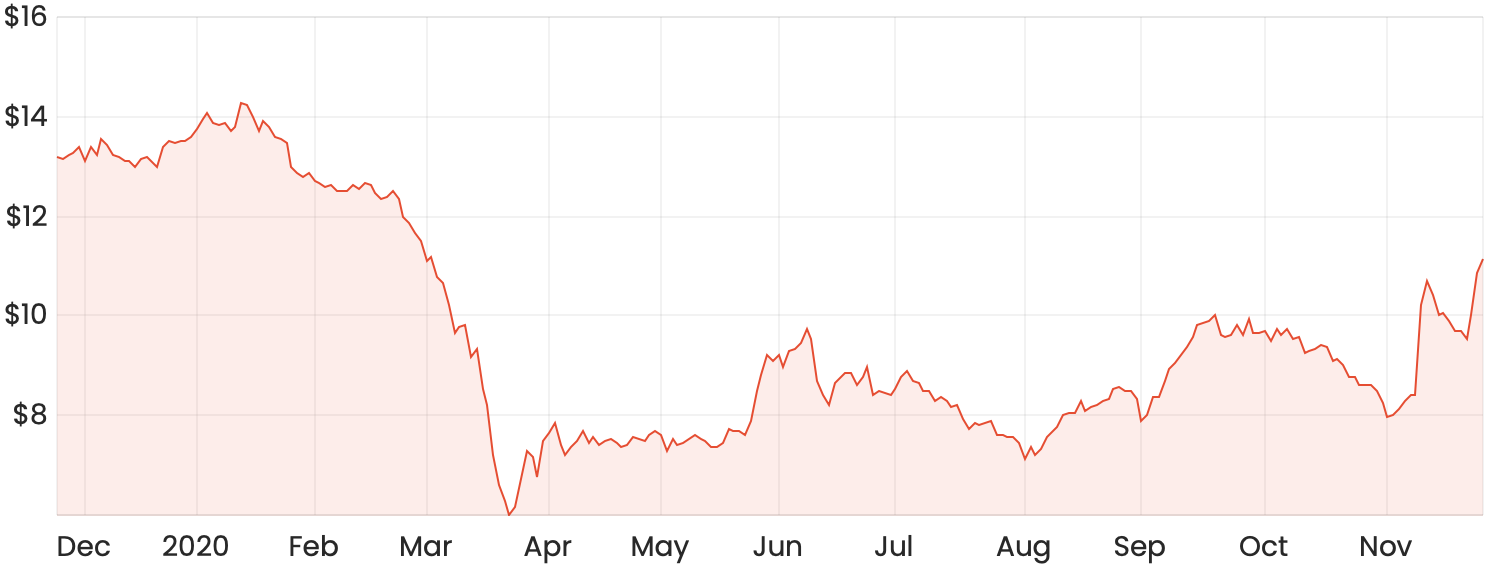

The Event Hospitality and Entertainment Ltd (ASX: EVT) share price has finally seen some green days after a few promising COVID-19 vaccine announcements. Event shares are up around 29% this month and trade at $10.84 at the time of writing.

Even at these levels, the Event share price is still down 22% since the start of the year. Is now a good time to buy in?

EVT share price chart

What does Event Hospitality do?

Event Hospitality is a global entertainment business with 54 hotels, 142 cinemas and more than 8,000 employees. Some of its brands include Event Cinemas, State Theatre, Moonlight Cinema, Thredbo, Rydges, QT and Atura.

Is there more upside in the EVT share price?

The intuition behind Event Hospitality being another COVID recovery play is fairly straightforward. As restrictions are eventually completely removed, people should move around a bit more and Event’s sales volumes should pick up with increased hotel and cinema bookings.

However, don’t forget that the Event share price is only 22% off its pre-COVID levels. What’s more, pandemic aside, the company has struggled to grow its earnings over the last five years or so. As a result, the Event share price has gone sideways in recent years.

To invest now and expect substantial upside would be to assume that Event can not only achieve a strong recovery in its attendance and bookings numbers, but then also grow even more on top of that. This industry is a tough one to be in and I think Event could be up for some challenges in the coming years.

Possible headwinds

Event’s entertainment division operates cinemas across Australia and New Zealand and typically makes up the majority of the group’s revenue. Over the past five years, the Australian segment alone has generally been the underperformer with sluggish revenue growth.

In the past, the company has blamed this underperformance on a lack of blockbuster movies released, resulting in lower attendance. To me, it’s not ideal that financial performance is largely impacted by the popularity of the screened movies. This can’t be predicted and would be ongoing in nature.

Additionally, as a result of COVID-19, you’d have to be questioning how the Netflix (NASDAQ: NFLX) revolution is going to affect the cinema industry over these next few years. It could bounce back or it could not, but this is definitely something to consider.

Thredbo Alpine resort has been Event’s most resilient segment though COVID-19 and historically performed quite well. One thing to remember is that revenue generated through this segment is affected by the quality of the snow conditions as more people want to visit the resort when there’s more snow. Again, there’s an uncertain element here that would be quite cyclical.

Summary

I wouldn’t be a buyer of Event Hospitality shares at these levels, although I think the company has done quite well up until this point.

I’d personally rather invest in companies where there are sustainable tailwinds working for the business rather than headwinds.

If you’re on the hunt for a potential COVID-19 turnaround play, here are three ASX shares to consider.