While most ASX shares have experienced some significant upside since March this year, the Treasury Wine Estates Ltd (ASX: TWE) share price has gone against the crowd.

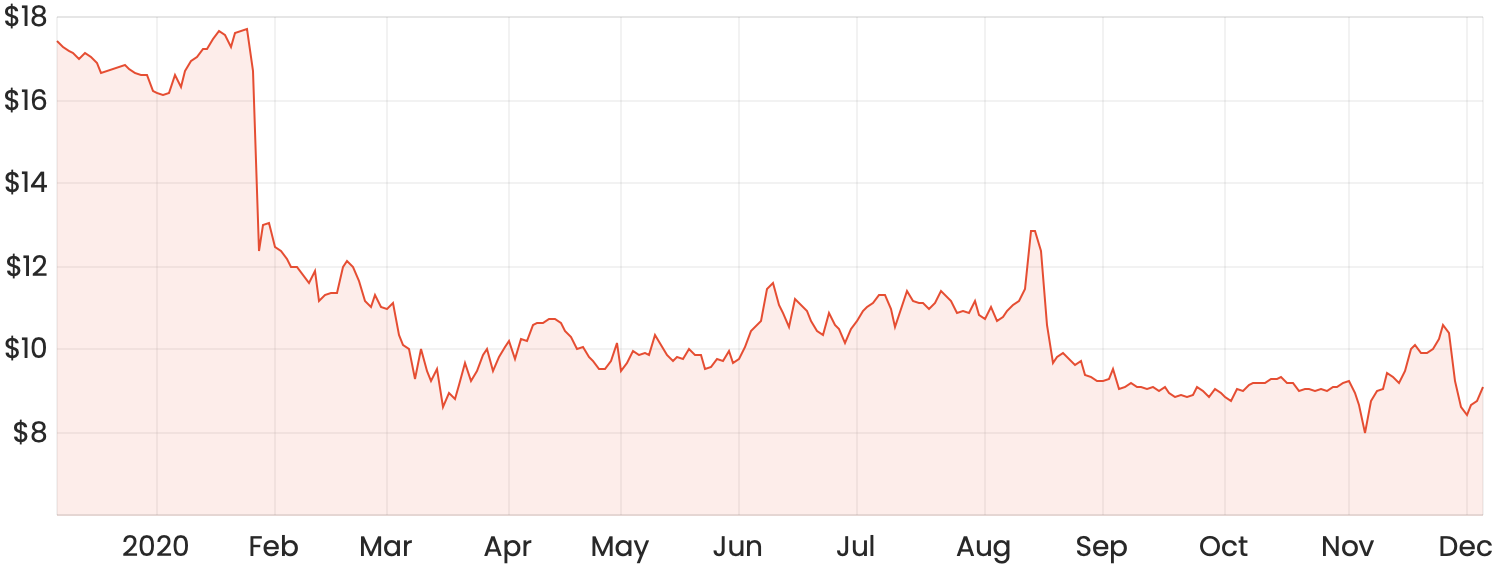

TWE shares currently trade at $9.08 per share – nearly a 50% discount to where they were prior to COVID-19. While Treasury Wine has typically been considered an ASX growth share, many investors are gaining interest purely from a value perspective.

TWE share price chart

Background

Treasury Wine Estates is a global winemaking and distribution business, selling wine to more than 100 countries.

TWE has been recently accused by Chinese authorities of selling its products into the market at lower, anti-competitive prices – a process known as dumping. As a result, Treasury Wine’s exports have been subjected to a 169.3% tariff for smaller containers, potentially until August 2021.

China accounted for around 30% of TWE’s earnings in FY20, so it’s likely that as long as the measure remains in the place, there will be a significant impact on demand.

In the meantime, Treasury Wine will implement a series of measures to mitigate the effects of the tariffs. The focus will now be on distribution into other lucrative markets in Europe, the US, and other parts of Asia. The product that was destined to China will be re-allocated to other markets.

Is the TWE share price a buy today?

If you have the patience, I think buying shares in Treasury Wine could still be an attractive investment opportunity. Some commentators have pointed out that these sorts of issues with China do generally come to a resolution eventually.

That being said, it doesn’t look like it’ll be resolved any time soon, at least in the short-term, so I’m not too sure if you’d need to rush in and buy shares today.

While other recovery plays like ASX travel shares are leveraged to the general reopening of the economy, I don’t think shares in TWE are going to experience the same sort of quick recovery. Treasury Wine’s FY21 figures likely aren’t going to look great considering its high concentration in the Chinese market.

I can see the appeal in investing now to capture some of that potential upside, but considering this might take quite some time, I would personally rather invest in other areas that might experience some more growth in the short to medium term.

If you’re looking for shares that aren’t being held back by external forces, here are 3 ASX shares I’m really liking at the moment.