COVID-19 seemed to be the nail in the coffin for energy producer and retailer AGL Energy Limited (ASX: AGL).

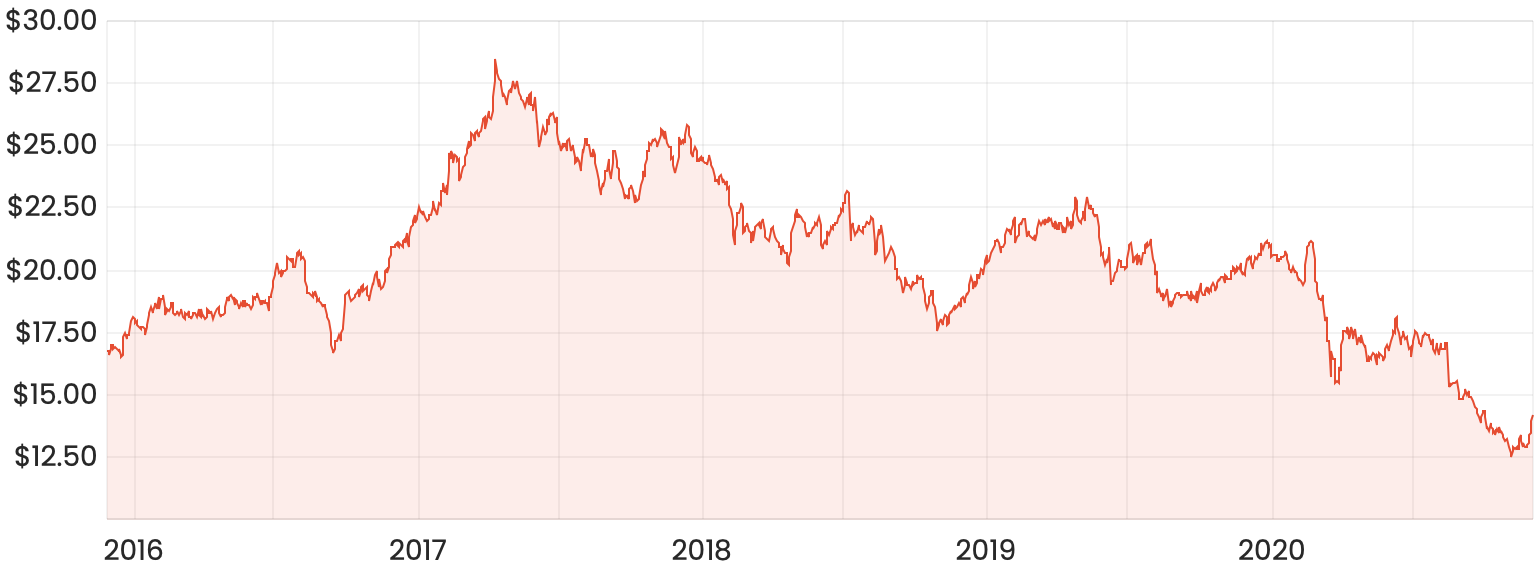

The AGL share price has been gradually trending down since 2017, and since the start of the year, shares have fallen a further 33%.

AGL share price chart

With the AGL share price looking this beat up, I’m sure there would be many investors coming at this from purely a value play, although I’m not entirely convinced based on this alone.

What does AGL do?

AGL is slightly different from some of its competitors in that it’s involved in both the generation and the retailing of electricity and gas for residential and commercial use in Australia.

Although AGL does generate a portion of its energy from renewable sources such as hydroelectricity and wind power, AGL probably wouldn’t pass many investors’ ethical standards being Australia’s highest greenhouse gas emitting company, producing 43.1 million tonnes in 2017-18.

Recent financial performance

Like many other companies, AGL’s recent underperformance has been the result of COVID-19 in both its electricity and gas segments.

AGL has traditionally benefitted from low-cost gas supply contracts in its wholesale segments. While these contracts had to be renewed this year, supply issues meant they had to be resigned at a much higher cost.

Another contributor to its performance over these last few years has been the gradual shift to renewable energy sources. Less demand has lowered the prices for wholesale electricity, putting further pressure on margins.

Is the AGL share price a buy?

I wouldn’t personally be a long-term holder of AGL shares, however, I could partially see the appeal of having a short-term investment horizon to try and capture some potential upside as a reopening play. That said, given AGL’s historical performance, I wouldn’t be certain of this happening.

Regardless of COVID-19, this sector is challenging and it’s not somewhere I’d typically invest in.

In a situation like this where the major players compete for a fixed amount of market share, I struggle to see where the future growth could come from. I could see AGL shares as a dividend play, but given the company’s outlook, there might be better options.

The additional challenge of this industry is the pressure from regulators and politicians. The cost of power and other utilities is a complaint you hear often and as a result, government regulation ultimately decides how much energy companies can charge the public for their services.

I’d rather invest in companies that aren’t price takers. For some ideas, here are 3 ASX dividend shares I’ve got my eyes on at the moment.