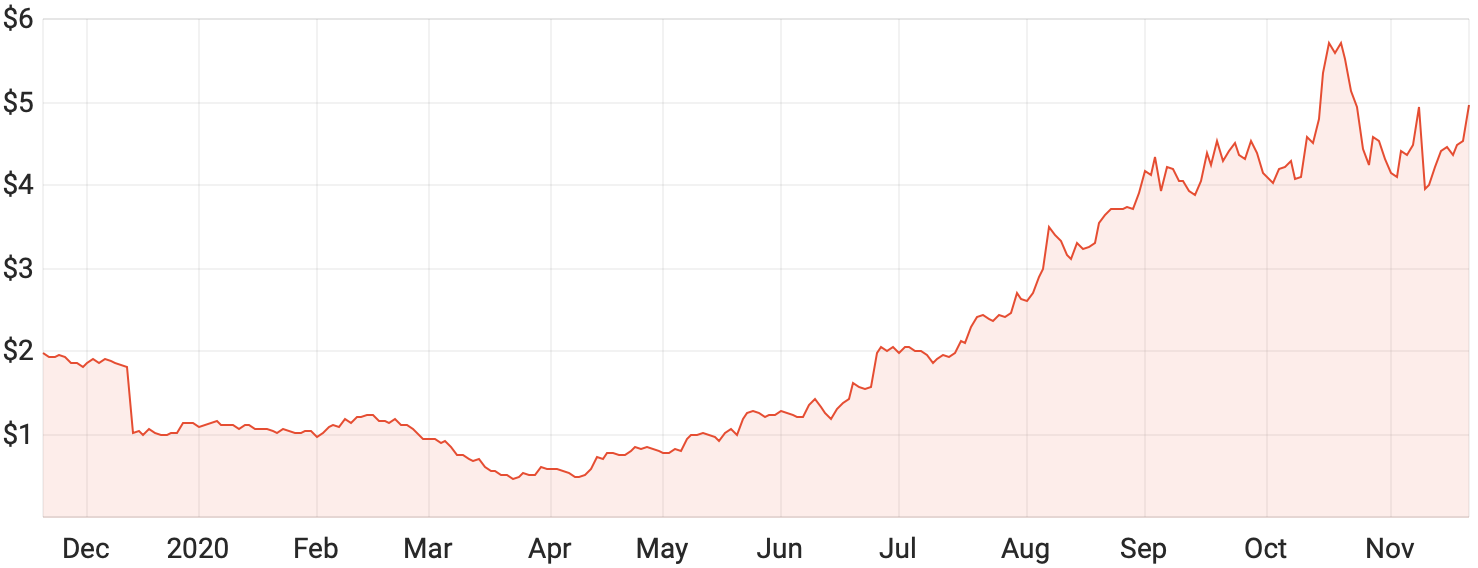

Redbubble Ltd (ASX: RBL) shares have been a hot favourite among ASX investors this year and have returned nearly 900% since March.

The Redbubble share price has pulled back slightly since last month and now sits at around $5 per share. Is now a good time to buy?

RBL share price chart

What does Redbubble do?

Redbubble operates as an online marketplace where over 800,000 independent artists can sell their designs on products like apparel, stationery, bags and other things. I really like the idea and the simple process behind this company. Artists just upload a design, then Redbubble takes care of the rest and prints it on pretty much anything you can think of!

Redbubble has had a fantastic 2020 and was perfectly positioned to take advantage of the accelerated growth of print-on-demand products. It did particularly well selling flat & fitted face masks in the wake of COVID-19.

I think there could be more to come for this company. Just last week, Redbubble announced former Seek Limited (ASX: SEK) executive Michael Ilczynski will take over as the new CEO from 27 January 2021. The focus is now taking Redbubble from a relatively small and niche platform to a larger mainstream marketplace with more personal and relevant products.

Is the Redbubble share price a buy right now?

Given the surge in Redbubble share price this year, I’d be willing to say the market could’ve gotten slightly ahead of itself at some stage. Even after the recent pullback, the market has still collectively valued the company’s shares at $1.35 billion.

Valuing the company on a price/earnings (P/E) basis isn’t possible, as the company is yet to be profitable.

I view Redbubble shares as a hold at this point, as I also think there are some broader uncertainties concerning retail that could play into this one. The million-dollar question is how much of these recent sales were the result of superannuation withdrawals and government stimulus – are customers going to stick around when stimulus runs out?

I’d be wanting to see the following quarterly announcements to see how sales are affected in a post-COVID environment before I’d be a shareholder in Redbubble.

I think if I had to go with an ASX retailer right now, I’d want to pick something quite defensive in nature, which is why I’m liking Baby Bunting Group Ltd (ASX: BBN) shares at the moment. If spending levels were to decrease, I would guess that baby-related products might be prioritised over more discretionary items.

For more reading, check out my in-depth analysis of Baby Bunting shares.