Woolworths Group Ltd (ASX: WOW) has had a structural tailwind from COVID-19 as one of the only retailers allowed to continuously trade around Australia all year long. Will this tailwind take the Woolworths share price to new highs?

WOW share price chart

Q121 results

Earlier this month, Woolworths reported its Q121 results and talked about the “strong trading momentum” from COVID-19 that continued into the first quarter of FY21.

Woolies reported a 12.3% increase in sales compared to Q120 with $17.9 billion across the group. More impressively, eCommerce sales were up an astounding 86.7% to $1.5 billion as shoppers embraced home-delivered groceries in lockdown.

The only laggard of Woolworths’ business was the Hotels division that was down 33.2% from Q120. Both the Drinks and BIG W divisions of the group posted the most impressive gains with 21.4% and 20.4% growth, respectively.

What has the Woolworths share price done?

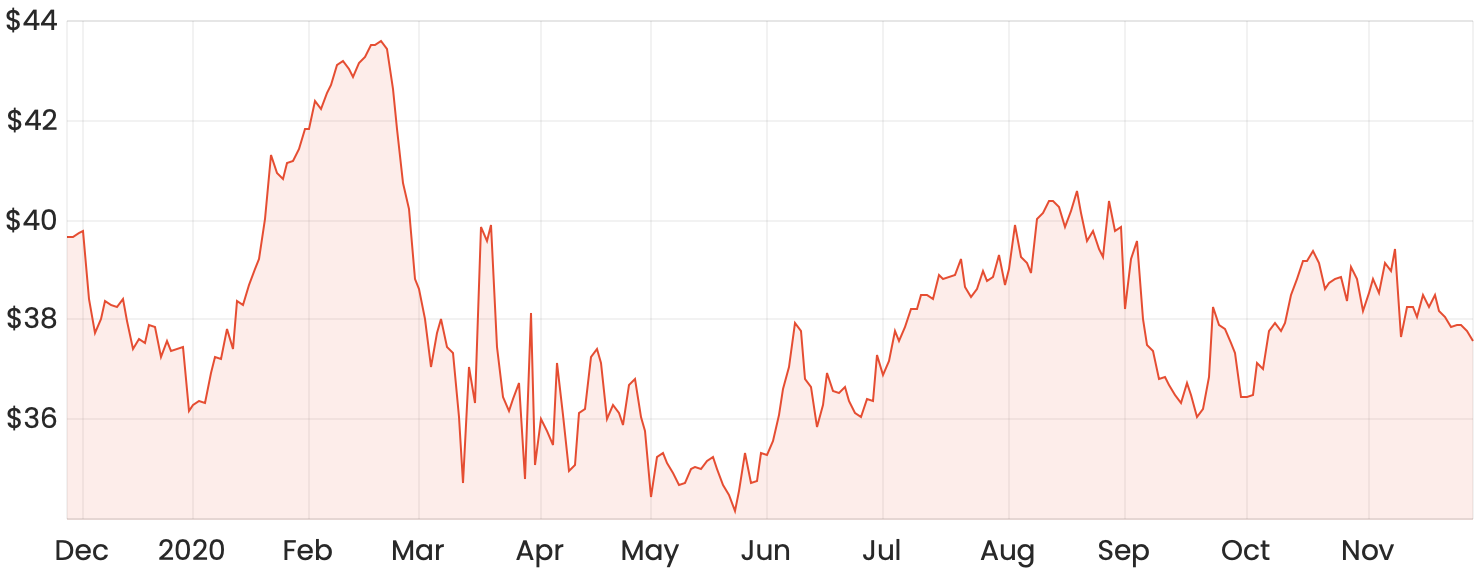

Woolworths is currently trading below the highs it achieved at the onset of COVID-19, with Woolies shares peaking at $43.60 per share on 20 February.

Woolworths shares have traded for as low as $34.16 in May and now sit somewhere in the middle of the year-to-date high and low at $36.98 at the time of publishing.

The Woolworths share price was largely unchanged after its Q1 announcement on 4 November 2020, falling around 0.67%.

Where to from here?

With a COVID-19 vaccine in the pipeline and cases in Australia declining, Woolies is looking towards the holiday season with momentum. Holiday season for supermarkets like Woolworths and Coles Group Ltd (ASX: COL) are key seasonal drivers to their revenue. Woolworths is banking on a “COVID-safe Christmas”.

With Woolworths shares currently trading at a P/E ratio of 41, the company cannot continue to rely on a COVID-19 uplift in sales. Woolworths shares are trading at around where they were a year ago, and I wouldn’t expect them to be much higher a year from now.

COVID-19 may have structurally changed a lot of the way Woolies operates, but it has not structurally changed its share price. In my opinion, Woolworths is not a “wow” stock.