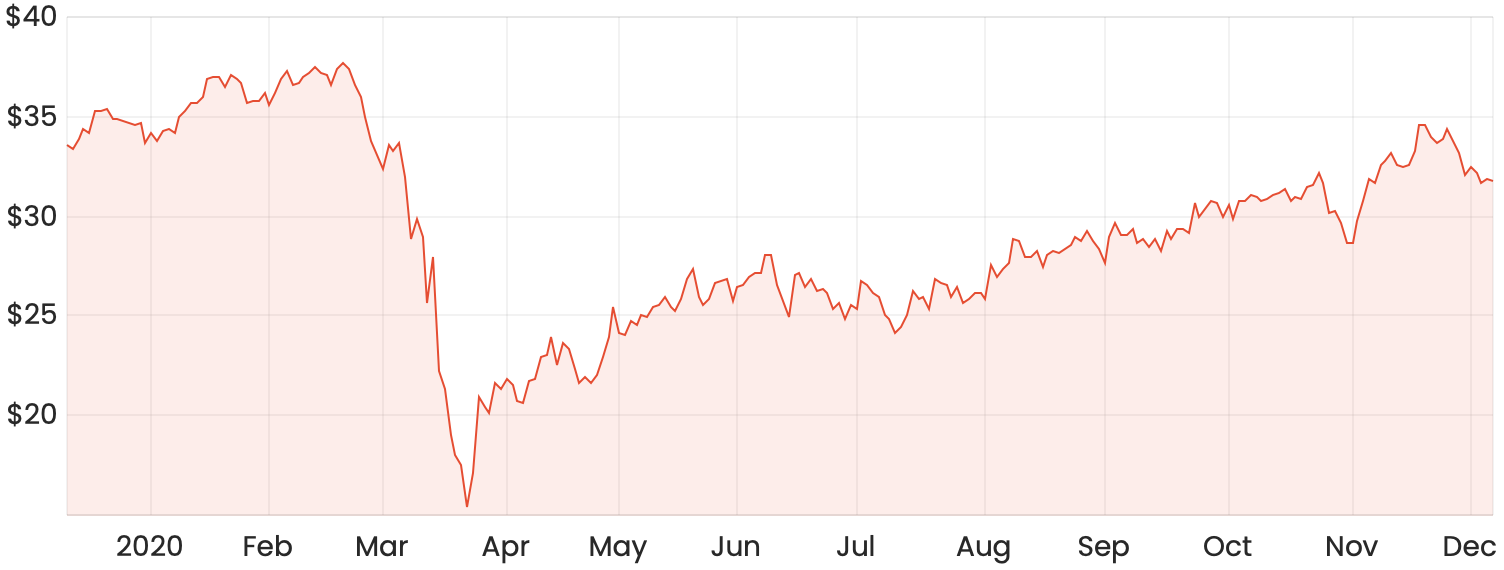

Aristocrat Leisure Limited (ASX: ALL) is a leading gaming provider and publisher that operates across Australia, New Zealand, the Americas and other countries. The Aristocrat share price has made a slow and steady recovery since its March lows and currently trades at a 15% discount to pre-COVID levels.

ALL share price chart

What I find interesting is that the Aristocrat share price has nearly made a full recovery despite its land-based segment still significantly underperforming. Part of the reasoning behind this is that the company was bolstered by its digital arm, which saw a 29% increase in revenue in FY20.

Many analysts are predicting a bounce-back in Aristocrat’s land-based segment. I believe that this, combined with further growth in its digital segment, will result in some significant earnings growth down the track.

Webjet

The travel sector is finally looking up with multiple potential vaccines in the works.

Everyone seems to have a different opinion on exactly how long it’ll take for travel volumes to return to pre-COVID levels. However, to me, it seems likely that there will be a substantial amount of pent up demand once international travel is phased back in.

Around half of Webjet Limited’s (ASX: WEB) revenue comes from WebBeds, its business-to-business (B2B) platform that essentially acts as a middleman between hotels (looking to fill rooms) and other travel provider clients. It’s important to note that prior to COVID-19, this segment alone was really just starting to take off. Management has stated that it plans for WebBeds to eventually become the number one player in this space (it currently holds the #2 position).

For further reading, here’s how I compare Webjet and Flight Centre shares.